-

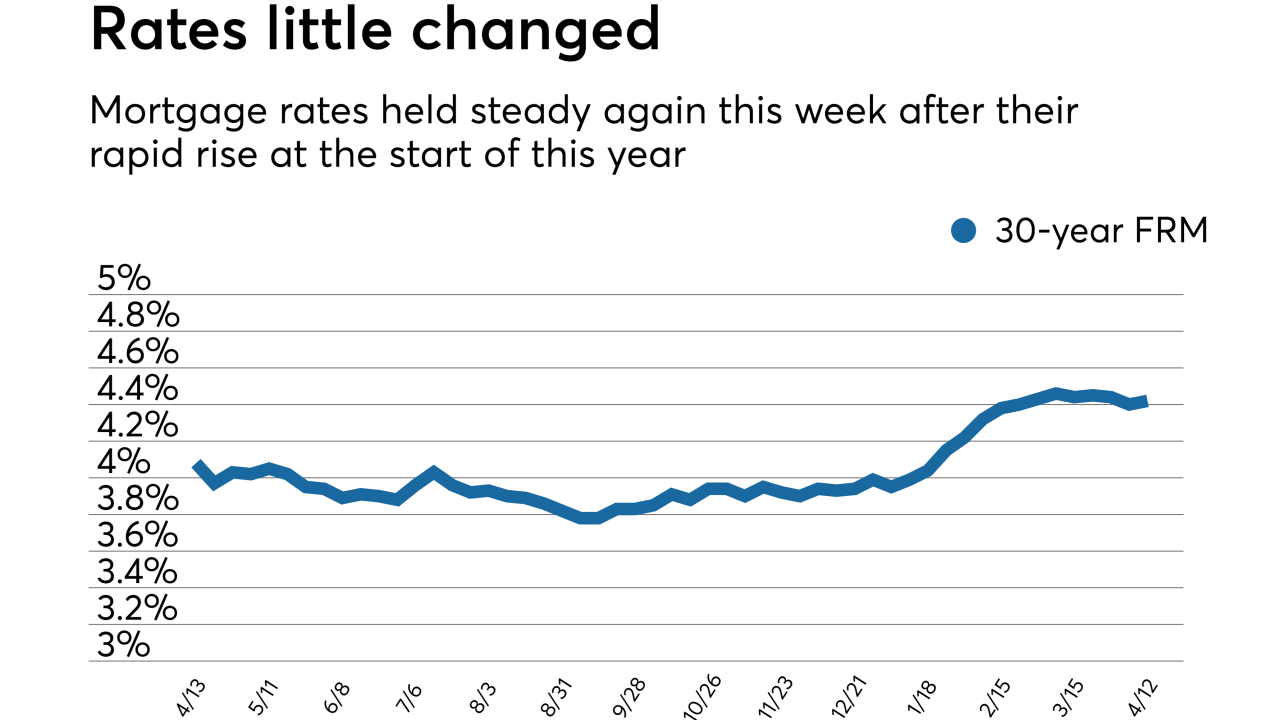

Mortgage rates were unchanged over the past week, but appear to be headed higher with a robust summer home sales season expected, according to Freddie Mac.

May 10 -

Mortgage rates dipped slightly over the past week as yields on the 10-year Treasury retreated after breaking the 3% barrier, according to Freddie Mac.

