-

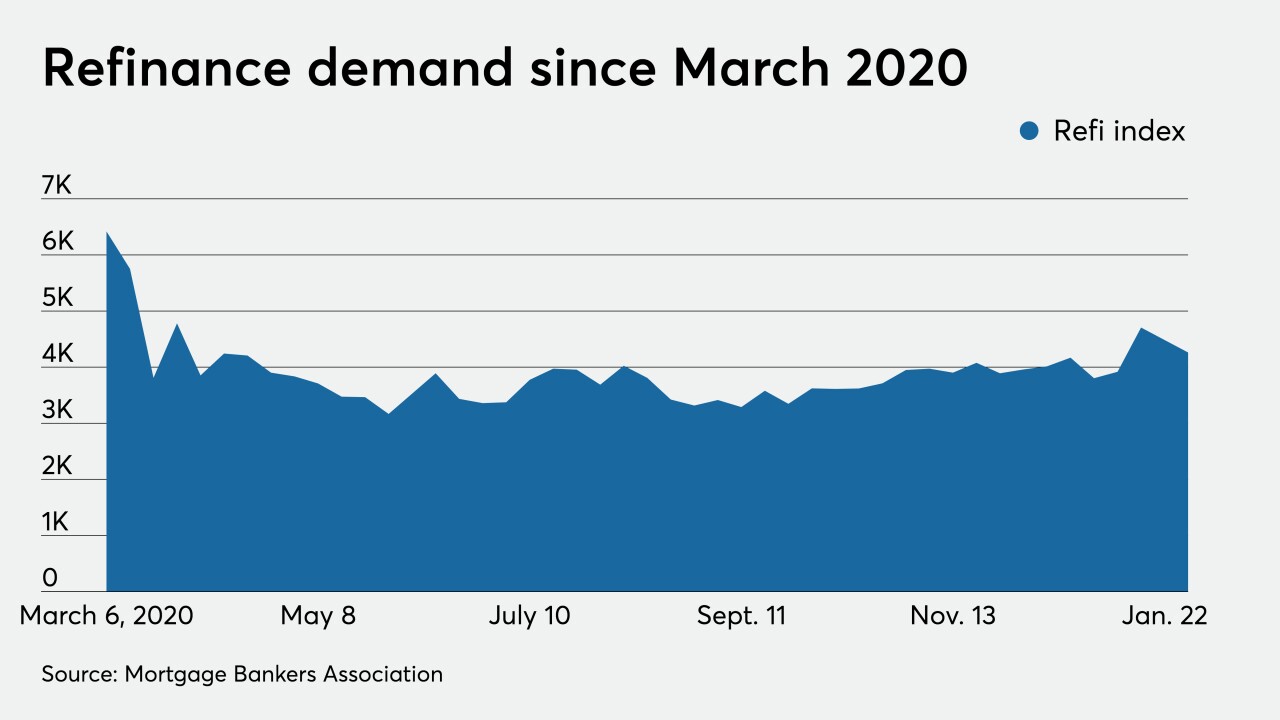

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

Purchase apps for new homes only eked out a small gain in December but the Mortgage Bankers Association is forecasting that they will continue to increase.

January 14 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

When the Uniform Residential Loan Application transition deadline hits on March 1, a data set within Fannie Mae’s Desktop Underwriter Program, which many lenders have used for a host of functions, will no longer be supported and unprepared lenders could later experience disruption.

January 6 -

Mortgage applications decreased 4.2% over the final two weeks of 2020, but the strong demand for home buying throughout most of the year should continue, according to the Mortgage Bankers Association.

January 6 -

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

December 24 -

Mortgage applications increased 0.8% from one week earlier, an indicator of the housing market’s strength as this year comes to an end, according to the Mortgage Bankers Association.

December 23 -

The accused, who also faces vehicle title and investment fraud charges, allegedly submitted falsified statements related to the payoff of an earlier mortgage when applying for a new one.

December 18 -

Mortgage applications increased 1.1% from one week earlier as a decline in rates to yet another low point brought consumers into the market, according to the Mortgage Bankers Association.

December 16 -

Applications for loans on newly built homes are still up considerably from a year ago, but they were down a little from October in the Mortgage Bankers Association’s latest survey.

December 15 -

Mortgage application activity decreased 1.2% on a seasonally adjusted basis last week, but refinance volume picked up as interest rates reached a new survey low, according to the Mortgage Bankers Association.

December 9 -

Mortgage applications decreased 0.6% on a seasonally adjusted basis from one week earlier as the period was truncated by the Thanksgiving holiday, according to the Mortgage Bankers Association.

December 2 -

A new report from California shows that less-regulated mortgage lenders may be doing a better than banks of serving Black and Latino homebuyers. But consumer advocates say the data bolsters the case for tougher supervision of nonbanks.

November 30 -

Mortgage applications increased 3.9% from one week earlier as another week of record low rates drew more borrowers into the market, according to the Mortgage Bankers Association.

November 25 -

Consumer demand for larger properties is driving the market in an atypical year that featured a delayed selling season, the Mortgage Bankers Association said.

November 23 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

Mortgage applications decreased 0.5% from one week earlier as inadequate housing supply is putting upward pressure on home prices and affecting purchase activity, according to the Mortgage Bankers Association.

November 11