-

There is an opportunity for home sales to break out of the doldrums if price appreciation slows, mortgage rates remain flat and supply increases, Freddie Mac said.

July 23 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 -

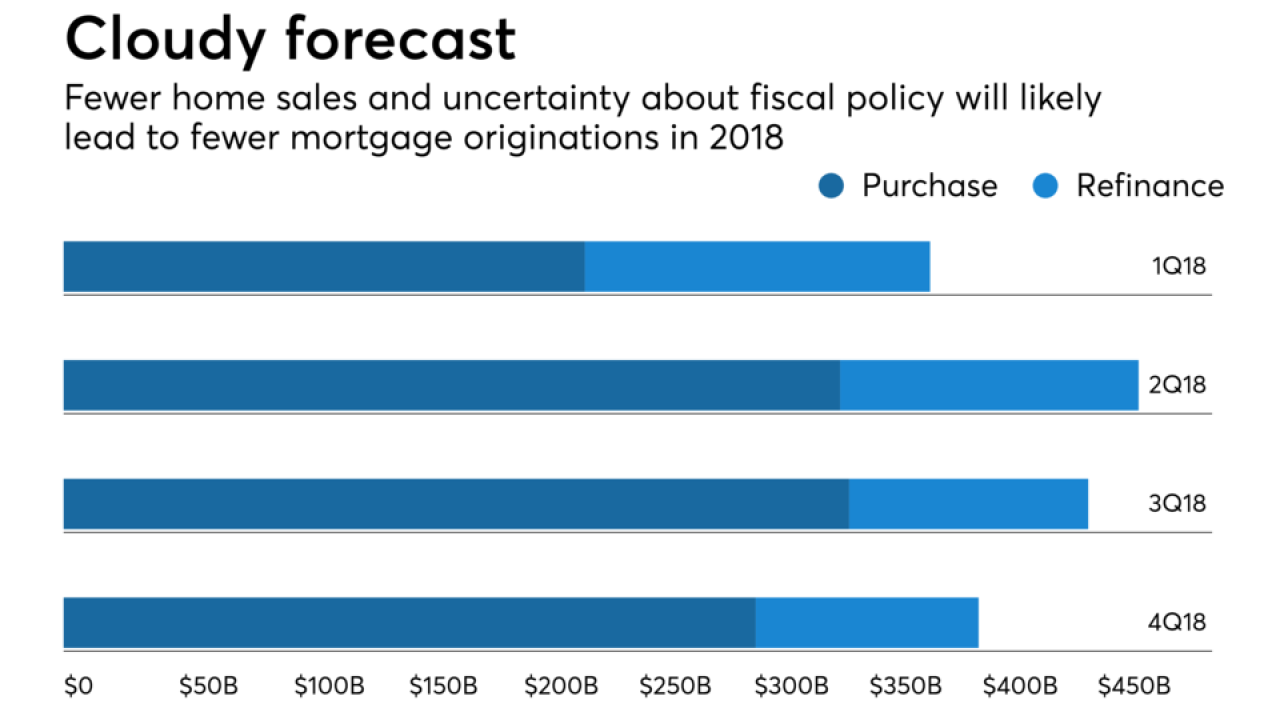

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Slight declines in consumer expectations for more favorable future job security, income and interest rates knocked Fannie Mae's Home Purchase Sentiment back down from a record high in June.

July 9 -

Mortgage rates maintained their recent slide and have now declined in five of the past six weeks, according to Freddie Mac.

July 5 -

From lowering expectations about their ideal home to moving faster to close a deal, here's a look at five ways house hunters say they would react to average mortgage rates reaching 5%.

June 29 -

Mortgage rates declined over the past week as worried investors increased their purchases of 10-year Treasuries, according to Freddie Mac.

June 28 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

While rising mortgage rates are top of mind for the industry after last week's increase in the federal funds rate, the housing market should be more concerned about limited home inventory, according to First American Financial Corp.

