-

With COVID-19 protections about to end for thousands, more distressed borrowers are opting for deferral as they exit their plans.

October 4 -

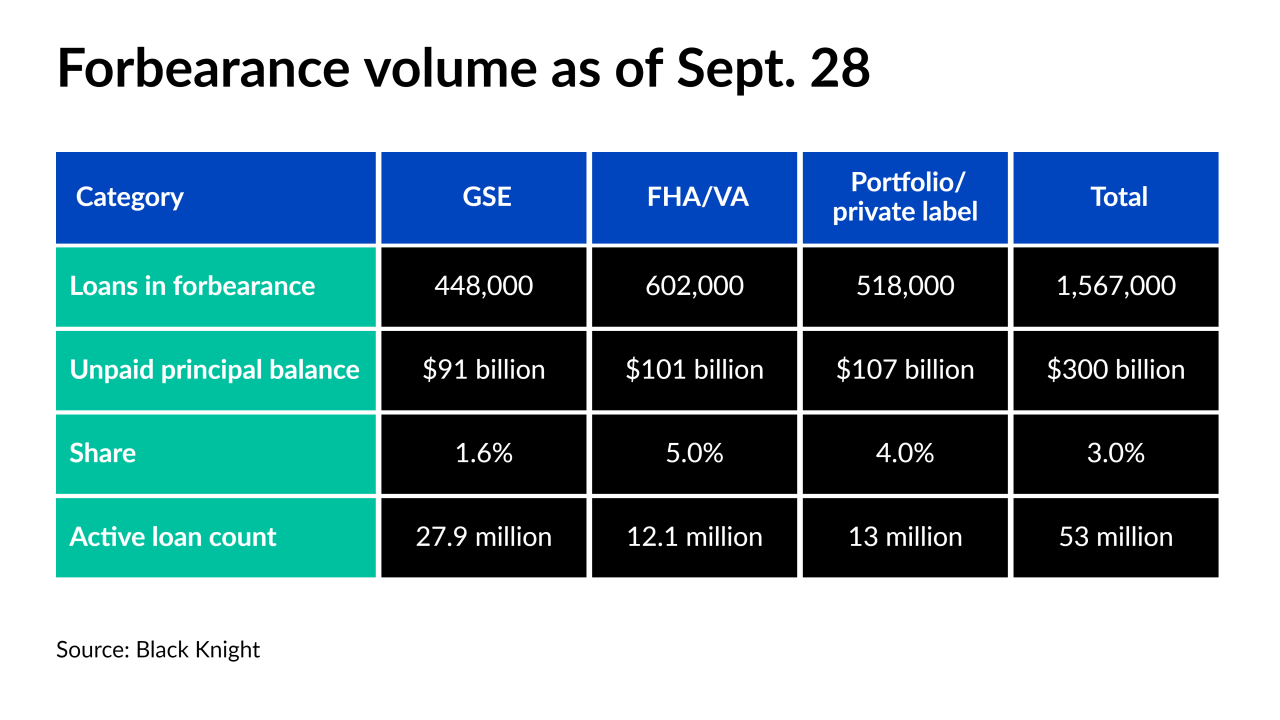

While record price appreciation led to trillions of dollars in equity, forborne borrowers still face the risk of losing their properties, according to Black Knight.

October 4 -

There is $900 million in debt on the land alone, including the $150 million junior loan that is for sale by Jones Lang LaSalle.

October 4 -

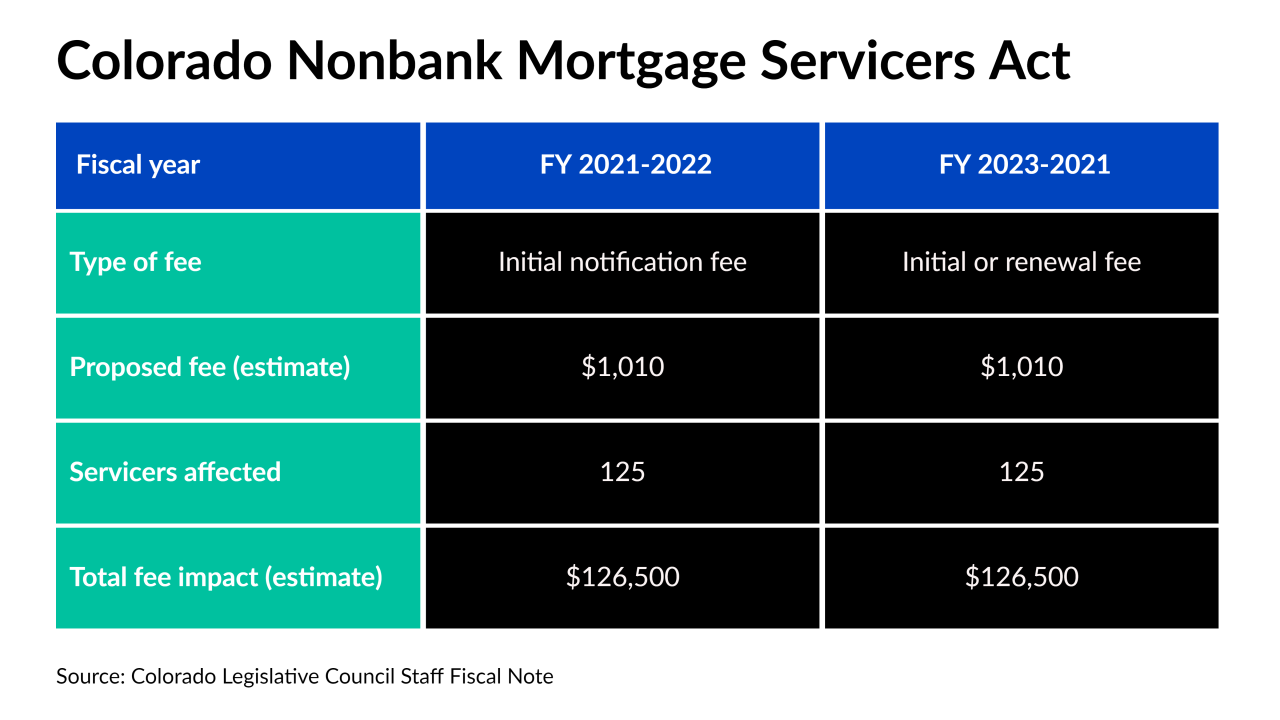

Non-depositories in the business also will have to submit annual reports and retain records for four years after they stop servicing the loan.

October 4 -

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

More than 19% of the related loans are early buyouts from securitized pools, and the deal is one example of growing bulk sales activity in the market.

September 30 -

The Federal Housing Finance Agency agreed to rework and improve procedures for regulatory communication about issues like servicing lapses in response to a recent inspector general audit.

September 29 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

Sara Avery previously worked for Common Securitization Solutions, which manages the issuance of the two government-sponsored enterprises’ bonds, including their uniform mortgage-backed security.

September 28 -

But the amount of forborne loans packaged into Ginnie Mae securities was up by 3 basis points on a consecutive-week basis, suggesting a concentration of distress there, amid broader declines.

September 27