A

The MBA’s Market Composite Index, a measure of loan activity based on a survey of association members, increased for the first time since late January, climbing a seasonally adjusted 8.5% on a weekly basis for the period ending March 4. Compared to the same period last year, though, new applications were down 36%.

Both refinances and purchases saw

The seasonally adjusted Purchase Index also saw an upswing of 9%, “as prospective buyers acted on lower rates and the early start of the spring buying season,” Kan said in a press release. But purchases came in 7.4% below their level during the same week of a

The average purchase size retreated slightly week over week, falling by less than 0.1% to $450,900 from $454,400. “The average loan size remained close to record highs, with higher-balance loan applications continuing to dominate growth," Kan said. Purchase-loan sizes have already set new survey records in six different weeks of 2022 thus far, while other research continues to show

But despite the drop in purchase size, the mean amount of all new mortgage applications increased overall. The average refinance size came in at $299,900, rising 1.7% from $294,900 a week earlier. The mean amount of all new activity climbed to $376,200, an 0.4% uptick from $374,800 the prior week.

For the second consecutive weekly period, refinances accounted for less than half of overall activity. New refinance loans took a 49.5% share of volume, decreasing from 49.9% seven days earlier. Meanwhile, adjustable-rate mortgages equaled 5.2% of activity compared to 5.3% the previous week.

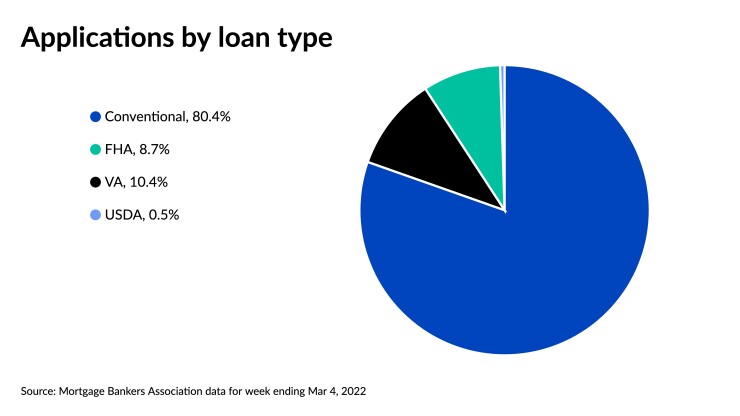

The share of government loans increased relative to total volume, with the seasonally adjusted government Index jumping 11% over the prior week. Federal Housing Administration-backed applications accounted for 8.7% of volume, up from 8.6%, while loans coming via the Department of Veterans Affairs took a 10.4% share compared to 10.2% seven days earlier. U.S. Department of Agriculture-backed mortgages increased to 0.5% of all activity, up from 0.4% a week prior.

Following the onset of hostilities in Ukraine on Feb. 24, mortgage rates among MBA members fell for the first time in 12 weeks, with the average dropping across all loan types tracked. The situation in Eastern Europe is set to dictate investor activity and rate movements for the near term, Kan said.

“Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates as these effects work against each other,” he said

The 30-year contract fixed-rate for conforming balances below $647,200 averaged 4.09%, a drop of six basis points from 4.15% a week prior.

The average 30-year fixed rate for