-

Purchases increased, but refinance activity cooled again due to rising rates.

March 16 -

Mortgage applications were up for the first time in over a month, with government refinances in particular seeing a sizable bump.

March 9 -

The overall number of applications decreased for the fourth straight week, but average loan sizes headed back up, according to the Mortgage Bankers Association.

March 2 -

Overall application activity was down by more than 40% compared with one year ago, the Mortgage Bankers Association found.

February 23 -

The estimated rate of annual sales also dropped in January to its slowest pace since July.

February 18 -

Credit availability also tightened in January, contributing to early 2022’s lending slowdown, according to the Mortgage Bankers Association.

February 16 -

Steadily climbing rates have contributed to a 40% decline in loan activity from one year ago.

February 9 -

But refinances came in 50% below levels from a year ago, with rate-and-term activity falling by over 40% in the third quarter of last year, according to TransUnion.

February 2 -

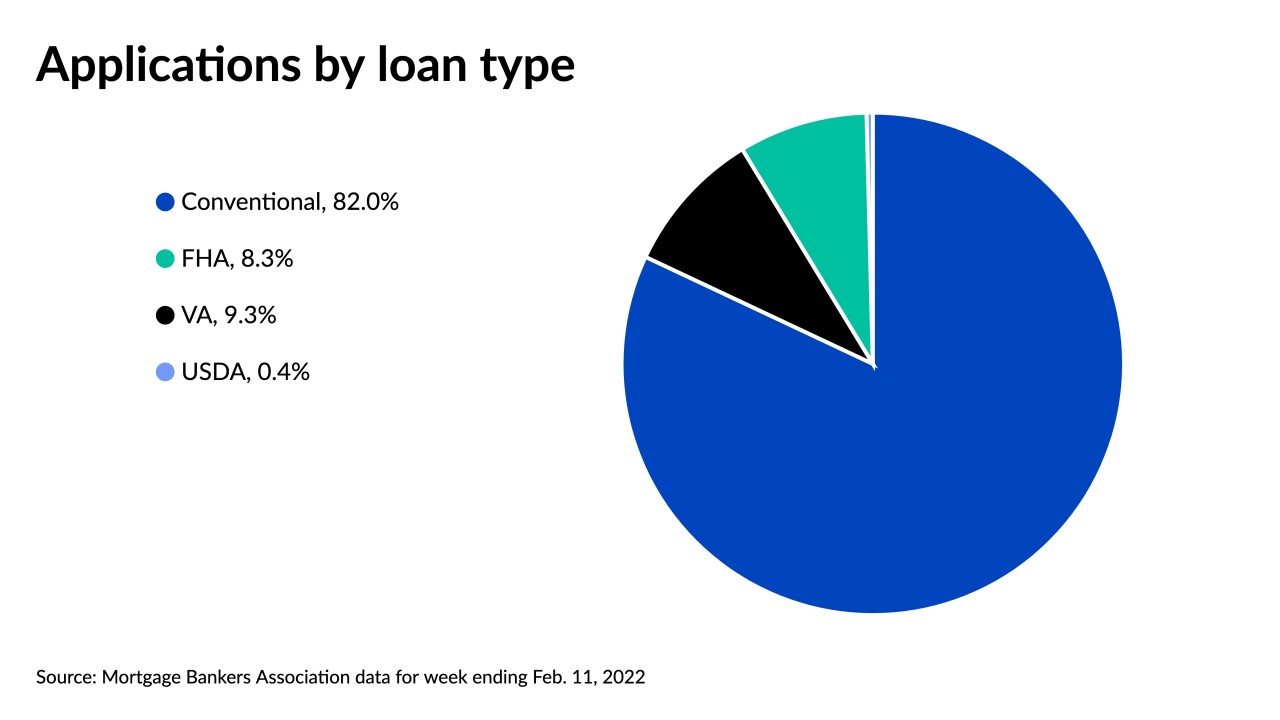

And a recent slowdown in government-backed loan issuance is pushing average purchase amounts to another record high.

January 26 -

But a surge in purchases led overall mortgage volumes to a weekly gain and pushed average loan size to a new record.

