Removing

Under current FHA policy, mortgage loans granted

While in forbearance, the originating lender's FHA loan performance score unfairly suffers, the organization said.

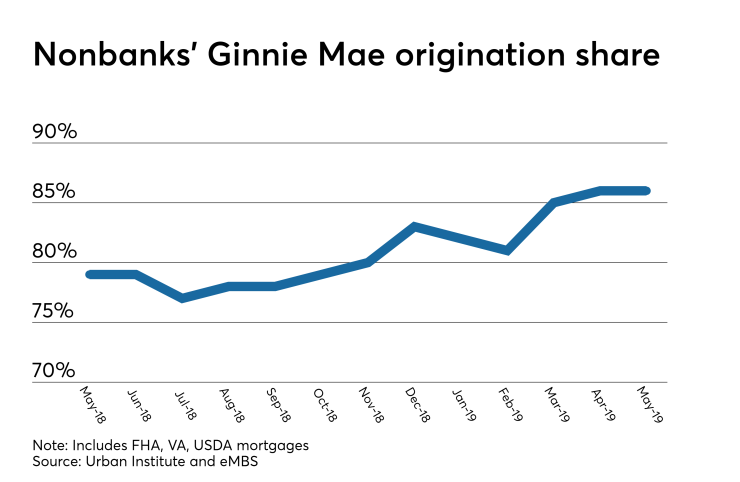

Smaller mortgage bankers who are CHLA's members often sell their FHA loans servicing-released to aggregators, and have little say in successor servicers' and investors' decisions to apply forbearance to loans, the organization noted. Independent mortgage bankers originated of 86% of all loans put into Ginnie Mae securities in May, according to the Urban Institute. This marked an all-time high for nonbank mortgage-banking share in this market, through which most FHA and other government loans are securitized.

"CHLA members can neither reliably forecast natural disasters nor predict whether a servicer will grant forbearance to provide the borrower time to recover. Yet when a natural disaster strikes and the borrower's loan is placed in forbearance, it is the originating lender that suffers the consequences," the CHLA said in a letter to Federal Housing Commissioner Brian Montgomery.

The situation is creating "undue attention to lenders with even a modest number of loans under servicer forbearance due to natural disasters, unnecessarily raising doubts and concerns among investors," according to the group.

These loans can affect a lender's

"These IMBs often lack the volume and geographic diversity of large lenders so only a few delinquent loans can cause severe repercussions," CHLA said.

Compounding the situation was a 40% increase in natural disasters between 2016 and 2018 compared with the previous three-year period, the group said. More recently, Tropical Storm Barry, while not living up to

HUD needs to exclude from the database delinquent loans in presidential-declared areas which were placed into forbearance, according to the group.

"There is precedent for culling loans that serve an important purpose in achieving the nation's housing goals from the Neighborhood Watch database," the letter said. "Four years ago, HUD created the Supplemental Performance Metric 'to help mitigate adverse selection away from borrowers with certain credit profiles and encourage the extension of homeownership opportunities to underserved segments of the market,' as FHA explained in its fact sheet on the metric."

By taking these loans out of Neighborhood Watch and instead including them in the Supplemental Performance Metric, it "will help mitigate investor concerns and ensure that markets facing disaster recovery will be served by a wide range of mortgage originators," CHLA said.