-

Most troubled homeowners can avoid a long foreclosure process by selling and exiting with clean credit or even a profit, but a little under 2% may not have enough value in their property.

July 13 -

The bank's second quarter production revenue was down 32% from the first quarter, even as volume increased 4%.

July 13 -

The Mortgage Bankers Association is advocating for more funding for the agency due to its elevated securitization activity, and counterparty risk linked to a lingering concentration of loans in forbearance.

July 12 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

The defendant faces seven criminal counts — ranging from stolen property to falsifying business records — for two Harlem brownstones he paid just $20 for in 2012, according to tax filings.

July 9 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

The company has seen business ramp up as servicers have sought additional help managing escrowed funds following last year’s refi boom.

July 7 -

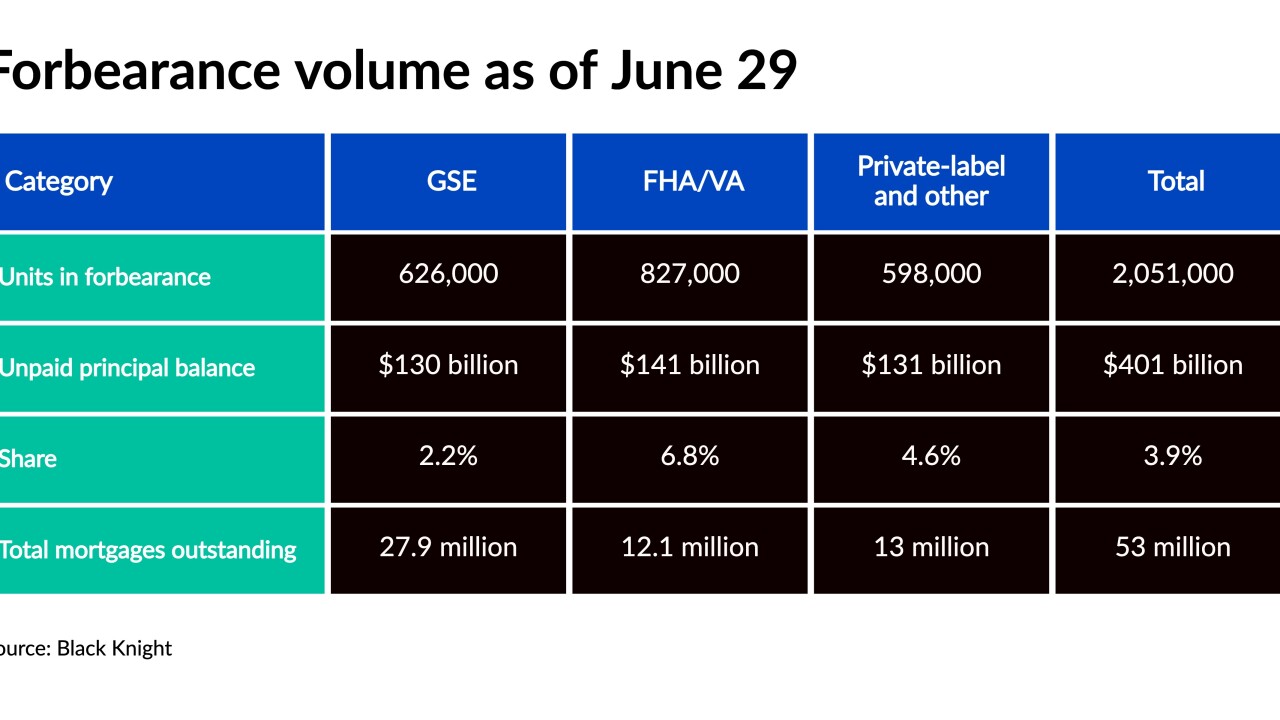

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

The $16 billion Champion Mortgage portfolio sale follows Ocwen Financial’s purchase of different assets from MAM a few weeks prior.

July 6 -

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2