-

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12 -

Mortgage industry hiring and new job appointments for the week ending June 12.

June 12 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

The coronavirus market disruption actually caused the company's execs to speed up its return.

June 10 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

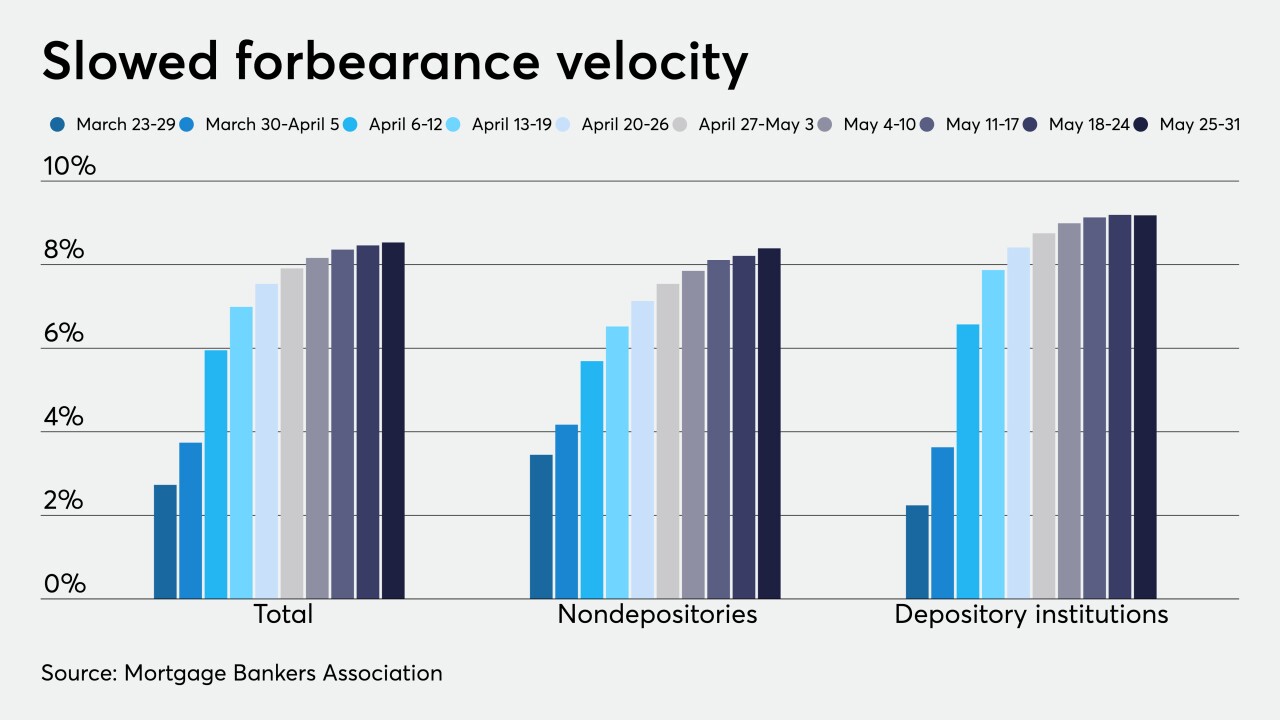

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

Former Comptroller of the Currency Joseph Otting landed a post with Black Knight, which provides technology solutions to mortgage and real estate companies.

June 8 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

Mortgage industry hiring and new job appointments for the week ending June 5.

June 5