-

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

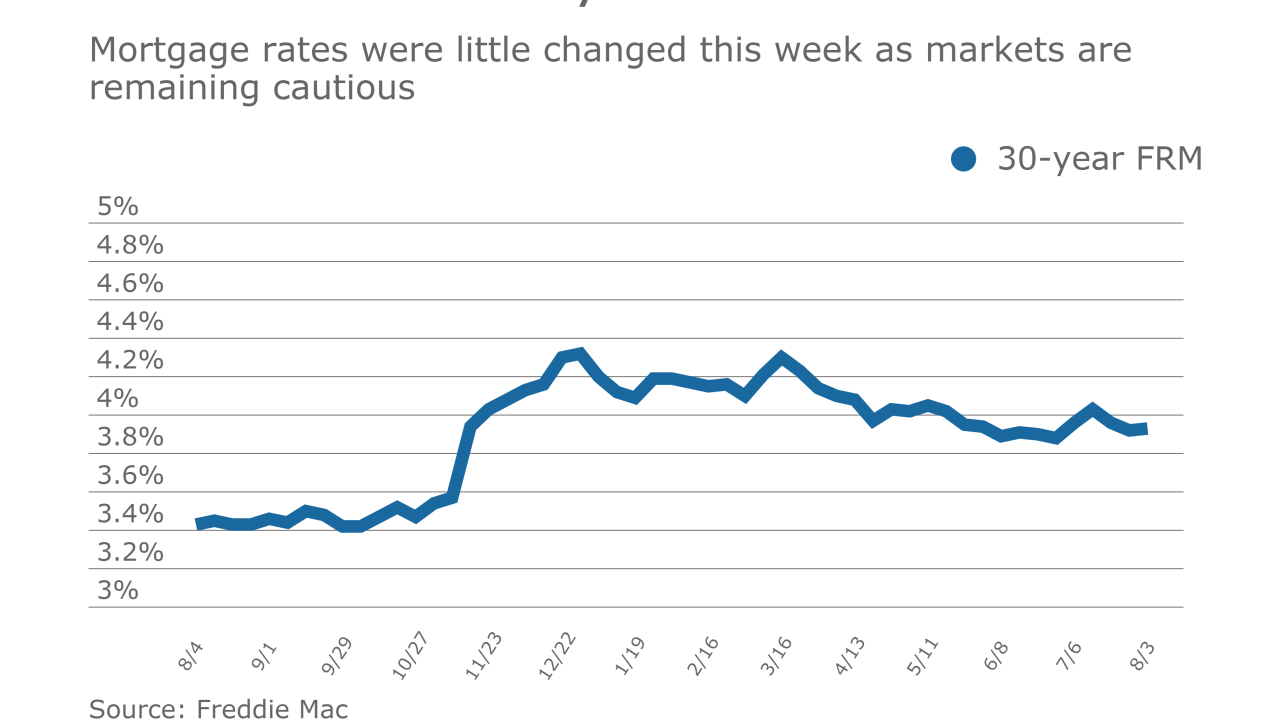

August 28 Fannie Mae

Fannie Mae -

Mortgage rates decreased for the fourth consecutive week and dropped to their lowest mark since November, according to Freddie Mac.

August 24 -

Mortgage rates continued to move lower as a result of economic uncertainty, according to Freddie Mac.

August 17 -

Mortgage rates dropped to their lowest point in six weeks as bond investors were concerned about inflation and the U.S. economy, according to Freddie Mac.

August 10 -

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Mortgage rates moved back below 4%, pushed by last week's weak economic data report, according to Freddie Mac.

July 20 -

Mortgage loan application volume increased 6.3% last week as interest rates remained flat after a sharp gain during the previous 14-day period, according to the Mortgage Bankers Association.

July 19 -

Mortgage rates rose across the board for the second consecutive week, with the 30-year fixed-rate loan moving over 4%, according to Freddie Mac.

July 13