-

A majority of the 49 economists in the survey predicted the U.S. central bank will begin the taper in November and wrap it up by mid-2022, curbing the current $120 billion monthly buying pace by reducing Treasuries by $10 billion a month and mortgage-backed securities by $5 billion.

November 2 -

The 30-year average stayed above 3% for the second straight seven-day period, with improved retail sales data helping drive the uptick.

October 21 -

Inflation, supply chain issues and labor shortages will lead to a tightening by the Fed sooner rather than later.

October 15 -

Rising inflation and moves by the Federal Reserve are expected to fuel interest rate growth into 2022.

October 14 -

Federal Reserve officials broadly agreed last month they should start reducing emergency pandemic support for the economy, minutes of the Sept. 21-22 Federal Open Market Committee meeting released Wednesday said.

October 13 -

However, economic data points to likely future increases, with investors awaiting numbers from upcoming jobs report.

October 7 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

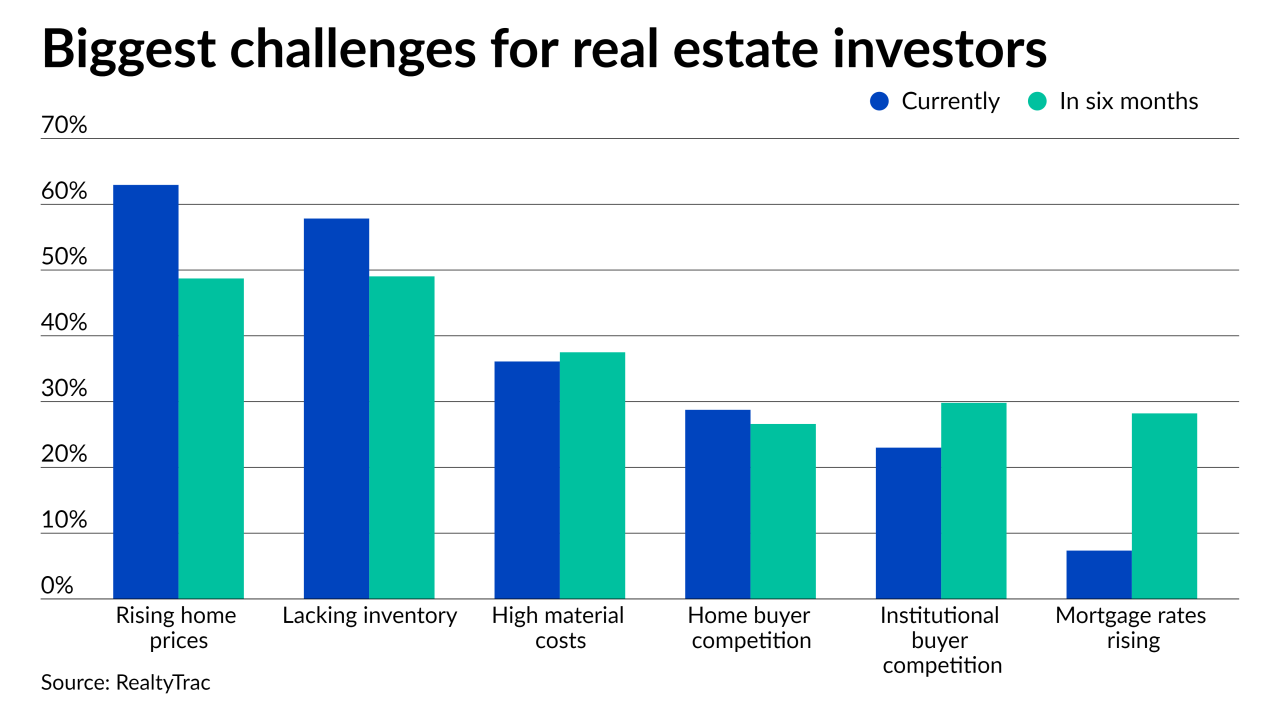

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Federal Reserve officials reinforced the U.S. central bank’s message that it would probably begin winding down its bond-buying program soon, though the economic recovery still had a way to go before interest rate increases would be appropriate.

September 28 -

However, the pullback in mortgage-backed securities purchases will be one of the factors in rates rising in the medium term.

September 23 -

Foreign investment helped offset a slowing domestic recovery, causing few ripples for the week, but economists expect future taper of bond purchases to lead to upward movement.

September 23 -

COVID-19 concerns, inflation hold back actions that might change current patterns.

September 16 -

Effects of major economic announcements this summer have had little impact on the lending market, with averages remaining under 3% since July.

September 9 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

The 30-year average has remained below 3% for two months.

September 2 -

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

The Federal Reserve will soon begin slowing its stimulus program as employment and the U.S. economy continue to rebound, according to Greg Fleming, head of wealth adviser Rockefeller Capital Management.

August 23 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18