-

The effect of the conflict and upcoming Fed announcements have left much of the industry guessing about what happens next.

March 3 -

The Federal Reserve Chair Jerome Powell said the central bank expects to raise interest rates later this month to tackle hot inflation amid a tight labor market while Russia’s invasion of Ukraine has added uncertainty.

March 2 -

Optimal Blue researchers found correlations of 75% or more when looking at numbers of different loan-size cohorts, but the percentages came in lower when state data was analyzed.

February 28 -

Strong economic data was countered by international political developments, sending the 30-year rate lower for the first time in a month.

February 24 -

Federal Reserve Governor Michelle Bowman suggested that a half percentage-point increase in interest rates could be on the table next month if incoming readings on inflation come in too high.

February 21 -

The 30-year average increased by 23 basis points on inflation, geopolitical news.

February 17 -

Minutes of the Jan. 25-26 Federal Open Market Committee meeting, released Wednesday, “[tell] us that they will raise the fed funds rate in March, and that a 50 basis point rate hike is in play,” said Gus Faucher, chief economist for PNC Financial Services Group.

February 17 -

Federal Reserve Bank of St. Louis President James Bullard said he supports raising interest rates by a full percentage point by the start of July — including the first half-point hike since 2000 — in response to the hottest inflation in four decades.

February 11 -

Inflation data showing a 7.5% increase in consumer prices will likely lead to Federal Reserve moves that apply continued upward pressure.

February 10 -

But the current lack of movement is likely only a temporary reprieve, according to Freddie Mac.

February 3 -

But economists predict upward pressure in the coming months after comments from Federal Reserve Chair Jerome Powell.

January 27 -

Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle the highest inflation in a generation.

January 26 -

However, the shortage of entry-level home listings should result in a competitive spring purchase season, the government-sponsored enterprise said.

January 24 -

Treasury dealers and investors are busy trying to predict exactly when the Federal Reserve might pull the trigger on cutting the size of its balance sheet and how big that drawdown could be when it does.

January 21 -

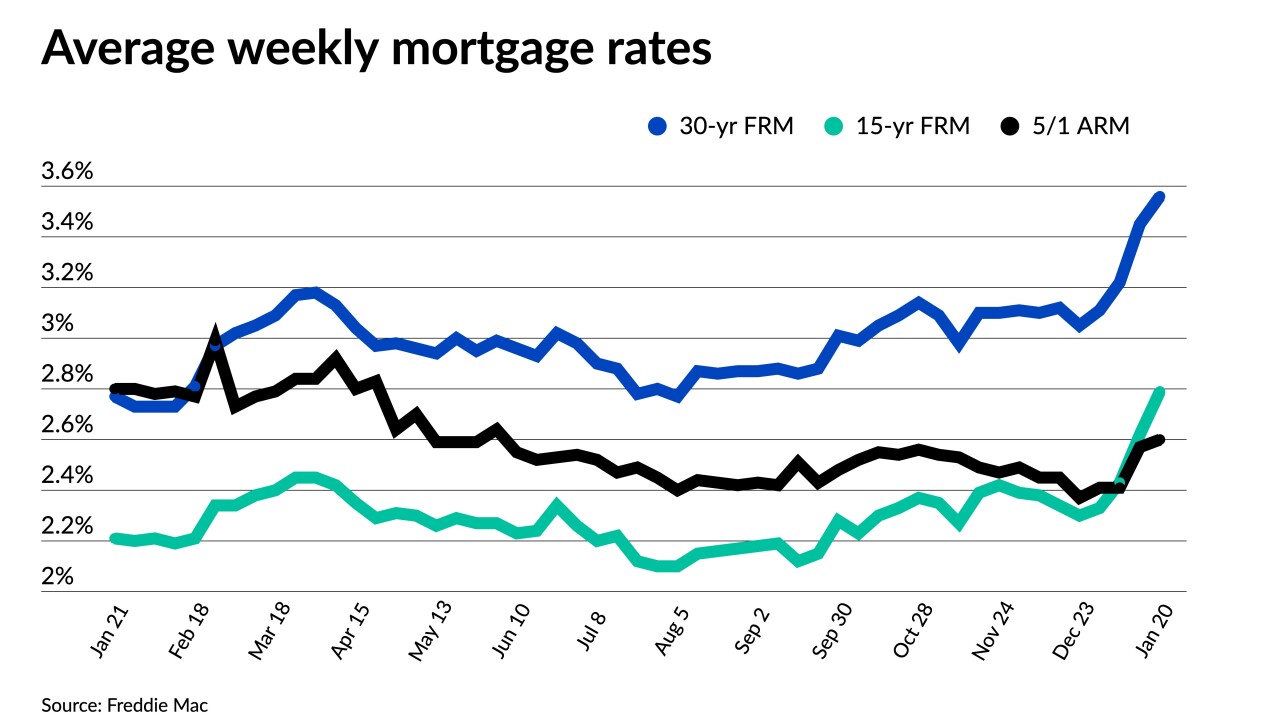

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

The latest jobs and economic numbers pave the way for additional upward movement throughout 2022, analysts said.

January 13 -

December's activity was down 18% from November, led by a 23% drop in purchase volume and a 17% decline in rate-and-term refinancings, Black Knight said.

January 10 -

Nearly half of likely buyers said they feel more urgency to act if the 30-year FRM reached 3.5%, a Redfin survey found.

January 7 -

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

Federal Reserve officials said a strengthening economy and higher inflation could lead to earlier and faster interest-rate increases than previously expected, with some policy makers also favoring starting to shrink the balance sheet soon after.

January 5