June 18 -

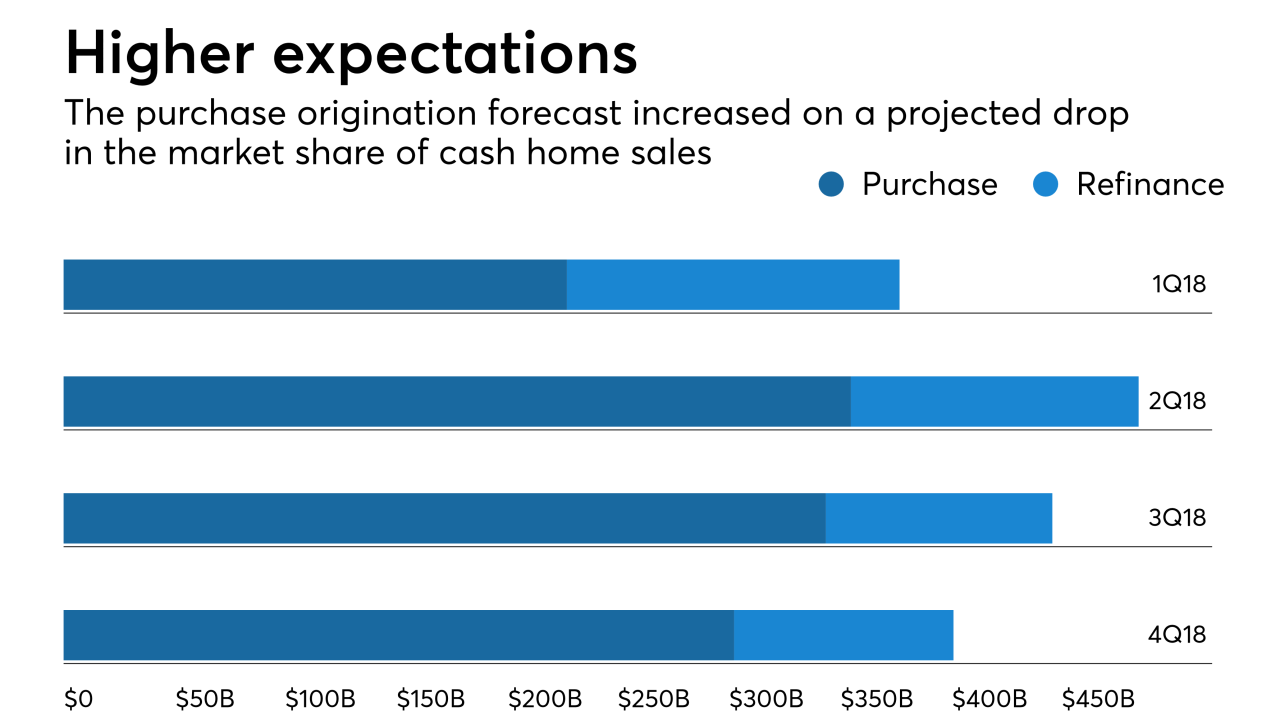

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Continued optimism in the sell side of the real estate market outweighed the growing negative perception on the buy side, as consumer sentiment about purchasing a home reached a new high, according to Fannie Mae.

