-

Mortgage applications increased 3.8% from one week earlier as a drop in most loan interest rates brought on an increase in refinance activity, according to the Mortgage Bankers Association.

November 4 -

A gauge of pending home sales unexpectedly declined in September for the first time in five months, a sign elevated asking prices and lean supply are tempering the boom in housing despite the record-low interest rates.

October 29 -

But for the first time in a month, fewer consumers refinanced into a government-guaranteed mortgage.

October 28 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

In the first episode of the five-part Arizent documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

In the first episode of the five-part documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

Mortgage applications decreased 0.6% from one week earlier, although a slight drop in purchase volume belied the fact that consumers are taking advantage of the current rate environment, according to the Mortgage Bankers Association.

October 21 -

While spiking from the year before, mortgage applications to purchase new homes fell in September from August, with low supply and high unemployment keeping it in check, according to the Mortgage Bankers Association.

October 15 -

-

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

-

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

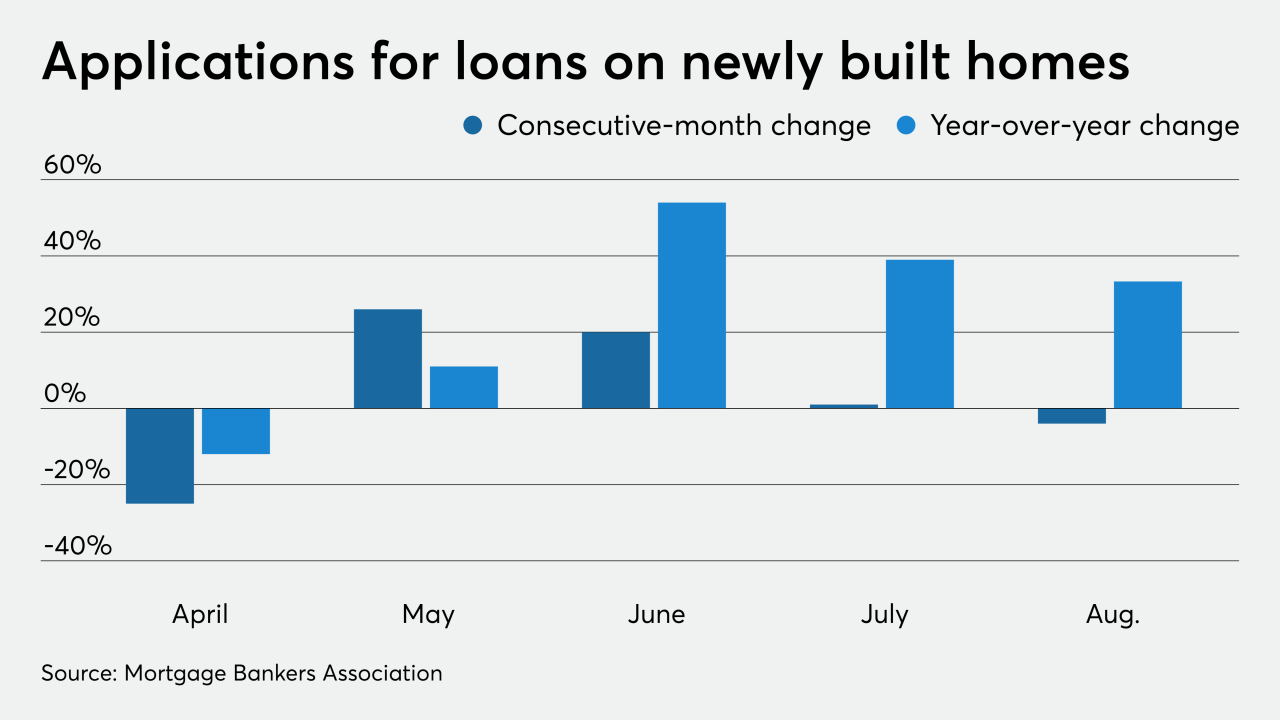

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2