-

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

Home prices are now something Americans can wager on. Polymarket partnered with Parcl to offer prediction markets tied to housing price indices.

January 9 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

Rochester, New York, and Harrisburg, Pennsylvania, stood atop Realtor.com's list for the second consecutive year, due to their affordability.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

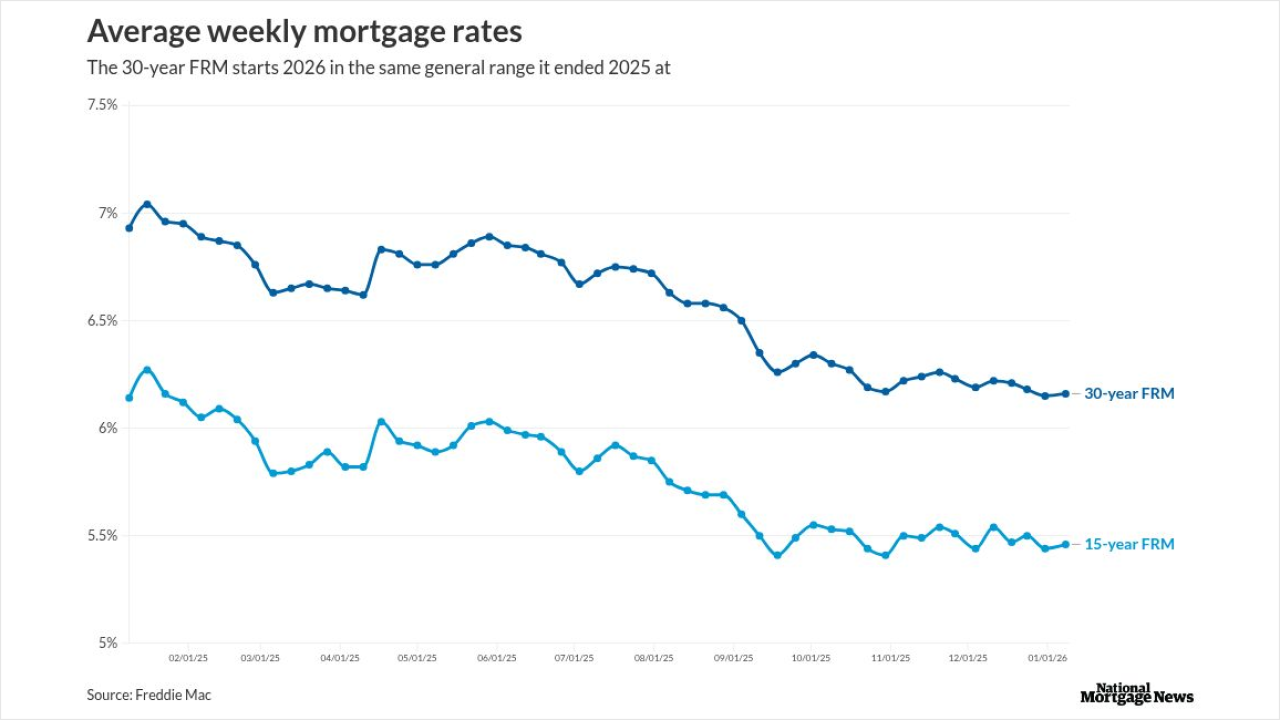

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8