-

During a seven-day period earlier this month, there were 1,740 new home listings and 270 listings coming back on the market, and 2,065 pending sales, according to the Greater Metropolitan Association of Realtors.

June 16 -

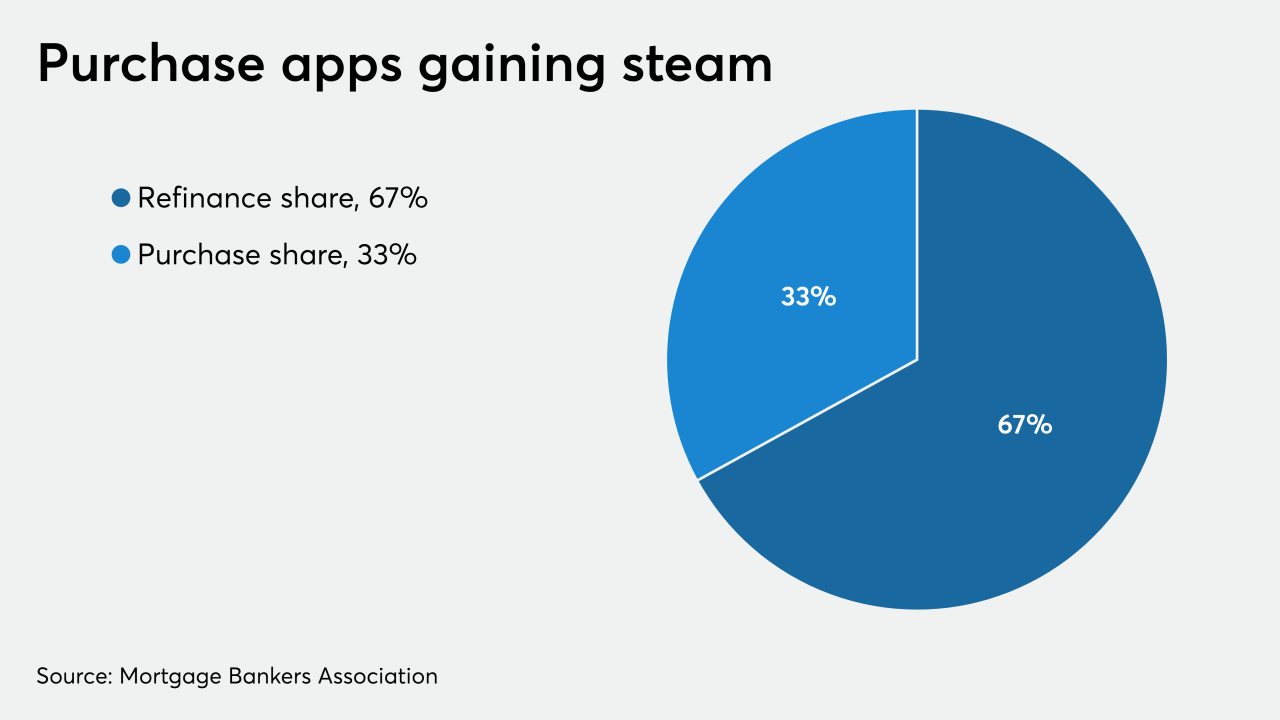

Mortgage applications increased 9.3% from one week earlier, fueled by low mortgage rates and the release of pent-up demand, according to the Mortgage Bankers Association.

June 10 -

Southern California housing markets are rebounding off what arguably was the worst April in the history books.

June 9 -

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Stuck day and night in their homes, a surprising number of Americans are deciding the pandemic is a great time to upgrade.

May 29 -

Mortgage rates fell this week to the lowest level ever recorded by Freddie Mac, even as it appears the relationship to the benchmark 10-year Treasury yield has stabilized.

May 28 -

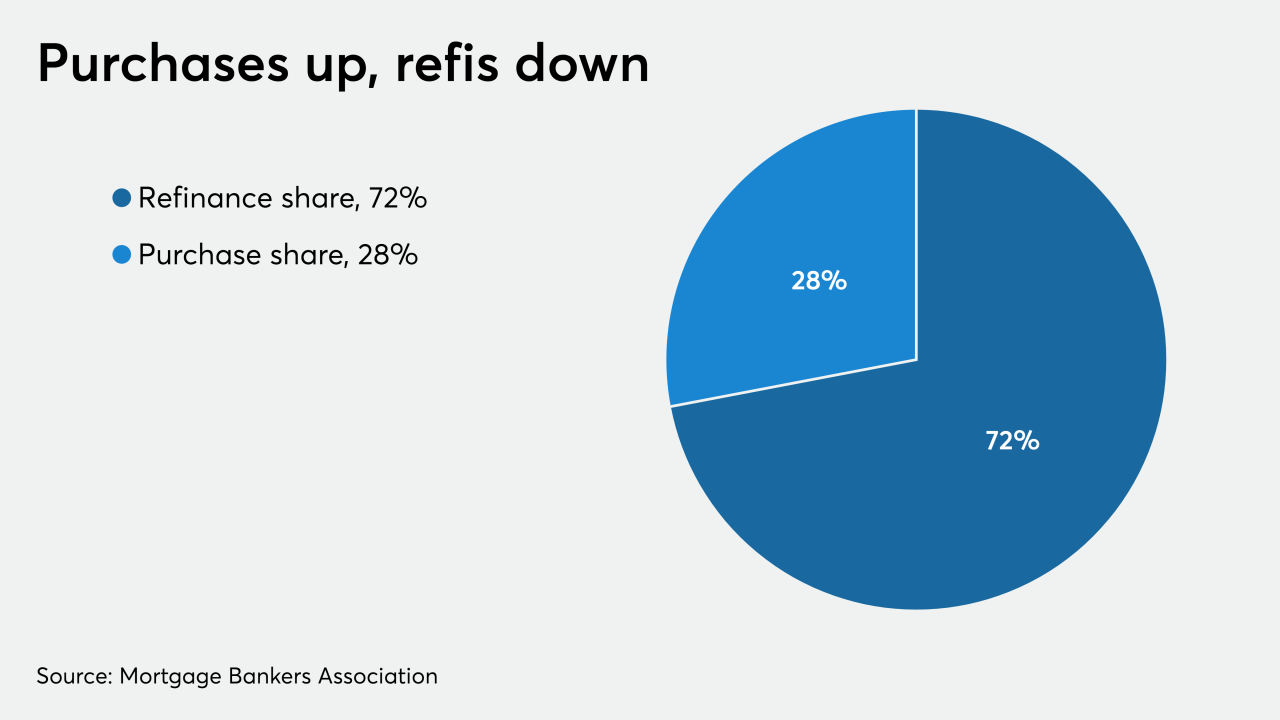

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

Mortgage rates declined this past week, further continuing to help attract previously reluctant buyers back into the purchase market, according to Freddie Mac.

May 21 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

Pent-up demand is already pushing buyers to a gradual return to the market, the report asserts.

May 18 -

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

-

-

Sales of new homes slid in March by the most since 2013 as the coronavirus started to wreak havoc on the country’s economy.

April 23 -

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16