-

-

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

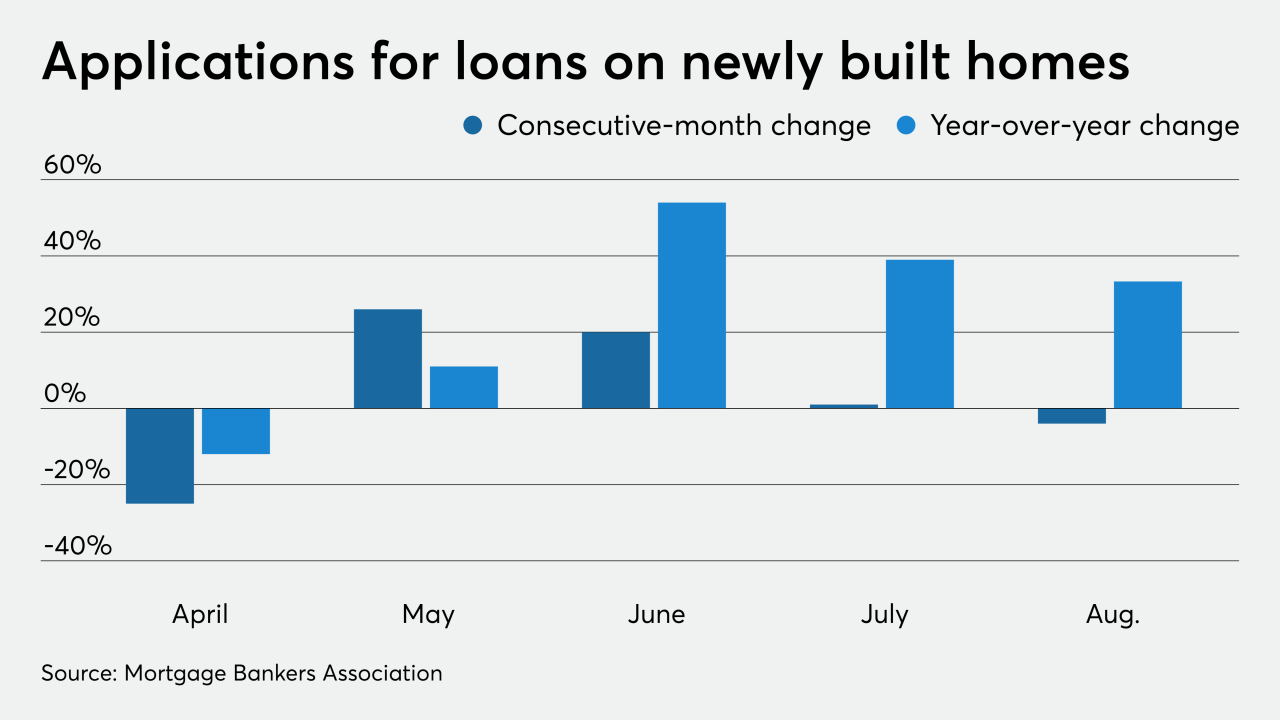

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

Mortgage applications decreased 3.3% from one week earlier, but purchase activity momentum persisted with home sales remaining a bright spot in the economic recovery, according to the Mortgage Bankers Association.

August 19 -

Home construction starts increased in July by more than forecast and applications to build surged by the most in three decades, indicating builders are responding to robust housing demand fueled by record-low interest rates.

August 18 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Mortgage applications decreased 0.8% from one week earlier as the latest spread of COVID-19 weighed on the minds of consumers looking to buy or refinance, according to the Mortgage Bankers Association.

July 29 -

Mortgage applications increased 4.1% from one week earlier as consumers continued to pursue both purchases and refinancings even as conforming rates rose from their record lows, according to the Mortgage Bankers Association.

July 22 -

Home construction starts rose 17% in June, with builders ramping up production as lockdowns eased.

July 17 -

Strong growth in refinance volume following several weeks of so-so activity drove a 5.1% week-to-week increase in mortgage applications, according to the Mortgage Bankers Association.

July 15 -

Mortgage applications to purchase new homes were up 54% compared to the same month the year before.

July 14