-

Mortgage rates declined for the third straight week, adding to a brighter outlook for the spring home buying season, according to Freddie Mac.

February 21 -

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

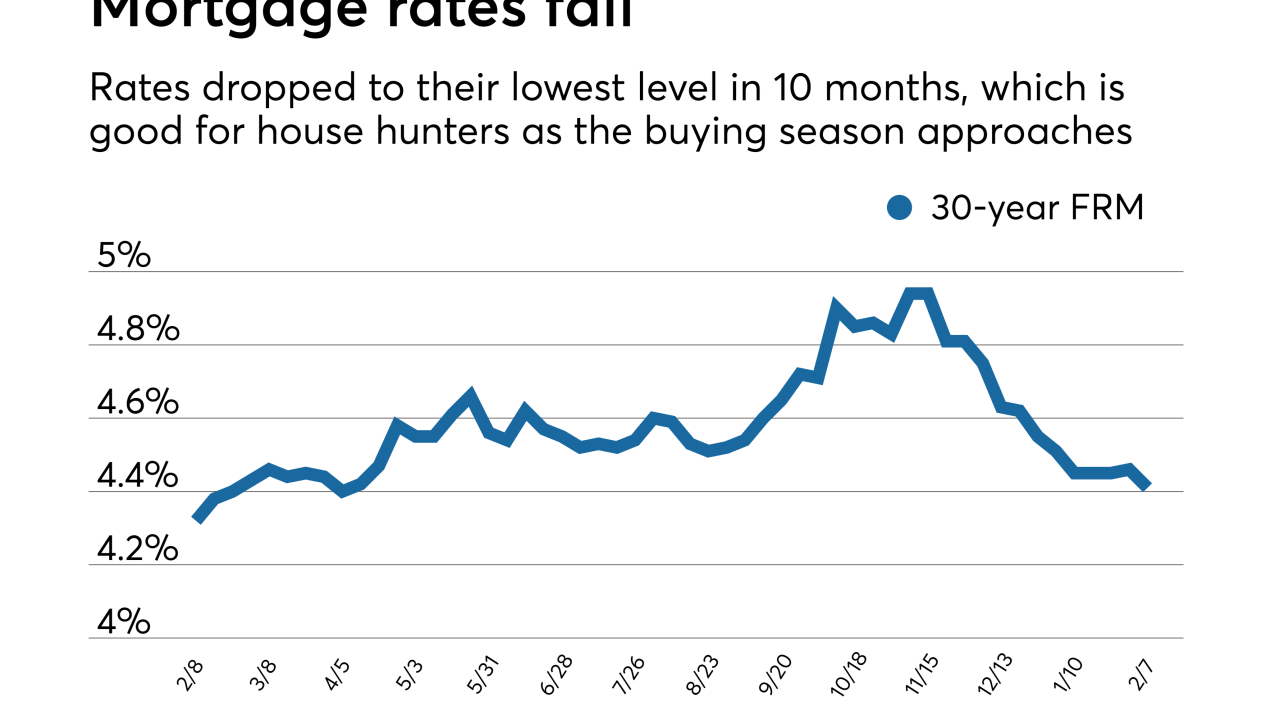

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10 -

Rising home prices along with a changing perception of the U.S. economy reduced consumer confidence in the housing market to the lowest point of 2018, according to Fannie Mae.

January 7