-

Sales of previously owned homes fell in April to a three-month low as lean inventory continued to stand in the way of further progress while driving up prices.

May 24 -

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

May 24 -

Mortgage applications decreased by 2.6%, falling for the seventh straight week as key interest rates jumped to seven-year highs, according to the Mortgage Bankers Association.

May 23 -

Purchases of new homes fell in April, reflecting a setback in the Western part of the country and indicating rising borrowing costs and property prices may limit the market's progress.

May 23 -

Rising mortgage rates, higher real estate prices and a scarcity of listings have some Orlando homebuyers rethinking their search for a new house.

May 22 -

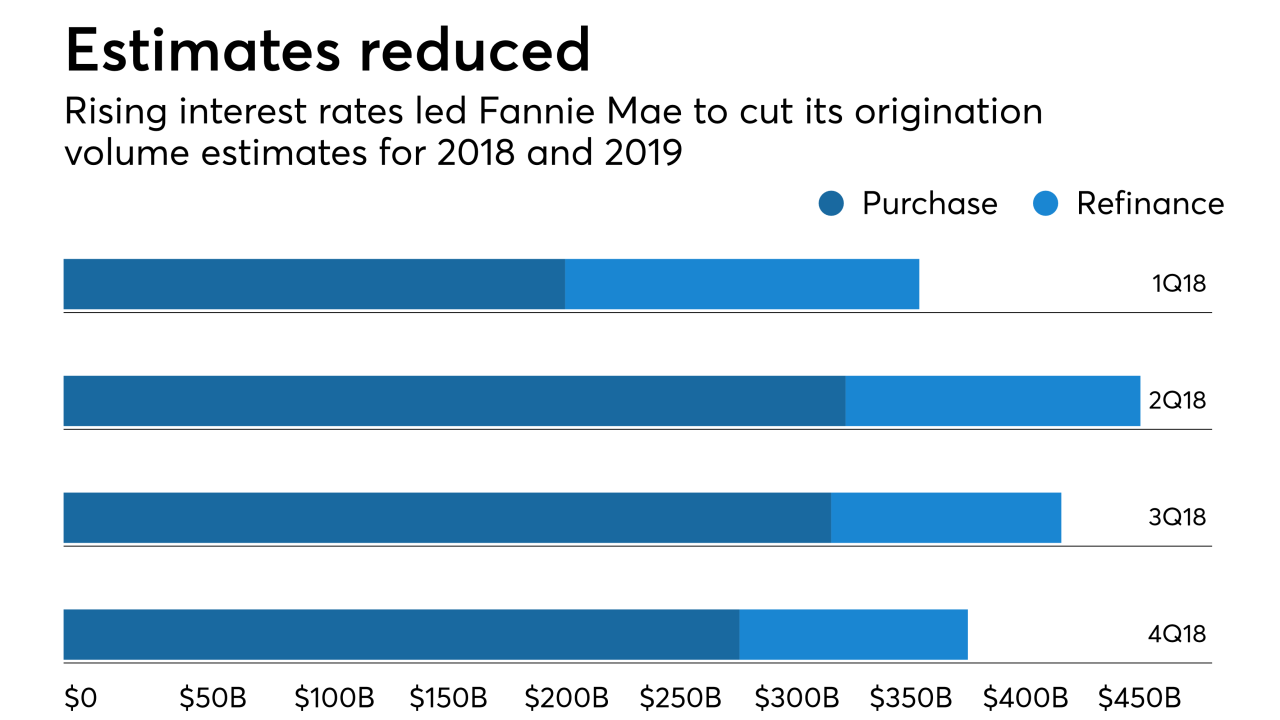

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16 -

Mortgage applications decreased by 2.7% and fell for the sixth straight week as key interest rates fell slightly, according to the Mortgage Bankers Association.

May 16 -

New-home construction declined in April as fewer starts of apartment projects outweighed a modest improvement in single-family structures, government figures showed Wednesday.

May 16 -

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

Sentiment among homebuilders rose for the first time in five months as job gains and tax cuts helped keep buyer demand healthy amid rising prices and mortgage rates.

May 15 -

Despite a healthier economy, growing household income was not enough to make an impact on home sales as the market still suffers from historically low levels of inventory.

May 14 -

The home buying season is already shaping up to be especially competitive this year, as rising prices and mortgage rates are putting a damper on purchasing power in many once-affordable housing markets.

May 10 -

Mortgage rates were unchanged over the past week, but appear to be headed higher with a robust summer home sales season expected, according to Freddie Mac.

May 10 -

Mortgage applications decreased by 0.4% and were down for the fifth straight week, as key interest rates also fell slightly, according to the Mortgage Bankers Association.

May 9 -

Bank of Montreal is wooing homebuyers with a variable mortgage rate with the biggest discount ever by a large Canadian bank, according to one market watcher.

May 8 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

The number of mortgage borrowers for whom it made sense to refinance declined by nearly half since the end of last year and is at its lowest since November 2008.

May 7