-

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

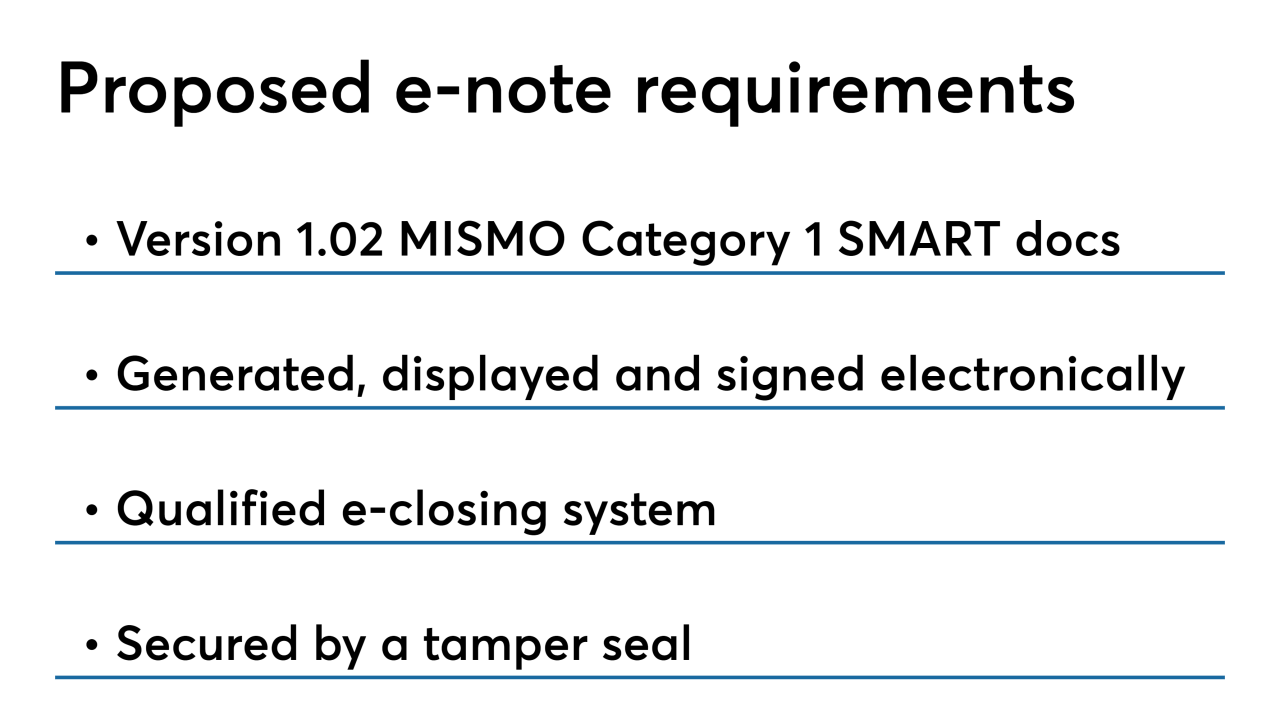

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

For the mortgage industry, the question of whether the Fed can control its target range for interest rates is crucial for managing volatility.

October 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

The spike in overnight repurchase agreements may prompt the Federal Reserve to expand its balance sheet.

September 18 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

The monthly volume of new mortgage securities insured by Ginnie Mae remained higher than it has been in more than two years in July, rising slightly on a consecutive-month basis.

August 13 -

Mortgage-backed securities investors are looking to the specified pool market to counter higher prepayment speeds seen with loans purchased through the TBA window.

August 9 -

In the world’s biggest covered-bond market, a Danish bank says it’s now ready to sell 10-year mortgage-backed notes at a negative coupon for the first time.

August 5 -

The Federal Reserve reduced short-term rates for the first time in years, and accelerated its plan to stop shrinking the Fed’s balance sheet by rolling maturing mortgage-backed securities into Treasuries.

July 31 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

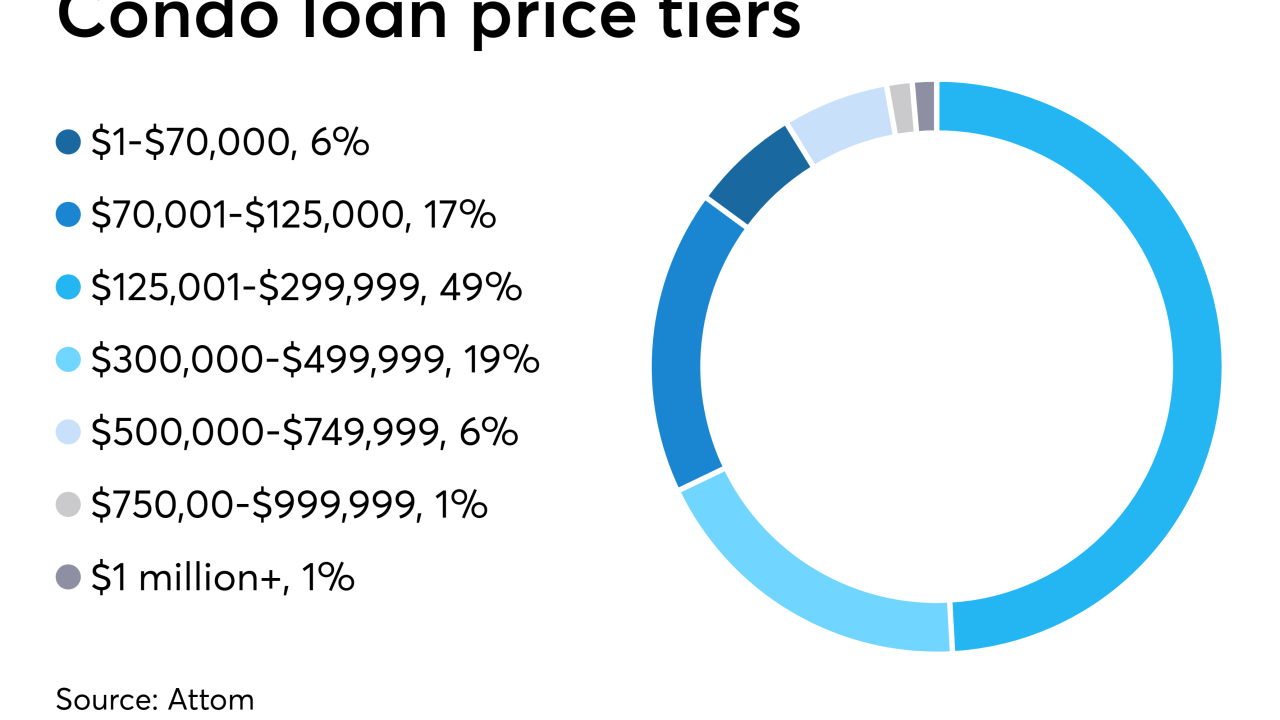

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11