-

Mortgage industry hiring and new job appointments for the week ending Aug. 2.

August 2 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Mortgage servicers are getting better at helping borrowers avoid foreclosure, as evidenced by a declining auction rate, which was also supported by healthy home equity levels, according to Auction.com.

July 30 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

Mortgage industry hiring and new job appointments for the week ending July 26.

July 26 -

Mortgage fraud risk took a serious dive in the second quarter amid lower interest rates, which brought more refinance transactions into the market, according to CoreLogic.

July 25 -

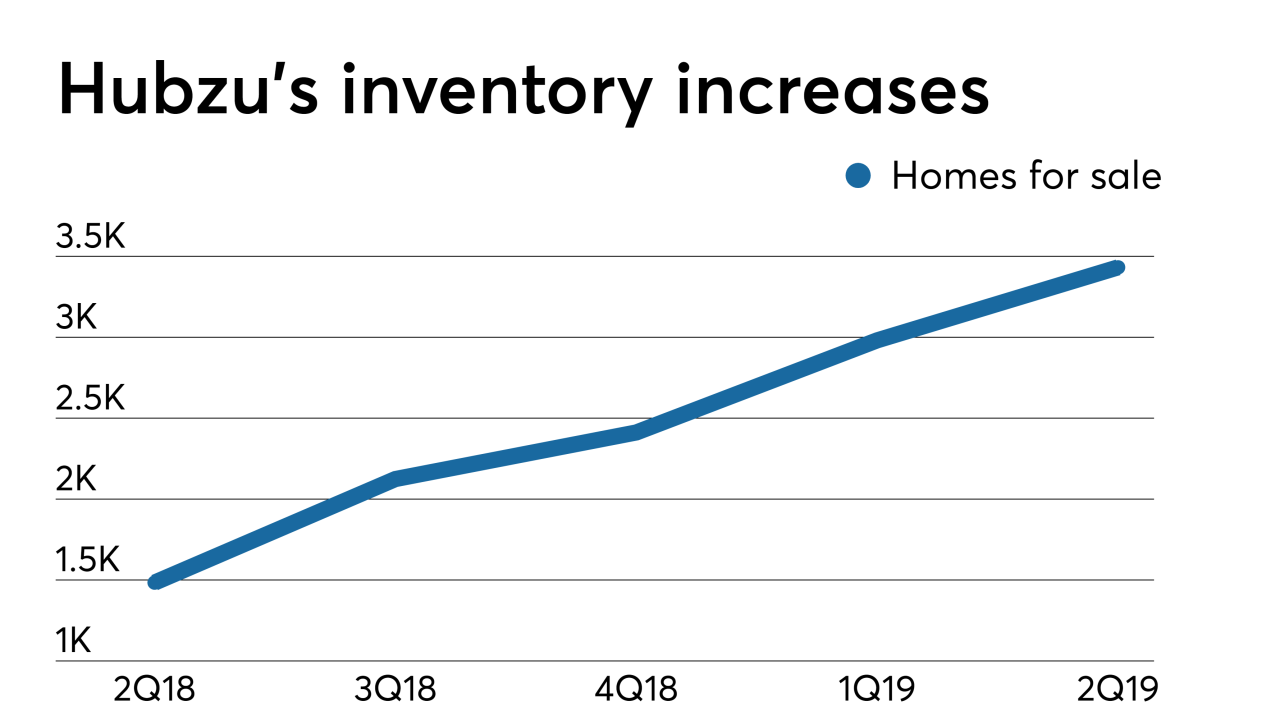

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird