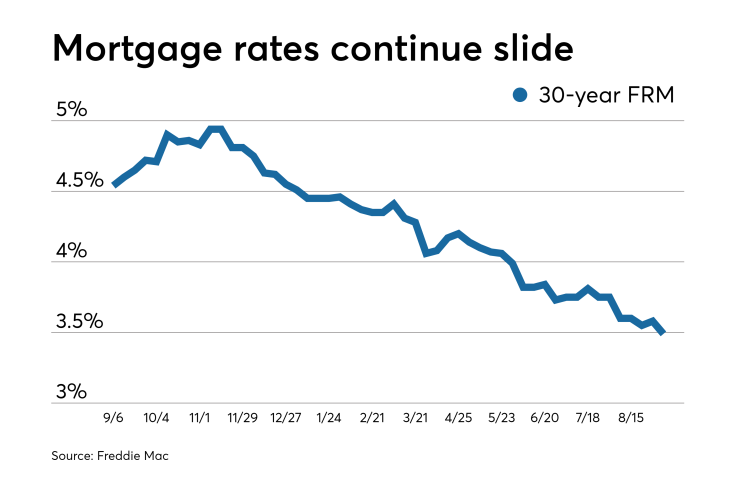

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.49% | 3.00% | 3.30% |

| Fees & Points | 0.5 | 0.6 | 0.4 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 3.49% for the week ending Sept. 5, down from last week when it averaged 3.58%. A year ago at this time, the 30-year fixed-rate mortgage averaged 4.54%.

"Mortgage rates continued the summer swoon due to weaker economic data," Sam Khater, Freddie Mac's chief economist, said in a press release. "While economic growth is clearly slowing due to rising manufacturing and trade headwinds, economic fundamentals are still solid for U.S. consumers. The unemployment rate is low, housing affordability is improving, homebuyer demand is rising and home price growth is stable."

Rates dropped following the release of a survey on Sept. 3 that showed the manufacturing sector contracted for the first time in more than three years, according to Zillow when it released its own rate tracker.

"The contraction was the latest sign that the U.S.-China trade war is doing real damage to the economy — indeed, most survey respondents noted that slowing global trade is forcing them to limit their output," said Zillow economist Matthew Speakman.

The 15-year fixed-rate mortgage averaged 3%, down from last week when it averaged 3.06%, Freddie Mac reported. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.99%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.3% with an average 0.4 point, down from last week when it averaged 3.31%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.93%.

Instability driven by world events as well as the upcoming Bureau of Labor Statistics employment release could reduce mortgage rates even further.

"Looking ahead, more turbulence for mortgage rates is likely to come, as the markets digest major developments emerging from Hong Kong and the U.K., as well as the August jobs report, which is slated for Friday," Speakman said. "The labor market has been a pillar of strength for the economy for many months, so a weak report would surely alarm investors and further depress already-low mortgage rates."