-

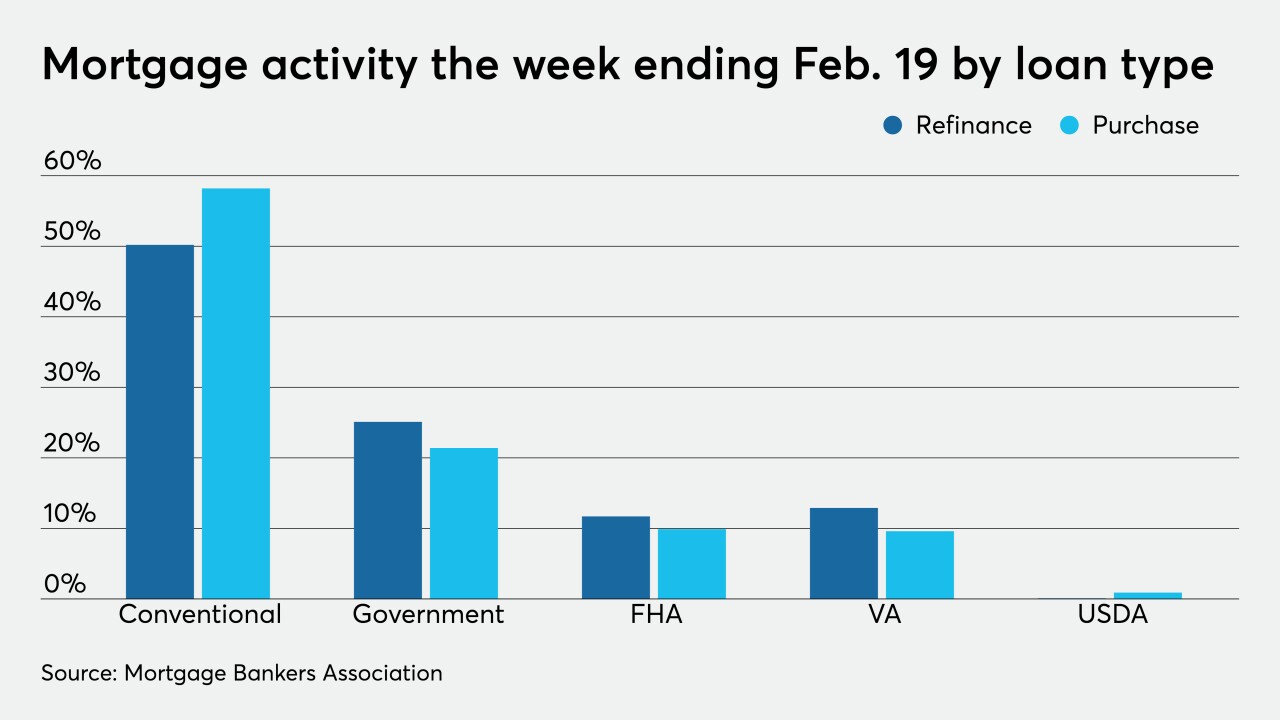

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

“Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” MBA’s Joel Kan said.

March 16 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

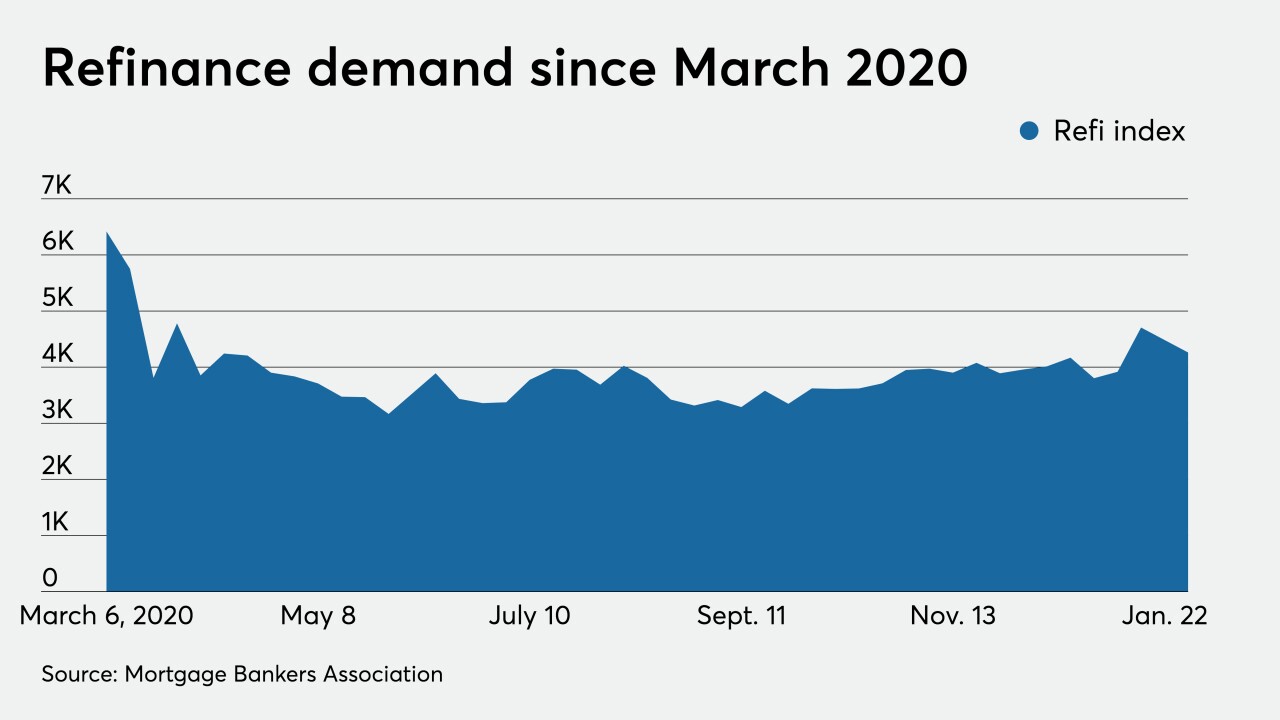

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

Purchase apps for new homes only eked out a small gain in December but the Mortgage Bankers Association is forecasting that they will continue to increase.

January 14 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

When the Uniform Residential Loan Application transition deadline hits on March 1, a data set within Fannie Mae’s Desktop Underwriter Program, which many lenders have used for a host of functions, will no longer be supported and unprepared lenders could later experience disruption.

January 6 -

Mortgage applications decreased 4.2% over the final two weeks of 2020, but the strong demand for home buying throughout most of the year should continue, according to the Mortgage Bankers Association.

January 6 -

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

December 24 -

Mortgage applications increased 0.8% from one week earlier, an indicator of the housing market’s strength as this year comes to an end, according to the Mortgage Bankers Association.

December 23 -

The accused, who also faces vehicle title and investment fraud charges, allegedly submitted falsified statements related to the payoff of an earlier mortgage when applying for a new one.

December 18