-

While rising mortgage rates are top of mind for the industry after last week's increase in the federal funds rate, the housing market should be more concerned about limited home inventory, according to First American Financial Corp.

June 18 -

Sentiment among homebuilders fell in June to match the lowest level this year, reflecting sharply elevated lumber costs, according to a report from the National Association of Home Builders/Wells Fargo.

June 18 -

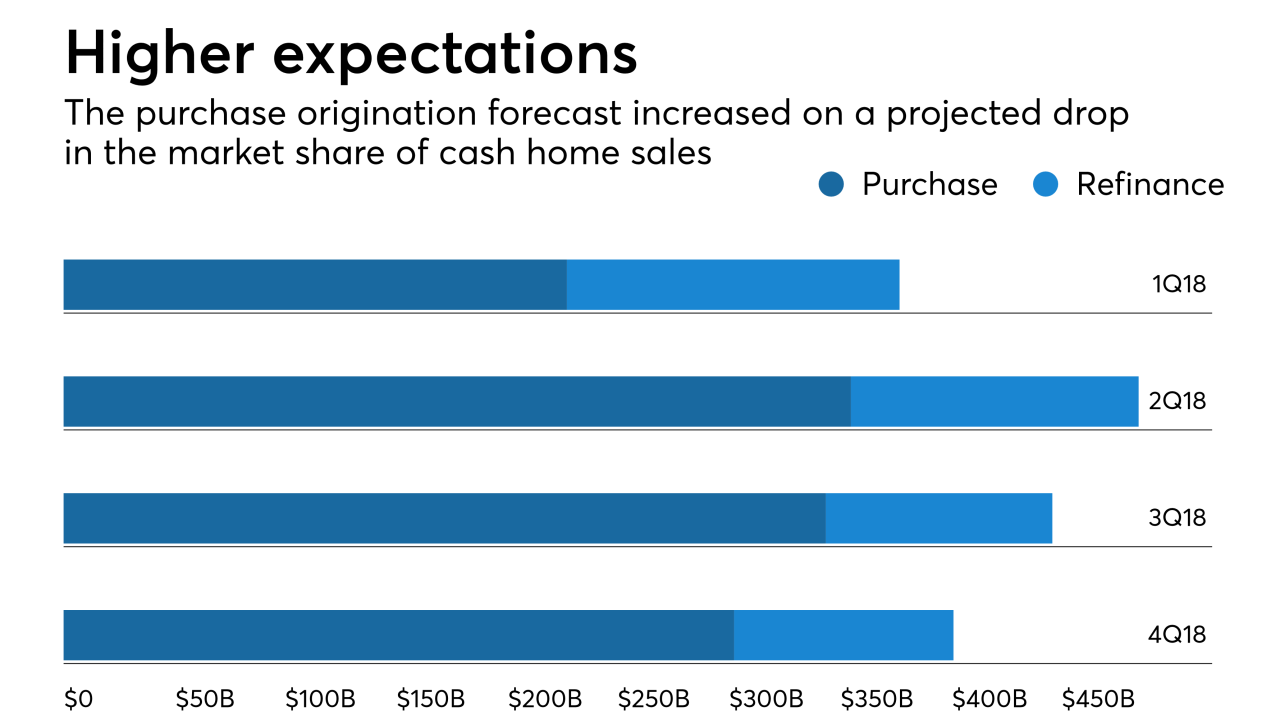

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

The high number of home sales both above and below the list price in May, combined with rising mortgage rates and prices, was a sign buyers are near affordability limits, Redfin said.

