-

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Mortgage rates declined for the third straight week, adding to a brighter outlook for the spring home buying season, according to Freddie Mac.

February 21 -

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

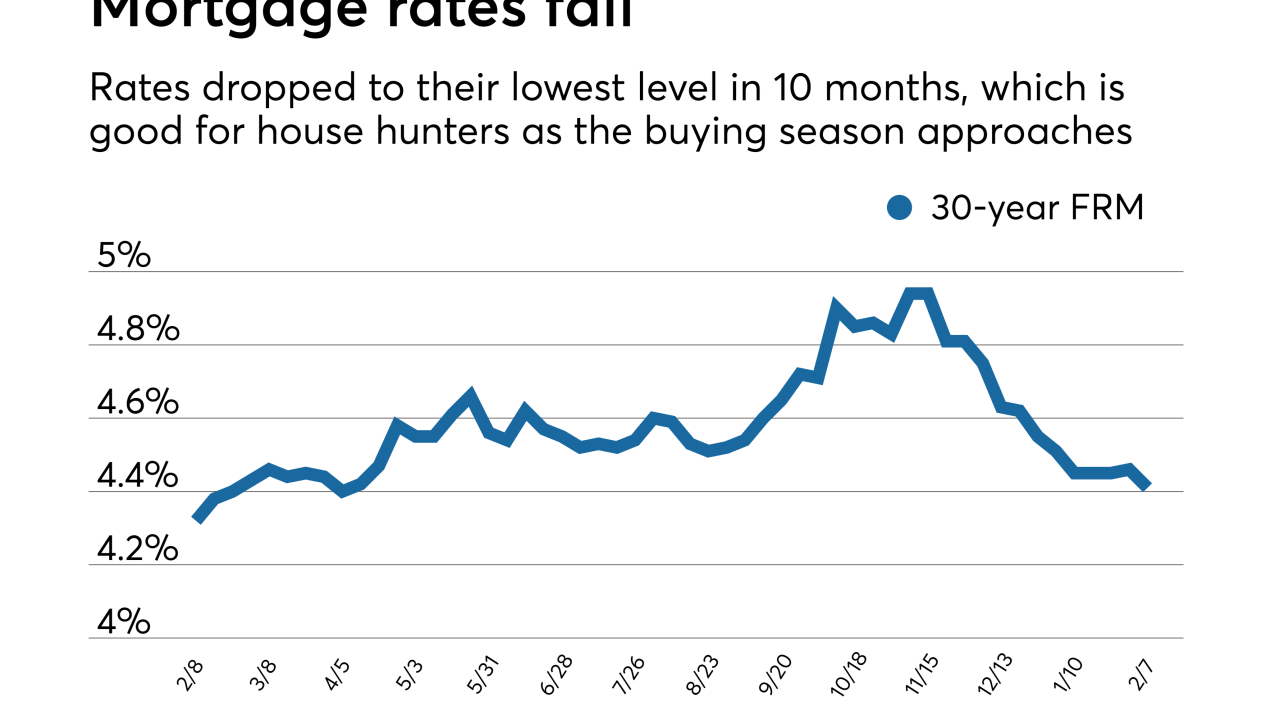

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10 -

Rising home prices along with a changing perception of the U.S. economy reduced consumer confidence in the housing market to the lowest point of 2018, according to Fannie Mae.

January 7 -

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

Contract signings to purchase previously owned homes unexpectedly fell for a second month in November, offering yet another sign that the housing market is struggling.

December 28 -

The mortgage industry heads into 2019 with little relief from the market strains of the past three years. To succeed — or at least survive — lenders must confront major questions about demand, affordability and market consolidation.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

Mortgage rates continued to drop this week with the positive effects already aiding housing, according to Freddie Mac.

December 20 -

Next year is unlikely to offer relief from higher rates or housing supply shortages, according to the consensus forecast from 24 of the Securities Industry and Financial Markets Association's member firms.

December 14 -

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Mortgage rates dropped significantly due to economic fears driving the markets following several weeks of little or no movement, according to Freddie Mac.

December 13 -

Average mortgage rates plunged after the United Kingdom first voted to leave the European Union. With uncertainty now growing about how Brexit will actually happen, here's a look at the implications for the housing market and mortgage lending.

December 12