-

Contract closings rose 5.1% to a 4.35 million annualized pace last month, the highest since February 2023, according to figures released Wednesday by the National Association of Realtors.

January 14 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

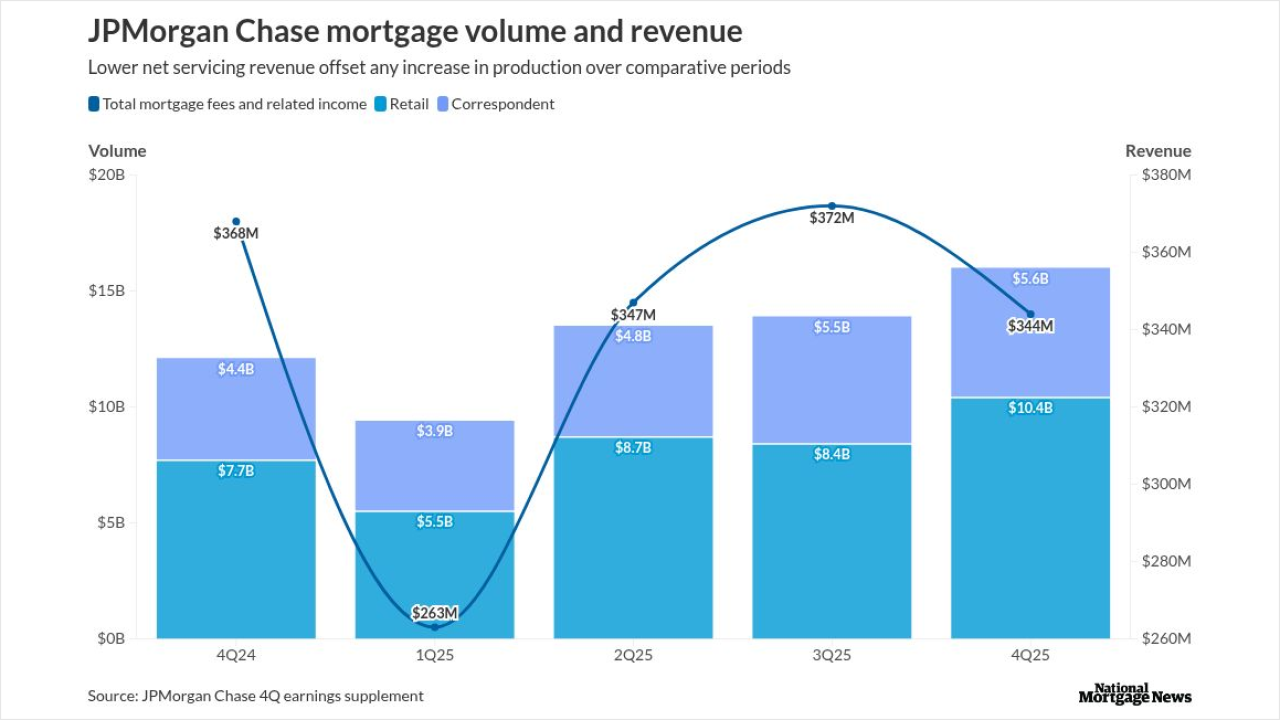

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

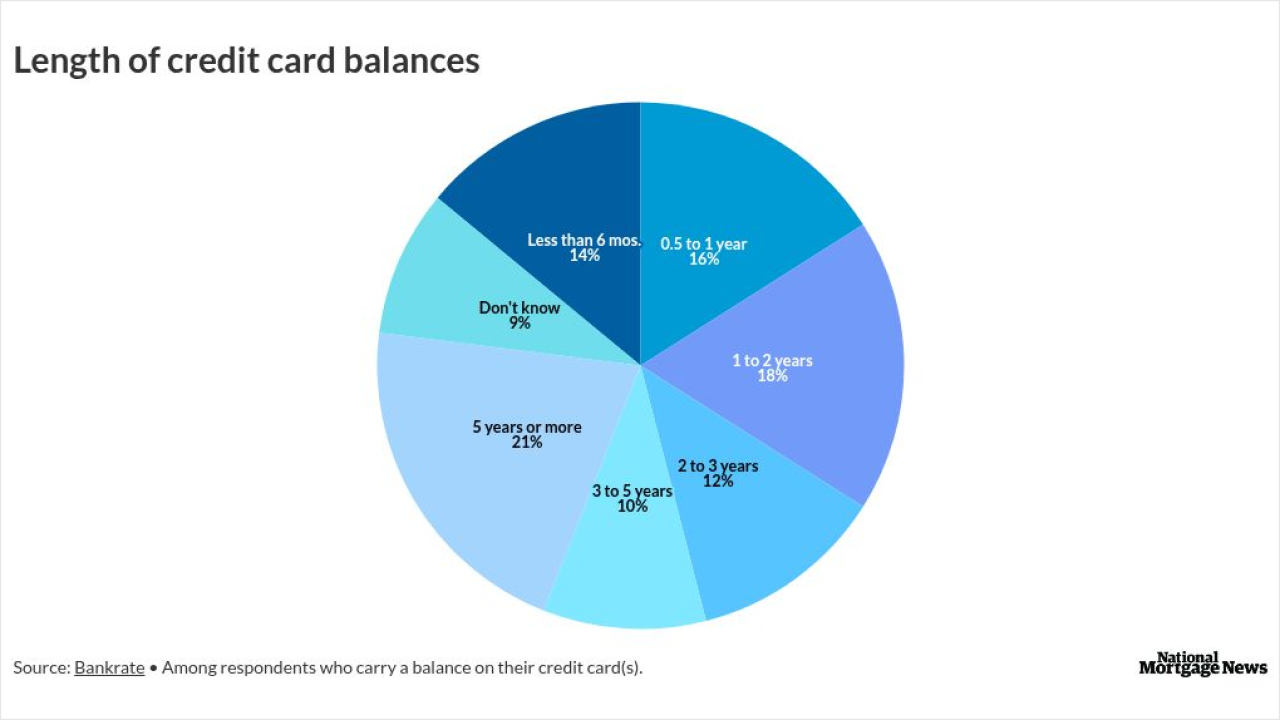

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12