-

New-home construction rose less than forecast in July amid a rebound in groundbreaking for single-family and multifamily houses, indicating the industry was trying to regain its footing at the start of the second half.

August 16 -

Purchase-loan share held steady month-to-month for the first time this year, even though it is still above year-ago levels in line with a seasonal decline, but growth remains in the forecast.

August 15 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

Homes in the Toledo, Ohio, area continued to sell quickly as they have done now for two years.

August 15 -

Confidence among homebuilders fell to an 11-month low in August on rising construction costs and shortages of skilled labor, a National Association of Home Builders/Wells Fargo report showed.

August 15 -

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

The risk of mortgage defaults reached its highest point since the second quarter of 2015 as lenders loosen credit, according to VantageScore.

August 10 -

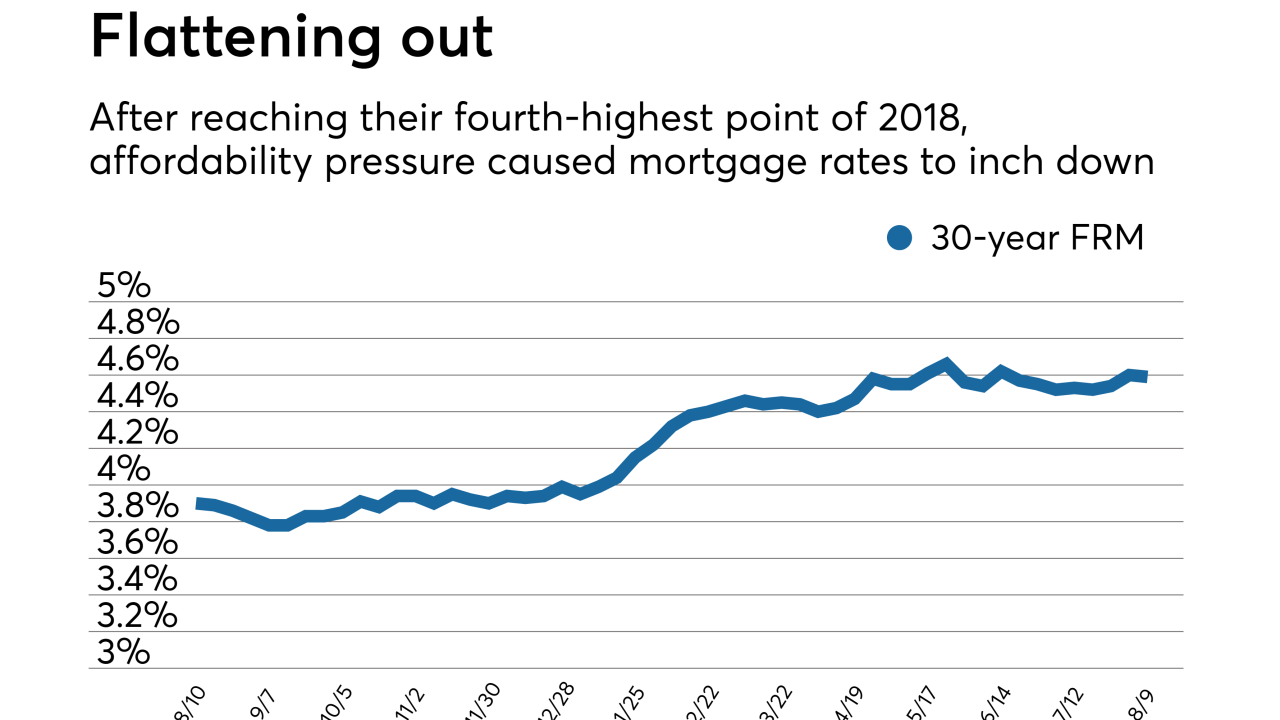

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8 -

Consumer optimism about purchasing a home continued to fade in July, as low inventory, rising prices and higher interest rates are affecting their market perception, Fannie Mae said.

August 7