June 14 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13 -

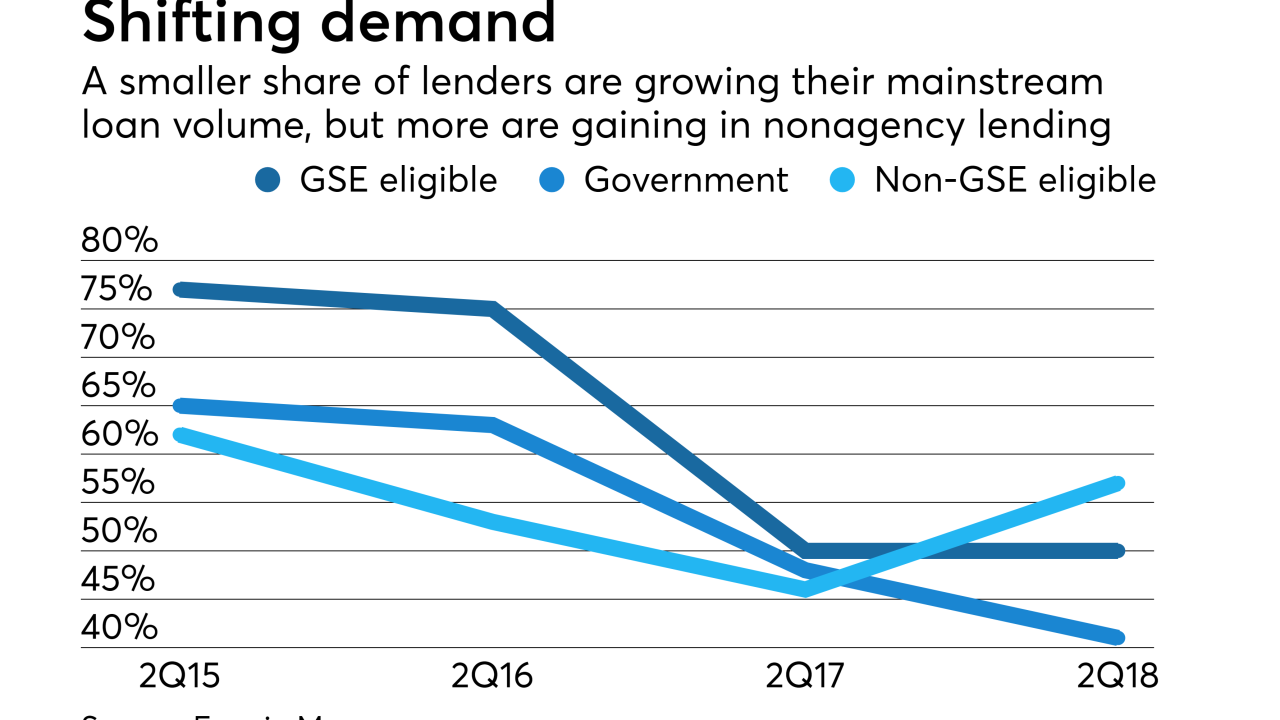

The net share of government and agency mortgage lenders who found spring homebuyer demand to be strong enough to drive purchase loan growth is considerably lower than three years ago.

June 12 -

Oahu housing prices moved up slightly in May but sales continued to lag during the spring homebuying season amid concerns that rising interest rates may be starting to have a dampening effect.

June 11 -

Continued optimism in the sell side of the real estate market outweighed the growing negative perception on the buy side, as consumer sentiment about purchasing a home reached a new high, according to Fannie Mae.

June 7 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

After eight consecutive weeks of decreases, mortgage applications increased by 4.1% last week as key interest rates dropped sharply, according to the Mortgage Bankers Association.

June 6 -

Contract signings to purchase previously owned U.S. homes unexpectedly declined in April, underscoring the housing market's challenge centered around a persistent inventory shortage.

May 31 -

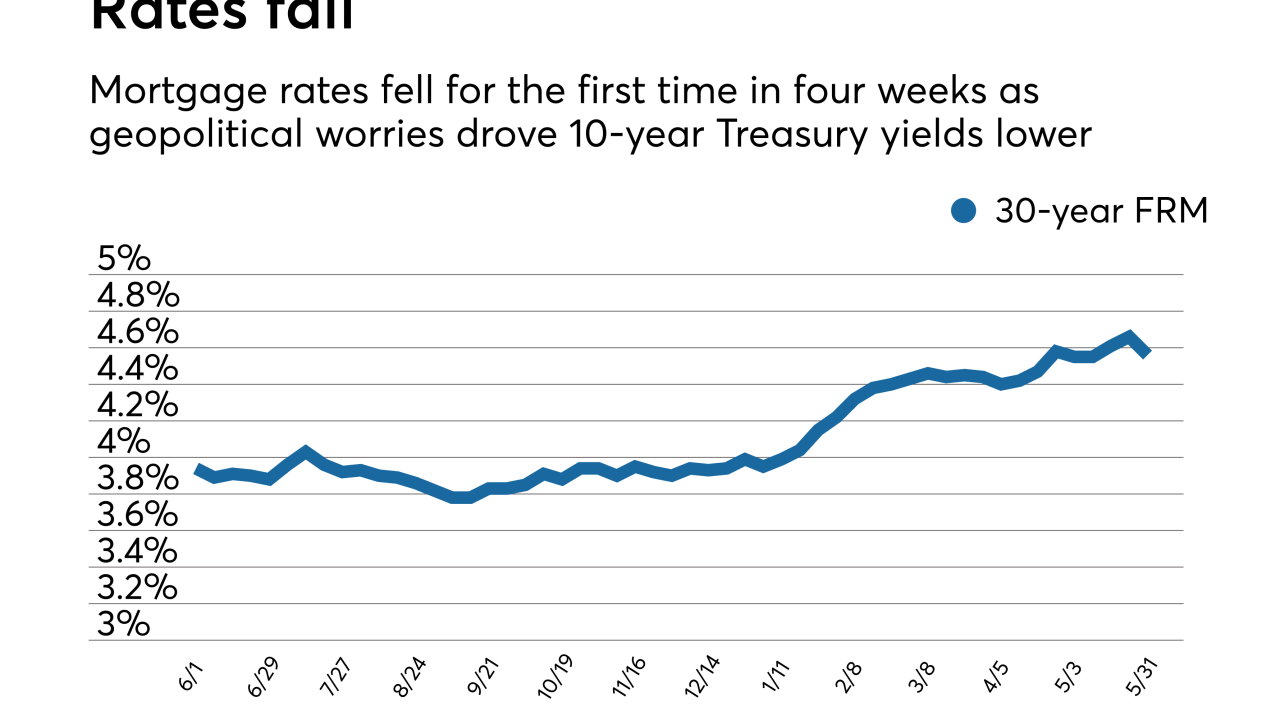

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

Marin's median home price spiked to $1.15 million in April, a 10% rise from the $1.045 million median price in April 2017.

May 30 -

In another sign that Palm Beach County finally has shaken off its long economic hangover, home prices hit another post-crash high in April.

May 29 -

From D.C. to Chicago, here's a look at the 12 cities where homebuyers are getting the best bang for their housing buck.

May 29 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

The cash-out mortgage refinance share was at its highest in nearly 10 years in the first quarter, due to rising interest rates and homes not being used as piggybanks.

May 24