May 3 -

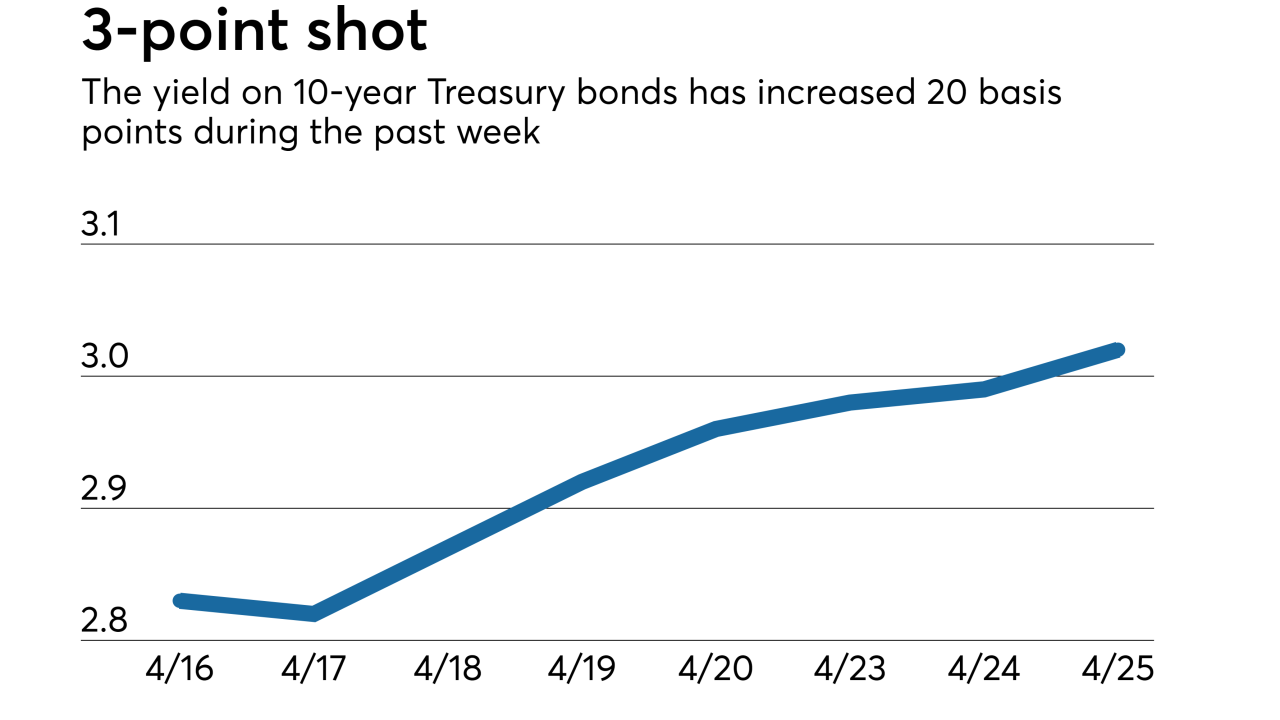

Mortgage rates rose to their highest level in over four years, as 10-year Treasury yields broke the 3% ceiling this past week.

April 26 -

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

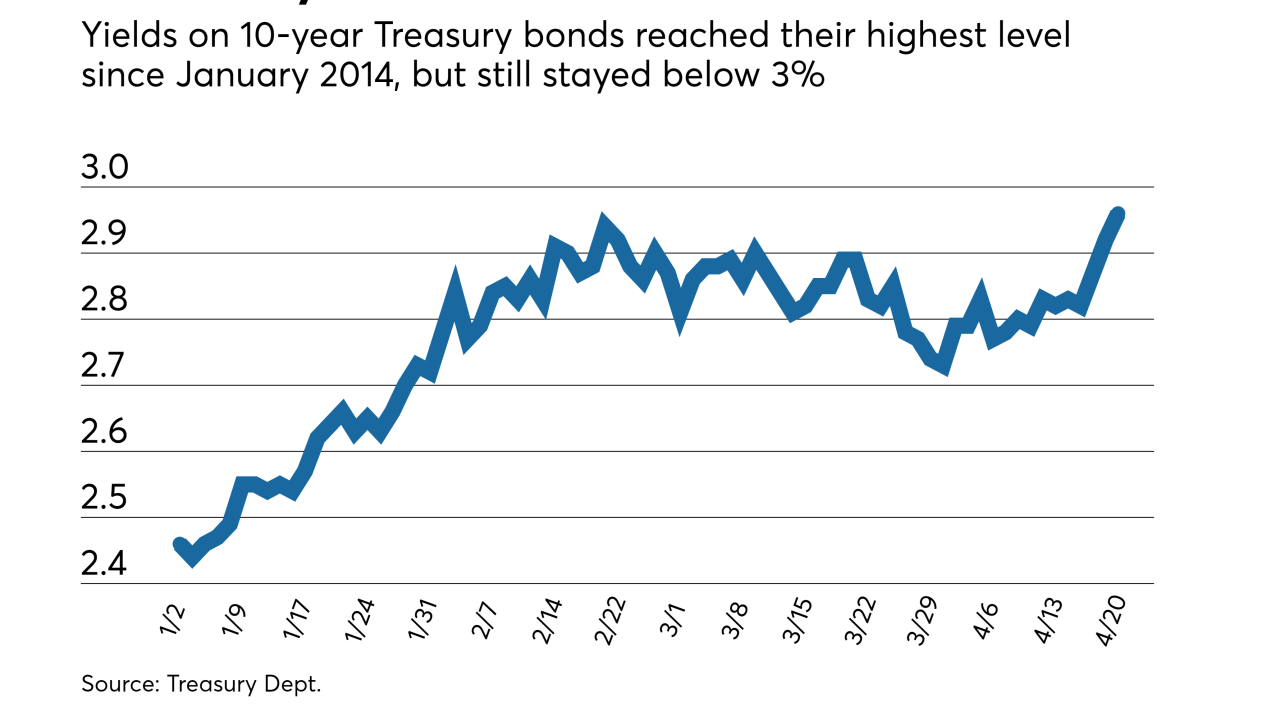

Yields on the 10-year Treasury hit their highest level since the start of 2014 and got very close to cracking the 3% mark, signaling a potential spike in mortgage rates.

