-

However, the pullback in mortgage-backed securities purchases will be one of the factors in rates rising in the medium term.

September 23 -

Foreign investment helped offset a slowing domestic recovery, causing few ripples for the week, but economists expect future taper of bond purchases to lead to upward movement.

September 23 -

COVID-19 concerns, inflation hold back actions that might change current patterns.

September 16 -

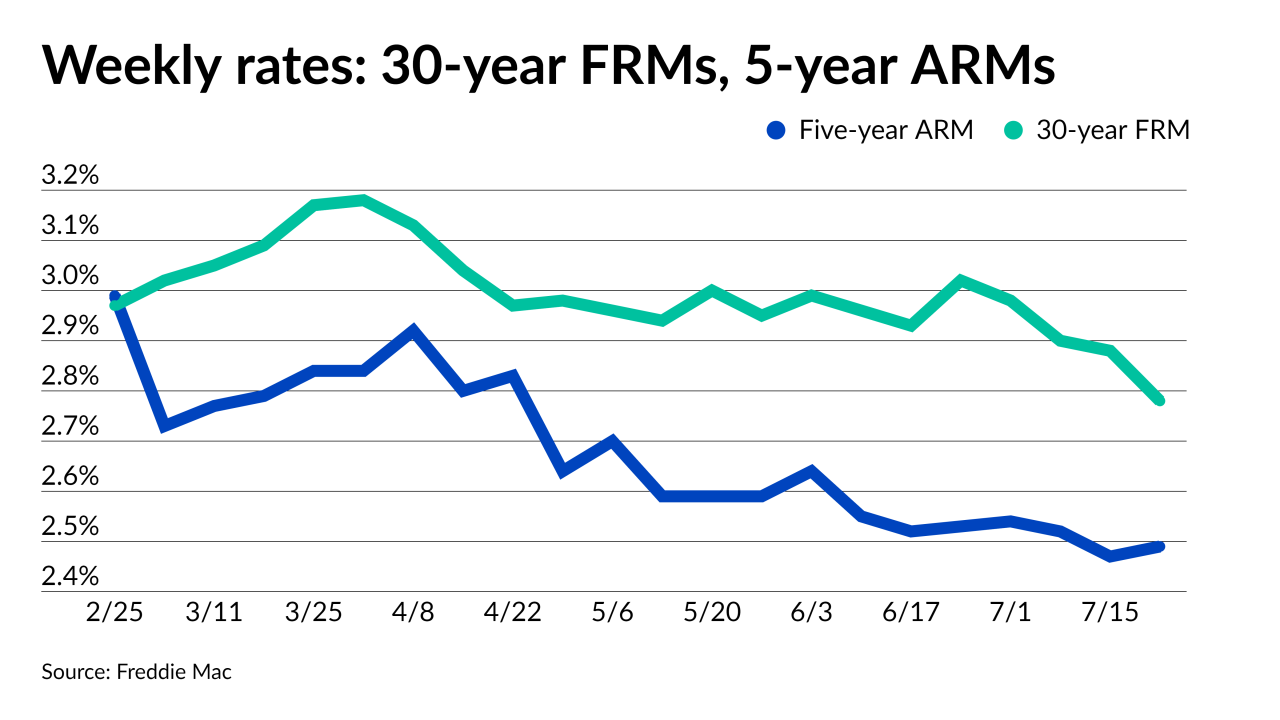

Effects of major economic announcements this summer have had little impact on the lending market, with averages remaining under 3% since July.

September 9 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

The 30-year average has remained below 3% for two months.

September 2 -

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

The Federal Reserve will soon begin slowing its stimulus program as employment and the U.S. economy continue to rebound, according to Greg Fleming, head of wealth adviser Rockefeller Capital Management.

August 23 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

But median prices still rose 17% year-over-year, the company found.

August 13 -

The average was up from 2.77% last week and the highest since July 15, Freddie Mac said Thursday.

August 12 -

An equal split of refinance and purchase rate locks occurred during July, helped by elimination of the adverse market fee, Black Knight said.

August 9 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The delta variant added uncertainty to markets, leaving investors cautious about moves that would lead to upward movement.

August 5 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

Despite declining rates, refinancing volume fell, while purchases slowed even further after dipping to its lowest point in over a year.

August 4 -

A change in the relationship between fixed and adjustable loans has increased some consumers’ interest in the latter market.

July 28 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28 -

Officials have pledged to maintain bond buying until the economy shows "substantial further progress" on inflation and employment as it recovers from COVID-19.

July 23