Widespread uncertainties regarding income and employment have resulted in the first increase in mortgage loan application defect risk in 15 months, First American reported.

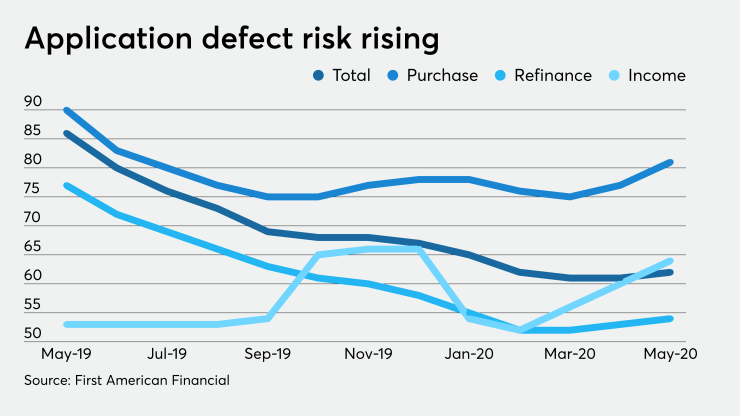

May's index of 62 was up one point from the

"The two primary drivers of the increase in fraud risk are employment and income fraud, which increased 10% and 7% respectively, relative to last month," Odeta Kushi, First American's deputy chief economist, said in a statement. "This is the first monthly increase in employment risk since October 2019. Higher income and employment fraud risk is likely a result of applicants, whose

While an application defect is not necessarily a fraudulent act, it is a red flag for lenders to go back and review that item.

"An

The purchase defect index rose for the second consecutive month, to 81, which is its highest level since June 2019.

While the refi defect index also increased for two months in a row, the rise has been much slower, going up by just two points during the period, to 54.

Meanwhile, the employment risk index, which had plummeted downward in the past year, increased eight points between April and May to 90; one year ago, the index was 171.

Unlike many of the other risk indicators tracked by First American, the income risk index is actually higher on a year-over-year basis. For May, it was 64, up from 60 in April and 53 in May 2019.