-

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

May 18 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

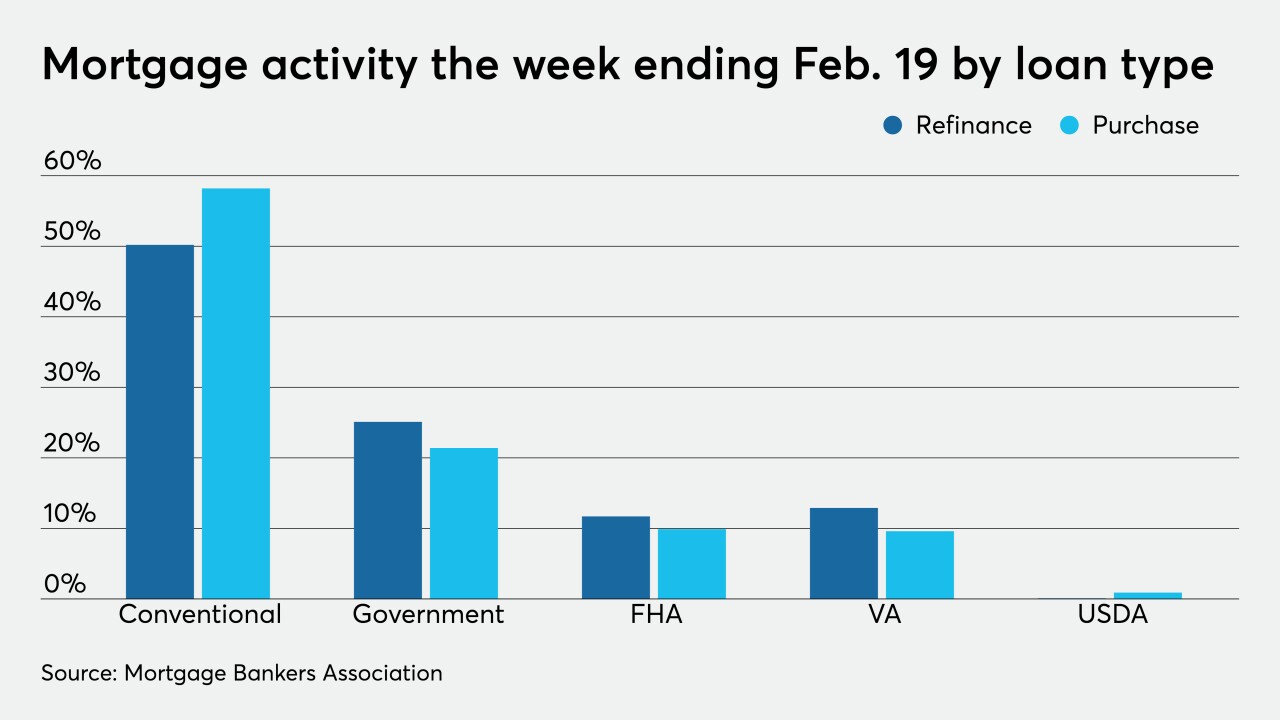

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

“Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” MBA’s Joel Kan said.

March 16 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10