-

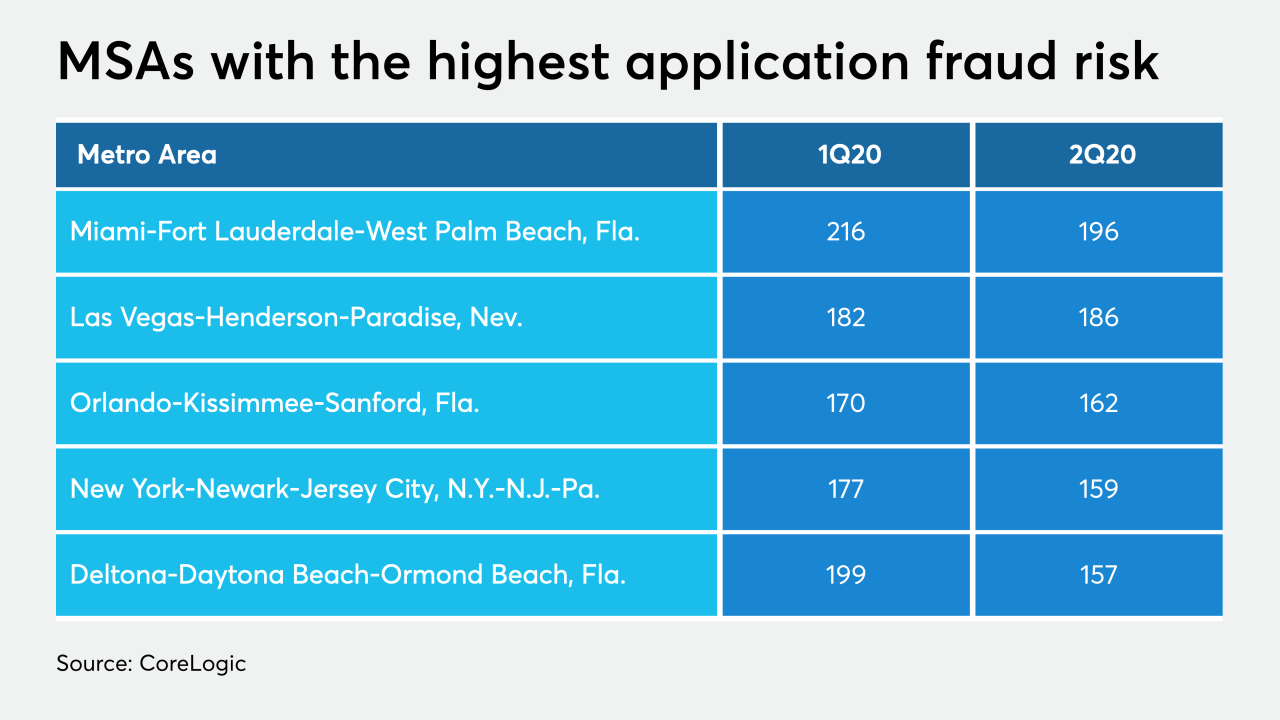

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

Mortgage industry hiring and new job appointments for the week ending July 24.

July 24 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Planet Home Lending took advantage of coronavirus volatility and low mortgage rates to increase its funding volume.

July 21 -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

July 21 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

July 17