January 19 -

Increasing rates contributed to a sluggish pace for refinances, but the purchase market showed sustained strength.

January 12 -

Refinances also decreased, with rising rates contributing to the slowdown.

January 5 -

While the overall number of applications dropped last week, average mortgage sizes shot up across all categories.

December 22 -

Although seasonal slowing and limited inventory have temporarily reduced prospective financing, the number sales in the sector hit nearly 1 million in November, according to the Mortgage Bankers Association.

December 16 -

Purchases inched upward, but refinance volumes retreated, with interest rates now well above levels from a year ago.

December 15 -

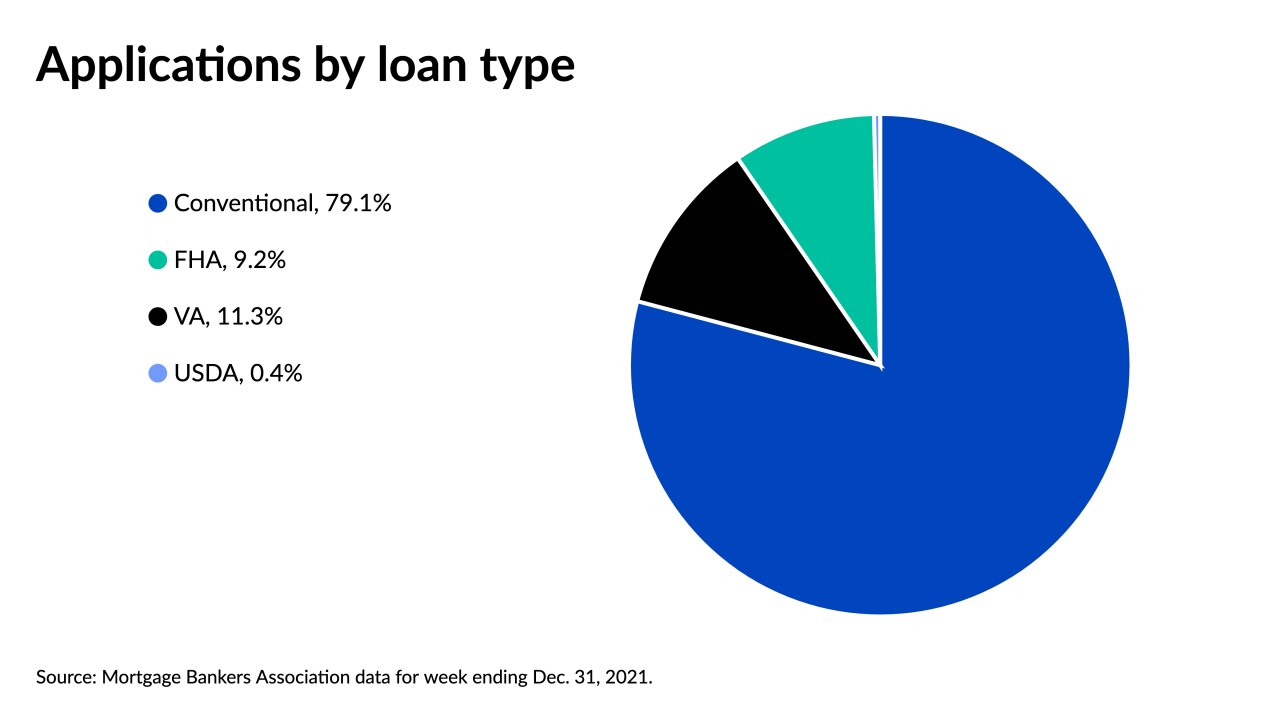

An upturn in government-backed applications also led average loan sizes to decrease for the first time in over a month.

December 8 -

Purchase applications increased for the fourth consecutive week, with the average loan amount at its highest since February.

December 1 -

Purchase and refinance numbers both came in higher, while average loan sizes also recorded an uptick.

November 24 -

Refinance numbers declined for the seventh time in eight weeks, leading to an overall weekly decrease.

November 17 -

Despite elevated prices and supply-chain bottlenecks, October application activity was up for the second time in three months and pushed the average loan size to a record high.

November 16