-

Baton Rouge-area home sales dropped by 16% in November from the year before, the result of continued tough comparisons with the sales gains resulting from the August 2016 flood.

January 19 -

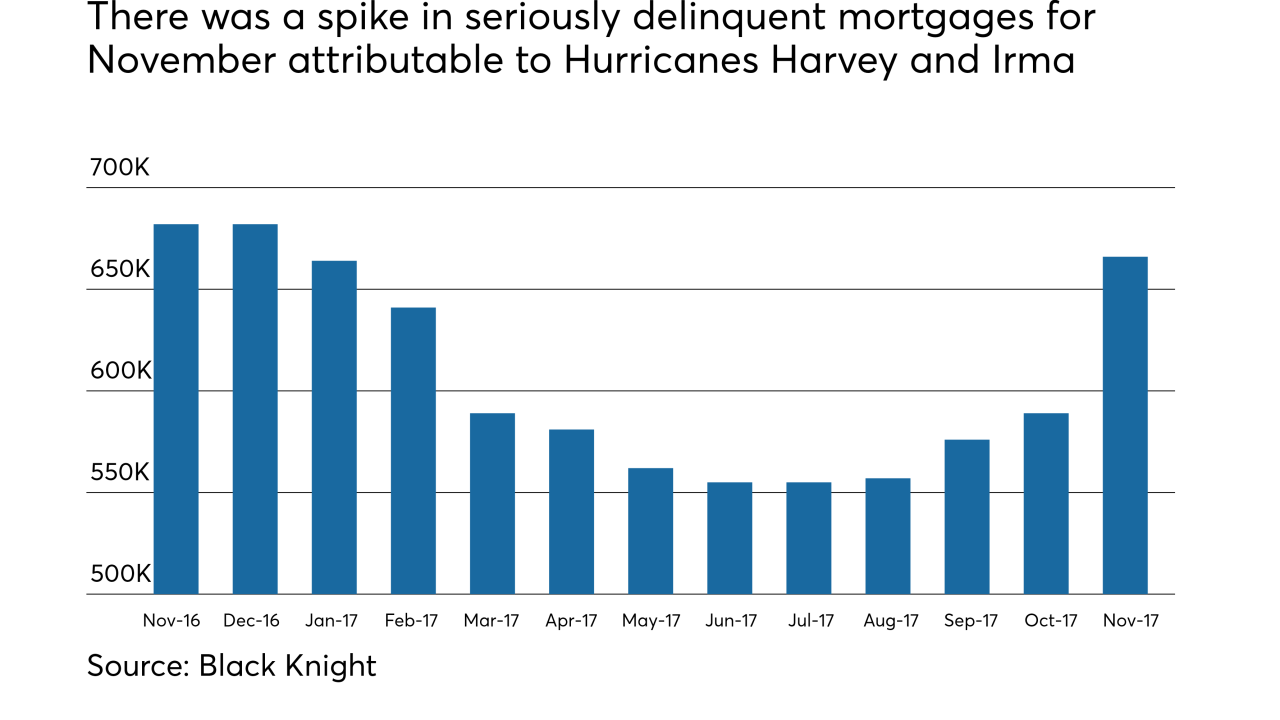

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19 -

Early-stage mortgage delinquencies had their largest year-over-year gain during September in over eight years, a direct result of Hurricanes Harvey and Irma.

December 12 -

Baton Rouge, La., area home sales plunged by 20% in October from the year before, the result of tough comparisons with the sales gains stoked by the August 2016 flood.

December 11 -

Housing inventory nationwide has declined for more than two years. But in a small number of markets, the number of homes for sale is growing.

