-

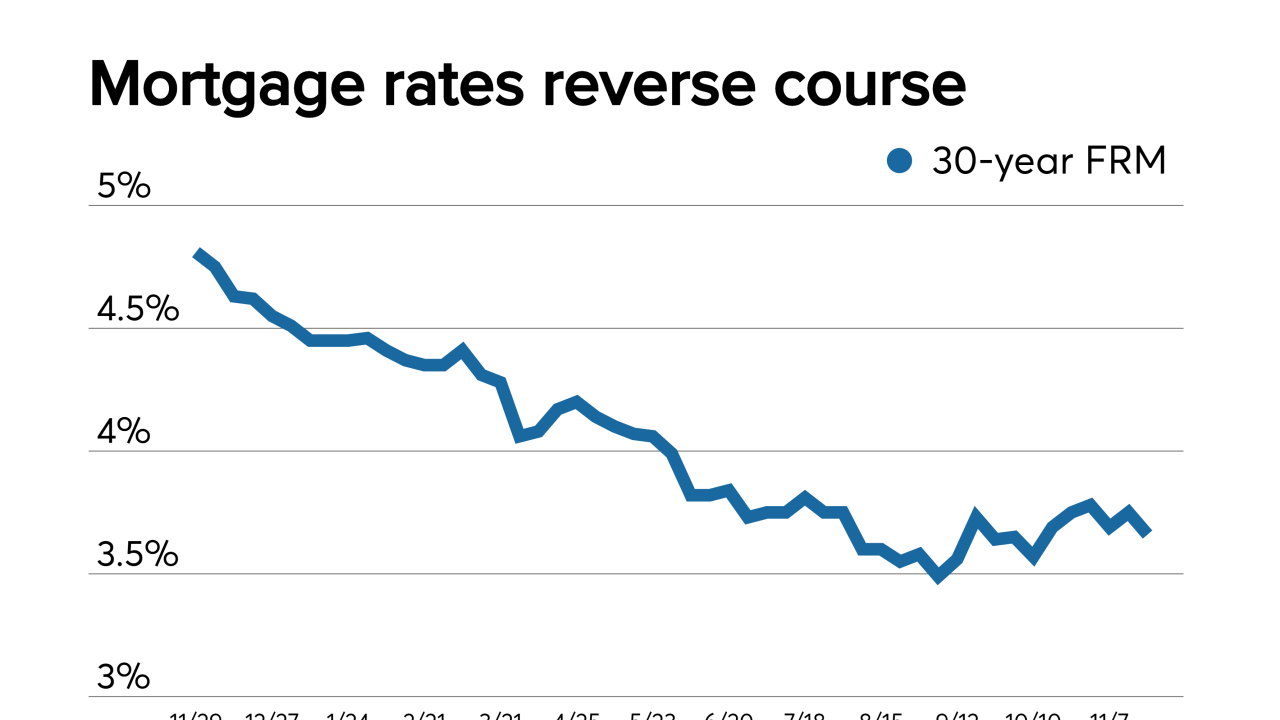

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

November 21 -

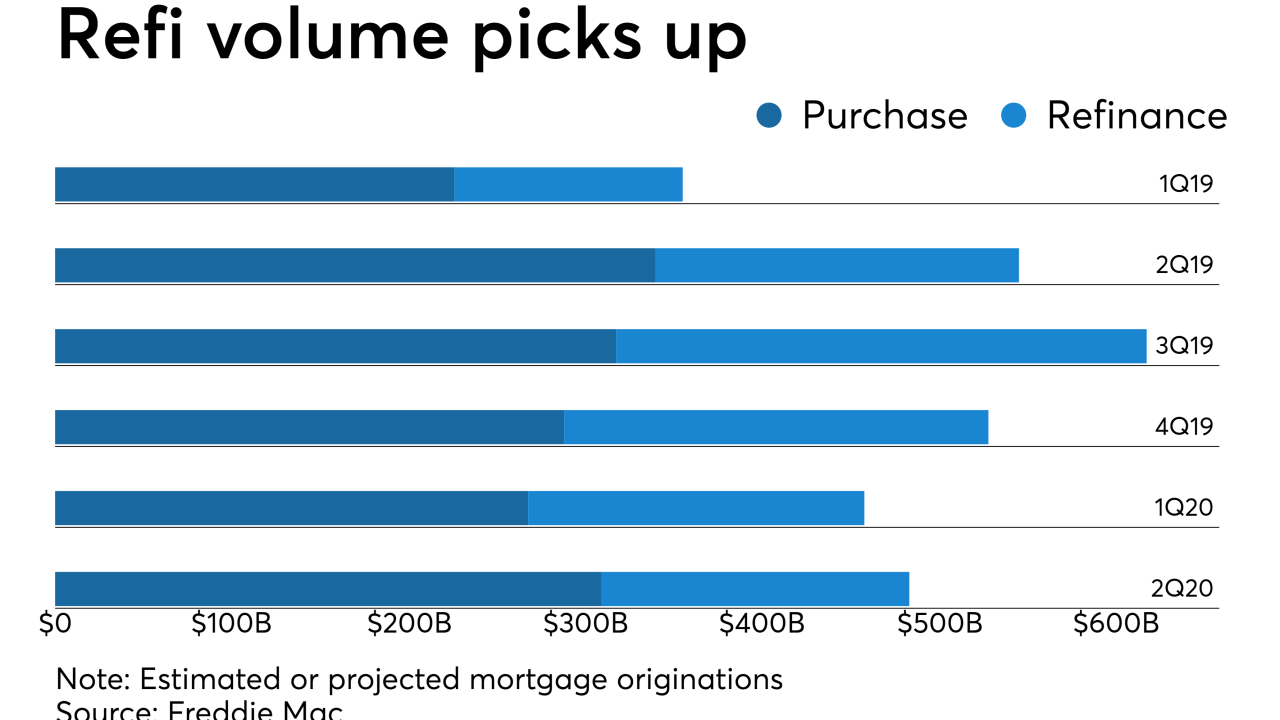

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

Mortgage rates rose modestly this week as investors have a more positive view of the economy and so they are moving money out of the bond market, according to Freddie Mac.

November 14 -

Mortgage rates fell for the first time in four weeks, although given investor optimism over better economic news, it might be a blip, according to Freddie Mac.

November 7 -

Mortgage rates rose for the third straight week — which hasn't happened since April — driven by investors' reaction to positive news regarding trade, according to Freddie Mac.

October 31 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

Strong economic trends like an improved employment outlook and rising homebuilder sentiment helped to drive average mortgage rates up 12 basis points from a week ago, according to Freddie Mac.

October 17 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

Real estate economists' outlook for single-family housing starts through 2021 weakened compared with six months ago even though they are relatively bullish on the economy, an Urban Land Institute survey found.

October 3 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

September has been the most volatile month since March when it comes to 30-year conforming mortgage rates, with average weekly movements of 11 basis points up or down, according to Freddie Mac.

September 26 -

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

Mortgage rates had their largest week-to-week uptick since October 2018 as bond market investors reacted to positive news about the economy, according to Freddie Mac.

September 19 -

Mortgage rates rose seven basis points compared with the prior week, but remained below 3.6% over four consecutive weeks for the first time since the fourth quarter of 2016, according to Freddie Mac.

September 12 -

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

September 5 -

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Mortgage rates continued to drop this week and hit their lowest levels since November 2016, while stimulating the real estate market and the economy, according to Freddie Mac.

August 22 -

The world's headlong dash to zero or negative interest rates just passed another milestone: Homebuyers in Denmark effectively are being paid to take out 10-year mortgages.

August 19 -

The global rally in bonds on Thursday drove the yield on the benchmark 10-year Treasury below 1.5% for the first time since August 2016.

August 15