June 7 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

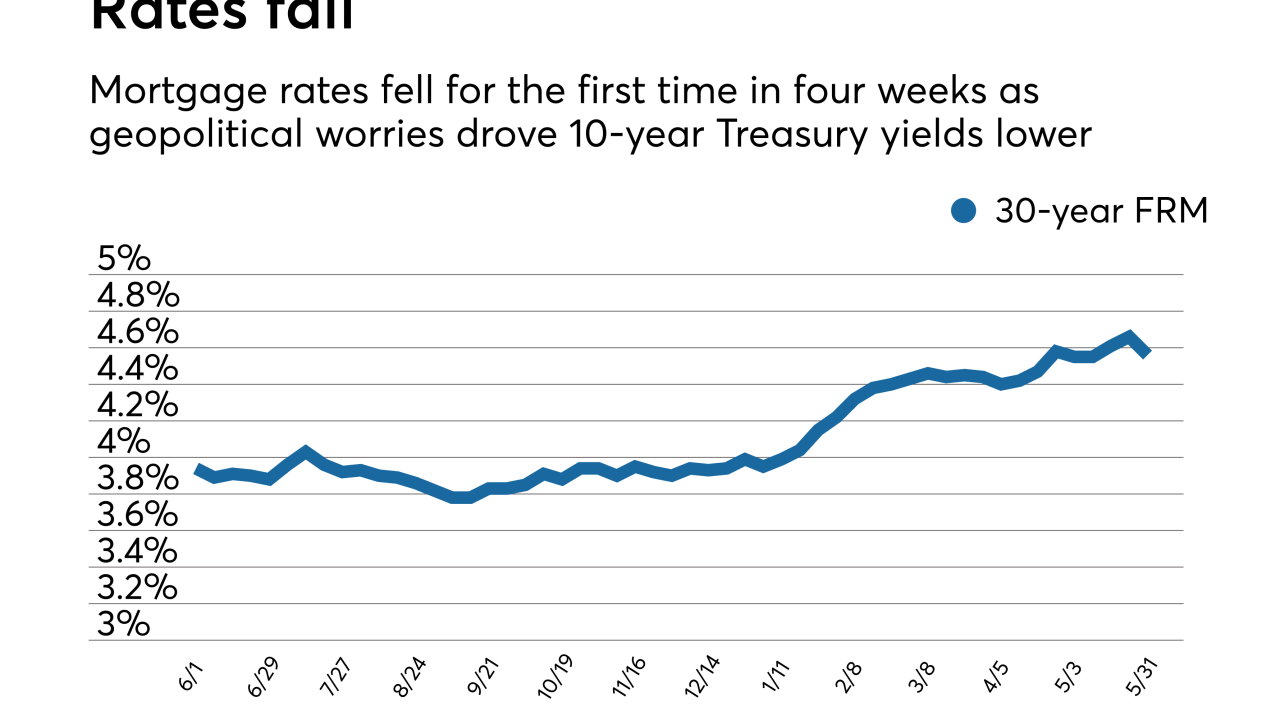

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

May 24 -

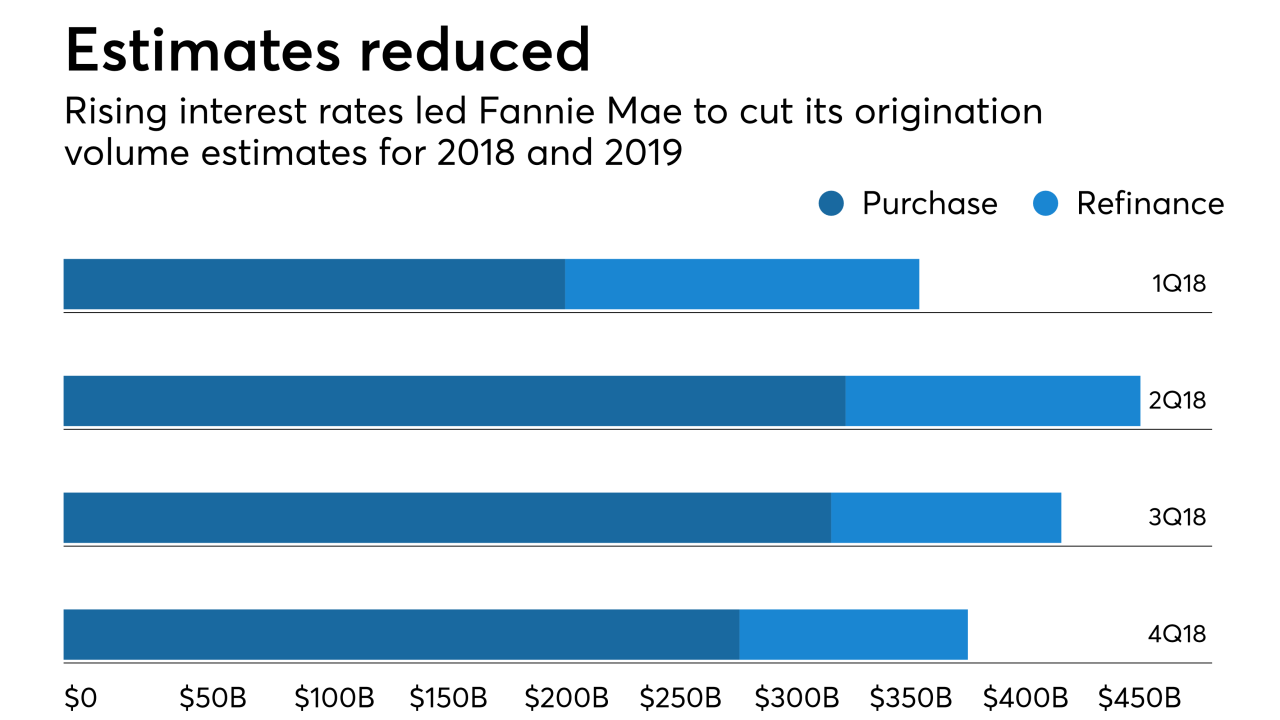

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15