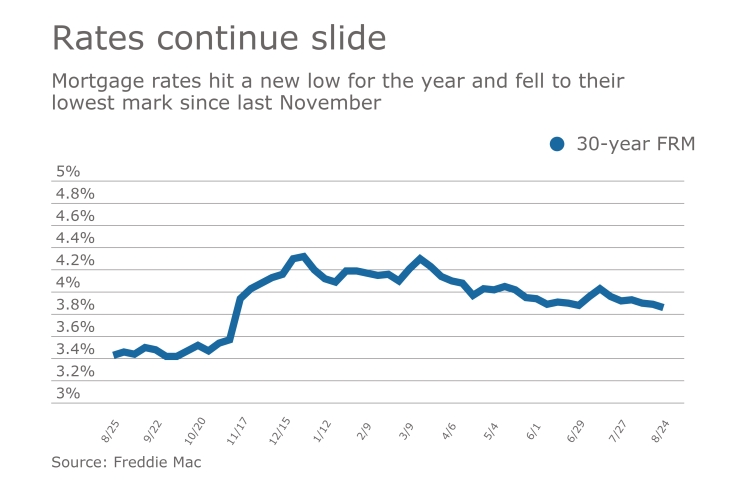

Mortgage rates decreased for the fourth consecutive week and dropped to their lowest mark since November, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.86% | 3.16% | 3.17% |

| Fees & Points | 0.5 | 0.5 | 0.5 |

| Margin | N/A | N/A | 2.74 |

Rates sank to their lowest level of the year this week as inflation remained stubbornly low and fears about a possible government shutdown mounted, Freddie Mac added.

The 30-year fixed-rate mortgage averaged 3.86% for the week ending Aug. 24,

"The 10-year Treasury yield fell 6 basis points this week amid concerns over lagging inflation. The 30-year mortgage rate also declined for the fourth consecutive week, dropping 3 basis points to a new year-to-date low," Sean Becketti, Freddie Mac's chief economist, said in a press release.

The 15-year fixed-rate mortgage averaged 3.16%, the same as last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 2.74%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.17%, up from last week when it averaged 3.16%. A year ago at this time it averaged 2.75%.

"Despite some volatility early in the week driven by geopolitical uncertainty and domestic political turmoil, mortgage rates ended last week roughly where they started it near 10-month lows,” Erin Lantz, Zillow's vice president of mortgages, said when that company released its own rate tracker on Tuesday.

"With little economic data on the schedule for this week, rates are likely to be relatively flat," Lantz said.