Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

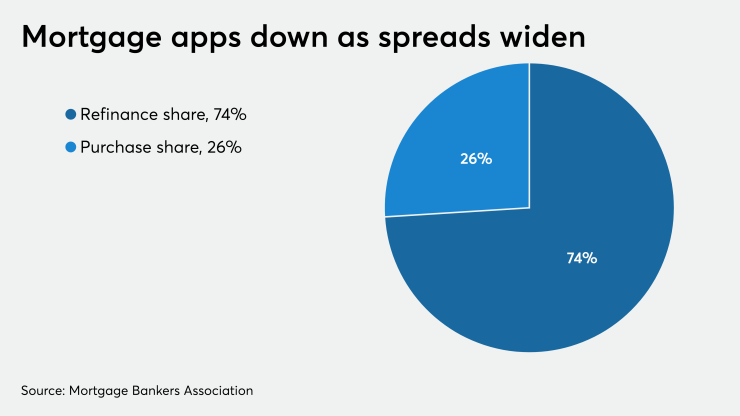

The MBA's Weekly Mortgage Applications Survey for the week ending March 13 found that the refinance index decreased 10%

Conforming mortgage rates increased by an average of 27 basis points during the MBA's survey period.

"The ongoing situation around the coronavirus led to further stress in the financial markets late last week, with unprecedented volatility and

"The Federal Reserve's rate cut and other monetary policy measures to help the economy should help to bring down mortgage rates in the coming weeks, spurring more refinancing. Amidst these challenging times, the savings that households can gain from refinancing will help bolster their own financial circumstances and support the broader economy. Looking ahead, a gloomier outlook may cause some prospective homebuyers to delay their home search, even with these lower mortgage rates."

However, given that the 10-year yield broke back above the 1% mark the morning of March 18, those spreads are likely to start narrowing again.

The seasonally adjusted purchase index decreased 1% from one week earlier, while the unadjusted purchase index remained unchanged compared with the previous week and was 11% higher than the same week one year ago.

Adjustable-rate mortgage activity increased to 6.4% from 5.9% of total applications, while the share of Federal Housing Administration-insured loan applications increased to 7.3% from 6.9% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 14.5% from 13.1% and the U.S. Department of Agriculture/Rural Development share increased to 0.4% from 0.3% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.74% from 3.47%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate increased to 3.77% from 3.58%.

When it came to FHA loans, the average contract interest rate for 30-year fixed-rate mortgages increased to 3.71% from 3.57%. For 15-year fixed-rate mortgages, the average increased to 3.1% from 2.9%. The average contract interest rate for 5/1 ARMs increased to 3.19% from 3.02%.