April 20 -

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

April 19 -

Mortgage rates increased a scant two basis points this past week, holding steady recently after their rapid rise at the start of this year, according to Freddie Mac.

April 12 -

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

After increasing for nine consecutive weeks, mortgage rates dropped for the first time in 2018, according to Freddie Mac's Primary Mortgage Market Survey.

March 15 -

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

March 8 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

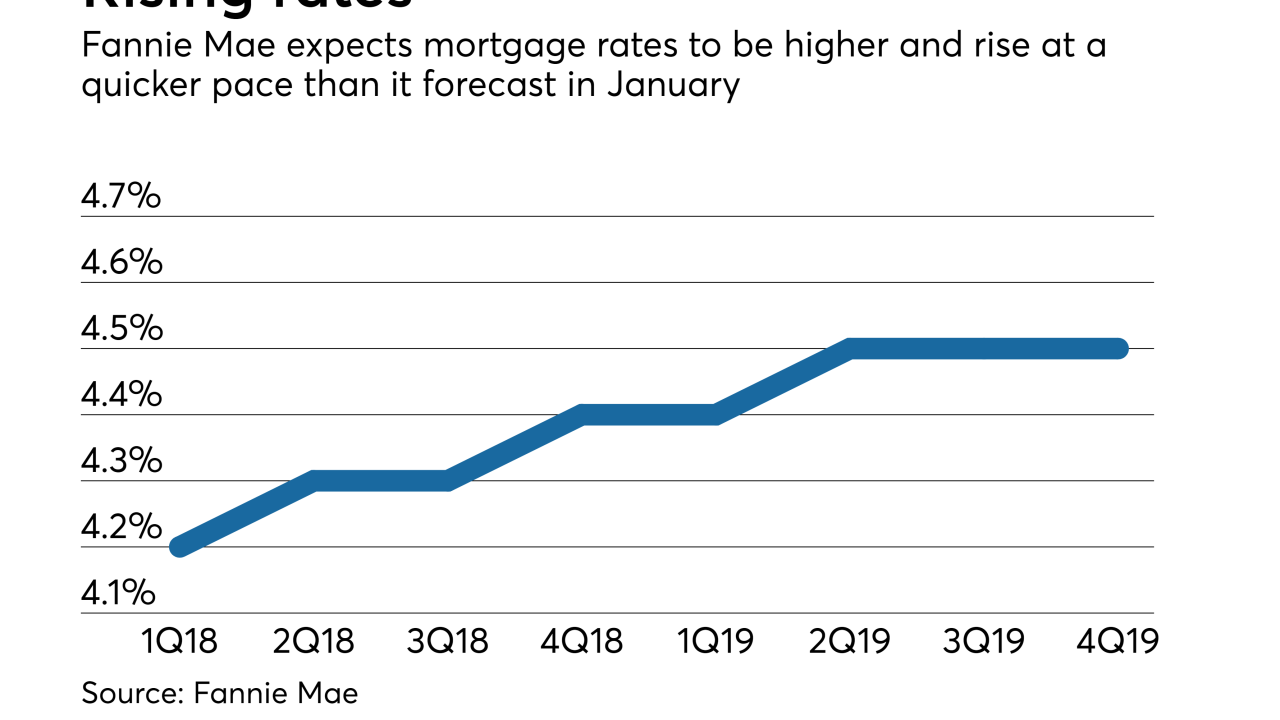

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

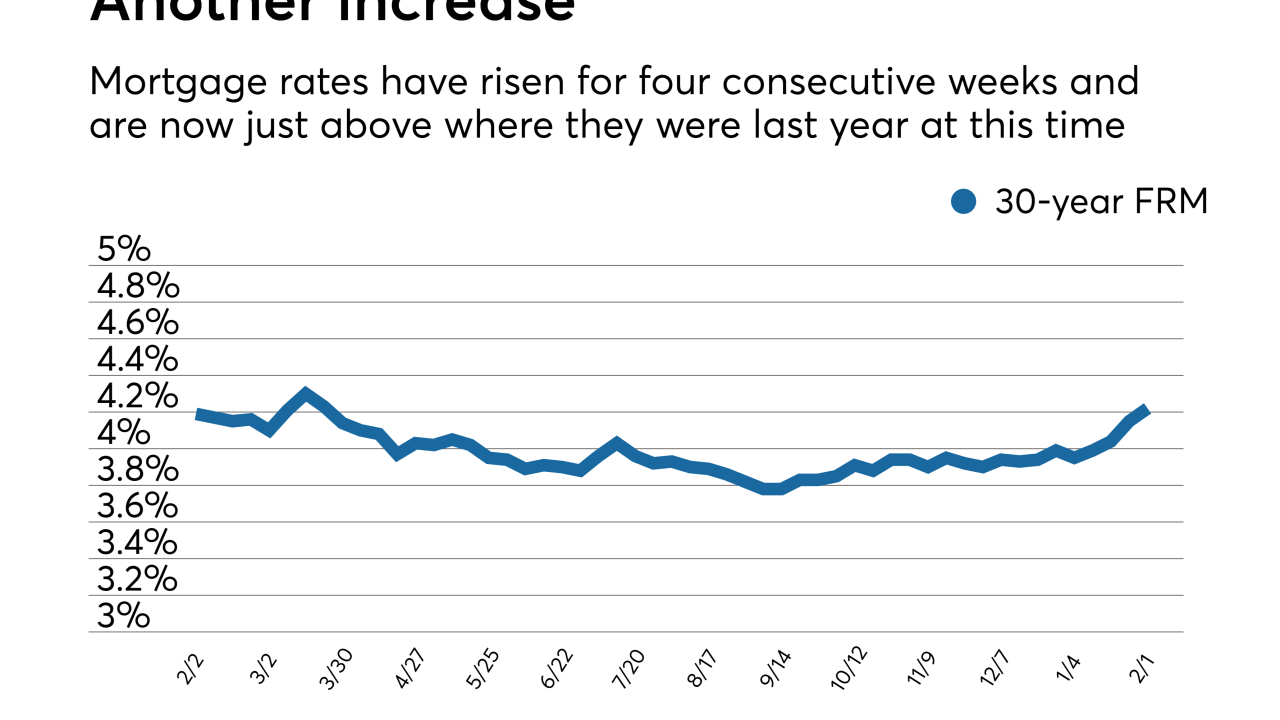

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

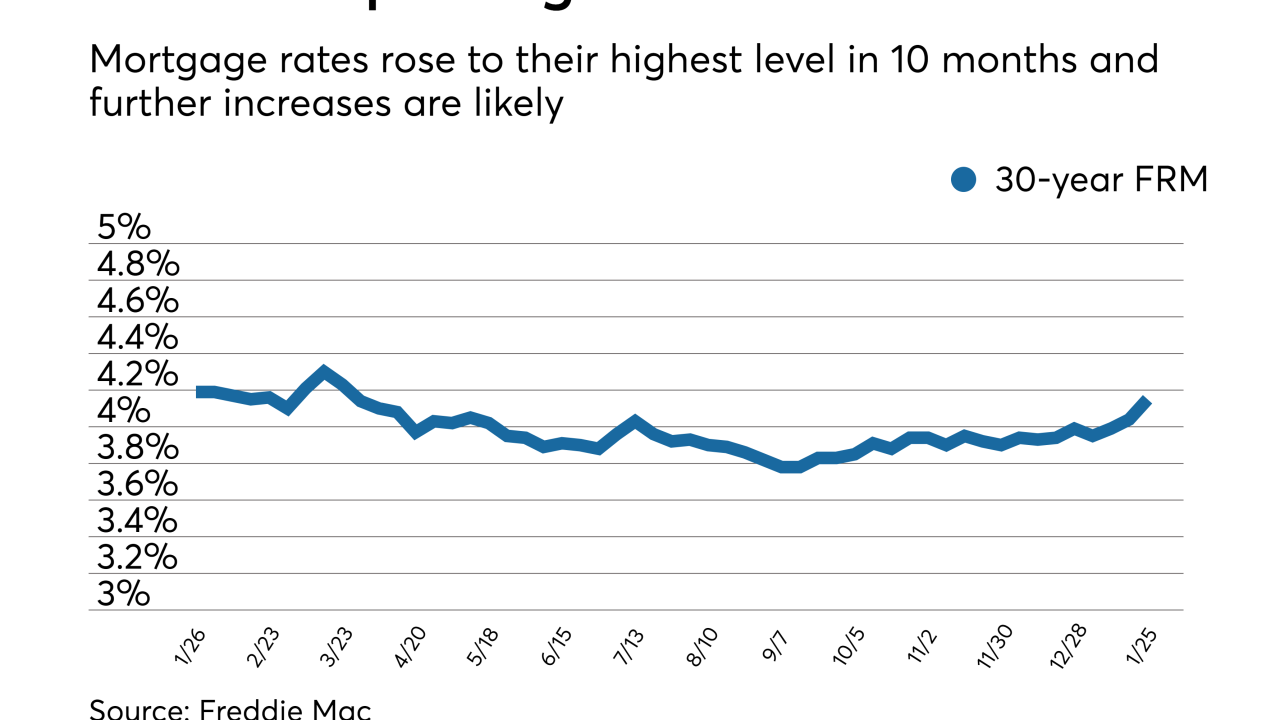

February 1 -

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25