Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.45% | 3.91% | 3.68% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

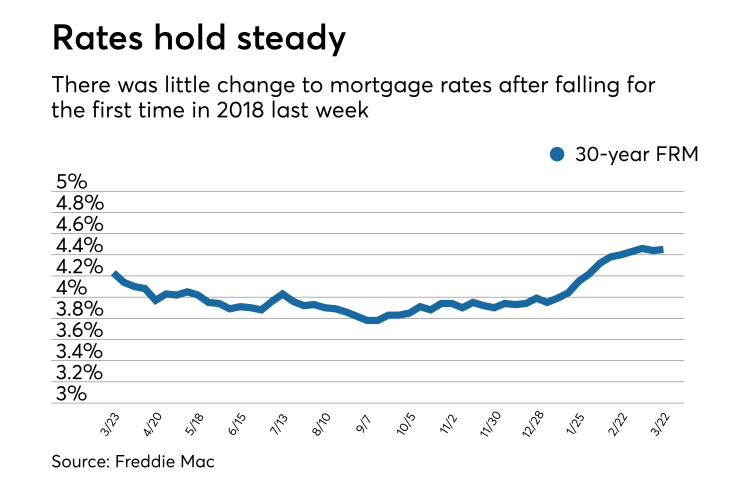

The 30-year fixed-rate mortgage averaged 4.45% for the week ending March 22,

The 15-year fixed-rate mortgage this week averaged 3.91%, up from last week when it averaged 3.9%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.44%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.68% this week with an average 0.4 point, up from last week when it averaged 3.67%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.24%.

"The Fed's decision to raise interest rates by a quarter of a percentage point puts the federal funds rate at its highest level since 2008. The decision, while widely expected, sent the yield on the benchmark 10-year Treasury soaring," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release. "Following Treasurys, mortgage rates shrugged off last week's drop and continued their upward march."

Higher rates have not yet affected the housing market, Kiefer continued, noting

Going forward, "markets are likely to watch incoming consumer confidence and gross domestic product data, but geopolitical events could always have an impact as well," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.