-

A ruling involving a Cleveland law firm casts doubt on CFPB claims that attorneys misrepresent their role to consumers.

July 27 -

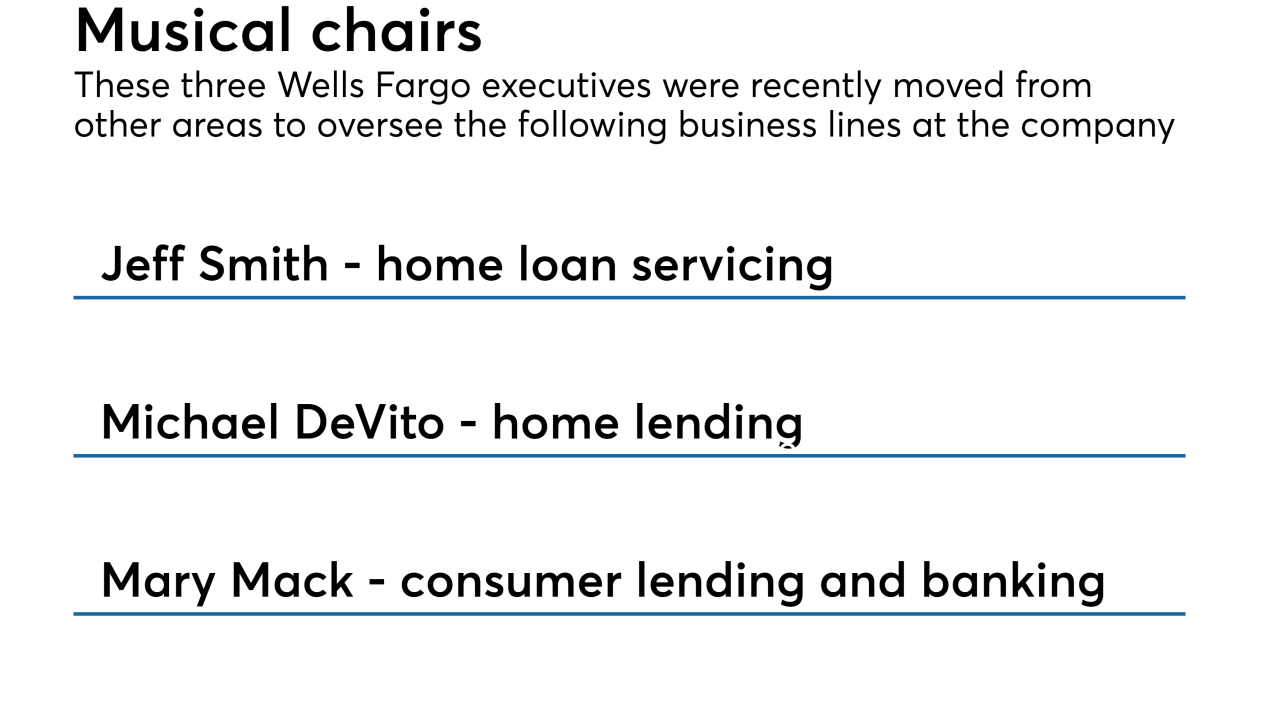

Mortgage industry hiring and new job appointments for the week ending July 27.

July 27 -

Wells Fargo has named Senior Vice President Jeff Smith to succeed Perry Hilzendeger as head of home loan servicing following Hilzendeger's earlier appointment to head of retail home lending.

July 26 -

Ocwen Financial took nearly a $30 million net loss in the second quarter due to expenses ahead of its PHH Corp. acquisition that outpaced its mortgage servicing profits.

July 26 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

Five potential witnesses against Paul Manafort, including accountants and bankers, were identified Monday as a U.S. judge gave the former Trump campaign chairman's lawyers more time to review tens of thousands of documents handed over to them in recent weeks.

July 25 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Mortgage foreclosure starts and active foreclosures were at their lowest level in over a decade although there was an increase in new delinquencies in June, according to Black Knight.

July 24 -

Debates on the issue often focus on how lending decisions affect certain demographic groups, but those analyses tend to ignore an important factor: default rates.

July 23

-

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23