November 16 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

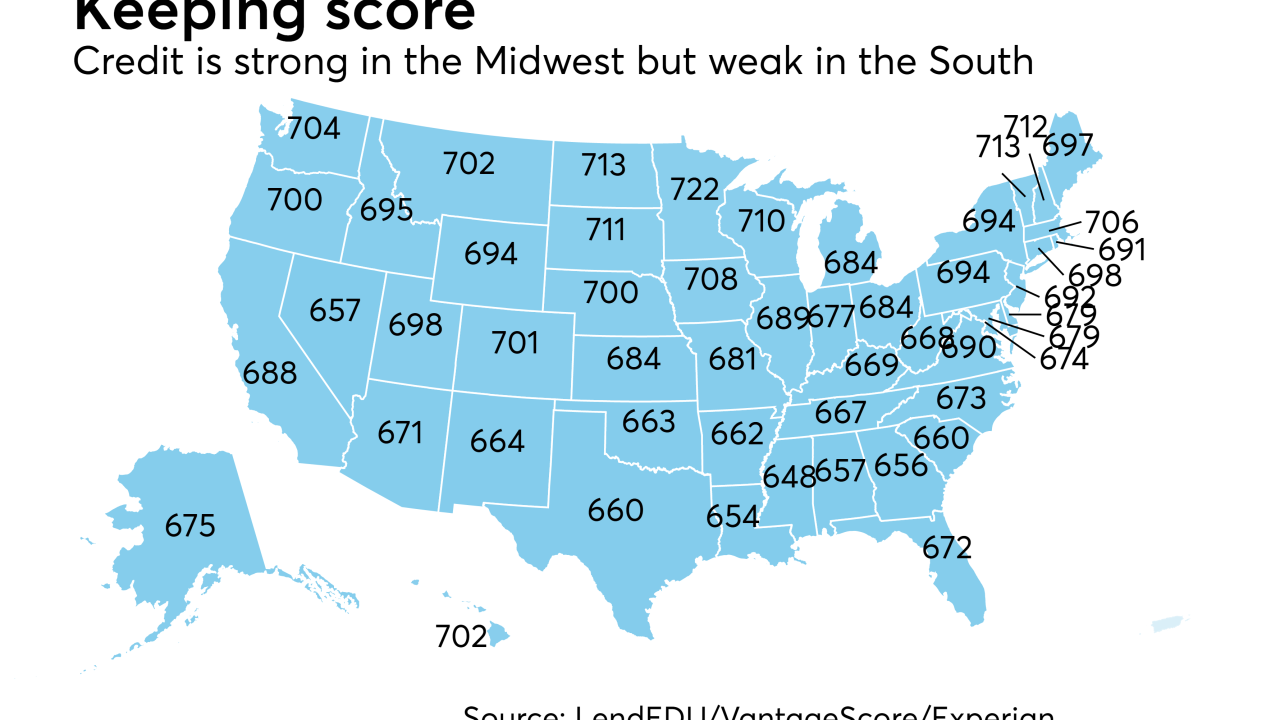

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Mortgage delinquencies in cities where the economy is dependent upon the oil industry are on the upswing, even as nationwide default rates remain near 10-year lows, CoreLogic said.

October 10 -

The Louisiana company also set aside funds to cover efforts to settle litigation tied to its mortgage business.

October 5 -

Here's a look at the 12 cities where homeowners who bought low during the housing crisis profited the most when they sold in 2016.

September 26 -

The parts of the U.S. most at risk of natural disasters are also the places where property values are highest and increasing most quickly.

September 22 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Return on investment from flipping houses has declined nationwide for three straight quarters. Here's a look at five cities that still offer robust returns and five markets worth avoiding.

September 14 -

Not every housing market is dealing with an inventory shortage, as over one-third of respondents said there was excess supply in their local area, according to a First American Financial survey.

September 13 -

Over one-quarter of all mortgages in the areas affected by Hurricane Harvey are likely to become delinquent because of the storm, according to an analysis from Black Knight.

September 8 -

From Indiana to Ohio, here's a look at the 12 states where the combination of prices and wages offer home buyers the best bang for the buck.

September 8 -

Residential flood damage from Hurricane Harvey could reach as high as $37 billion, with more than two-thirds of losses not covered by insurance, according to CoreLogic estimates.

September 1 -

Louisiana landlords with rental houses walloped by 2005's Hurricanes Katrina and Rita were eventually promised state help to rebuild: If they could get loans to rehab their properties, the state government would later reimburse them.

June 19 -

The Louisiana company also said that credit quality in its energy portfolio improved during the first quarter.

April 28