-

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

The 2018 spring home buying season could be even more competitive than last year's, marked by fewer listings, quicker sales, and a higher percentage of homes selling above the asking price in January.

February 15 -

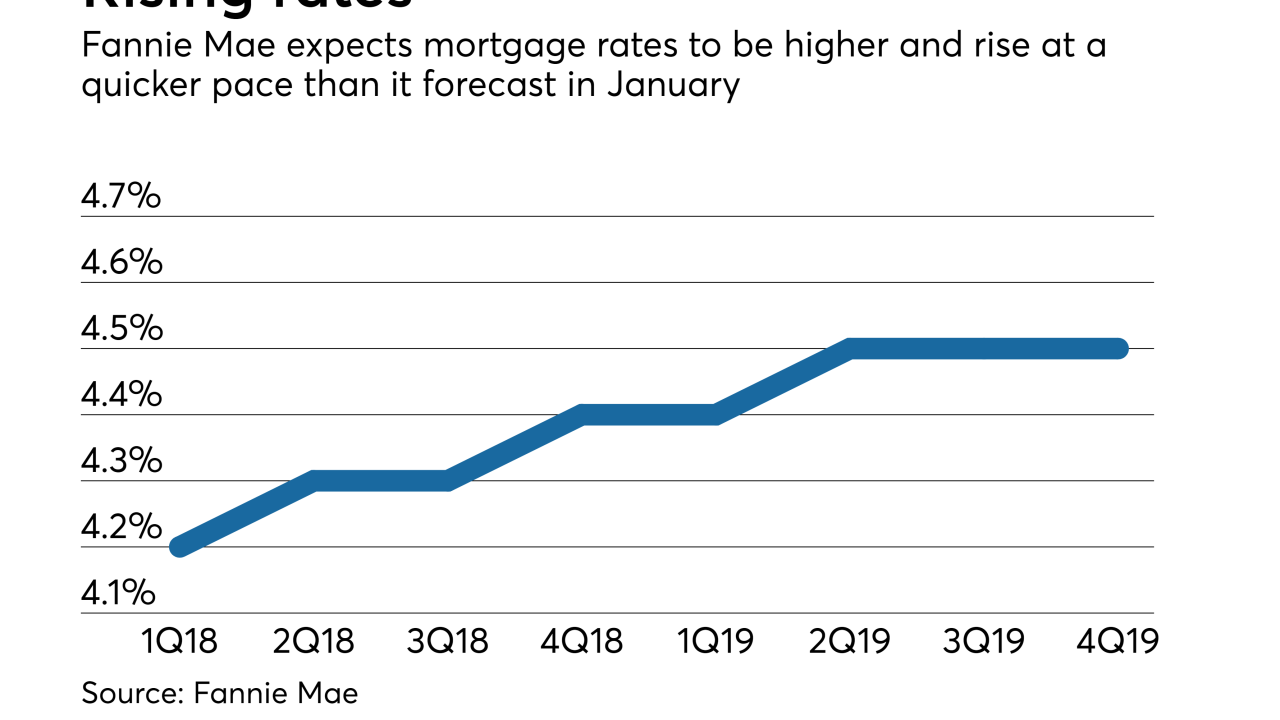

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

Homebuyers are most likely to slow their purchases or stay on course if mortgage rates rise above a certain benchmark, but some could act more quickly or drop out.

February 12 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6