-

Royal Bank of Scotland said it reached a tentative agreement to pay a $4.9 billion penalty to resolve a long-running U.S. probe into its packaging and sale of mortgage-backed securities before the 2008 financial crisis.

May 9 -

A former Cantor Fitzgerald managing director was cleared of charges that he defrauded customers by lying about prices of mortgage-backed securities.

May 3 -

A federal jury is poised to determine whether a former Cantor Fitzgerald managing director's tactics in trading mortgage-backed securities constitute securities fraud.

May 1 -

After less than a week of trial, prosecutors rested their case against a former Cantor Fitzgerald trader accused of lying to his customers about bond prices.

April 30 -

A portfolio manager for an investment firm allegedly defrauded by a former Cantor Fitzgerald managing director said he might still work with a trader who lied to him — depending on the circumstances.

April 27 -

The trial of a former Cantor Fitzgerald mortgage-backed securities trader charged with lying to his clients turned contentious as his lawyer aggressively questioned one of his alleged victims about methods his firm uses to invest.

April 26 -

Former Cantor Fitzgerald managing director David Demos is on trial, accused of deceiving clients about the prices his firm could sell or pay for mortgage-backed securities.

April 23 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28 -

UBS agreed to pay $230 million to resolve a New York state probe into the Swiss bank's marketing and sales of residential mortgage-backed securities before the financial crisis, boosting the state's recoveries in the investigation to almost $4 billion.

March 21 -

Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

March 20 -

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

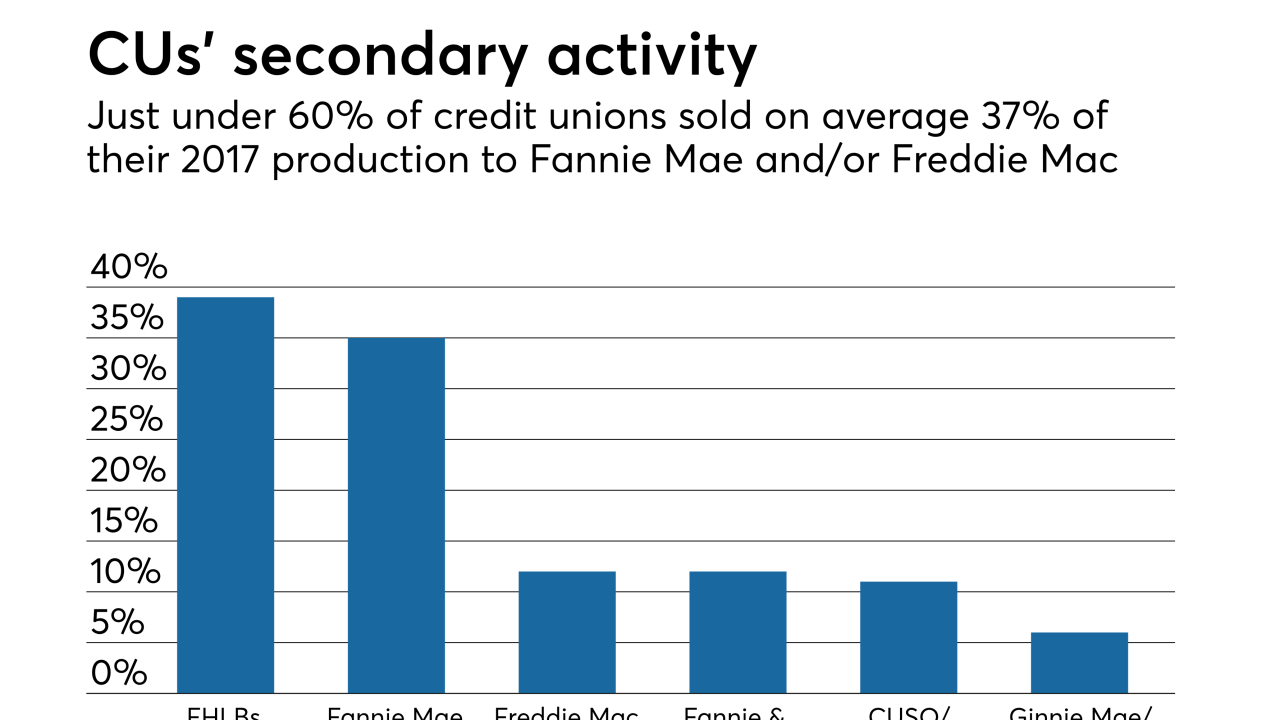

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

James Bennison, head of alternative capital markets at Arch Capital Group, says that a new insurance-linked security helps with regulatory capital requirements and provides information that can help the company to better manage risk.

November 3 -

Barclays and the Justice Department, engaged in a legal battle over the suspected fraudulent sale of mortgage securities a decade ago, have revived discussions about reaching an out-of-court settlement, according to people with knowledge of the situation.

October 27 -

Carlyle Group LP was exonerated in a lawsuit tied to the collapse of a mortgage fund from 2008, avoiding $1 billion in damages sought by the pool's liquidators.

September 5 -

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

August 28 Fannie Mae

Fannie Mae -

EagleBank has been approved as the 13th Ginnie Mae multifamily mortgage-backed securities issuer

May 23 -

The Securities and Exchange Commission isn't planning to bring an enforcement action tied to Deutsche Bank's losing nearly $550 million on mortgage-bond trades.

May 5