-

Two Harbors Investment Corp., which grew its servicing portfolio by 22% in the fourth quarter, priced a common stock offering to raise funds to buy more rights as well as mortgage-backed securities.

March 19 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

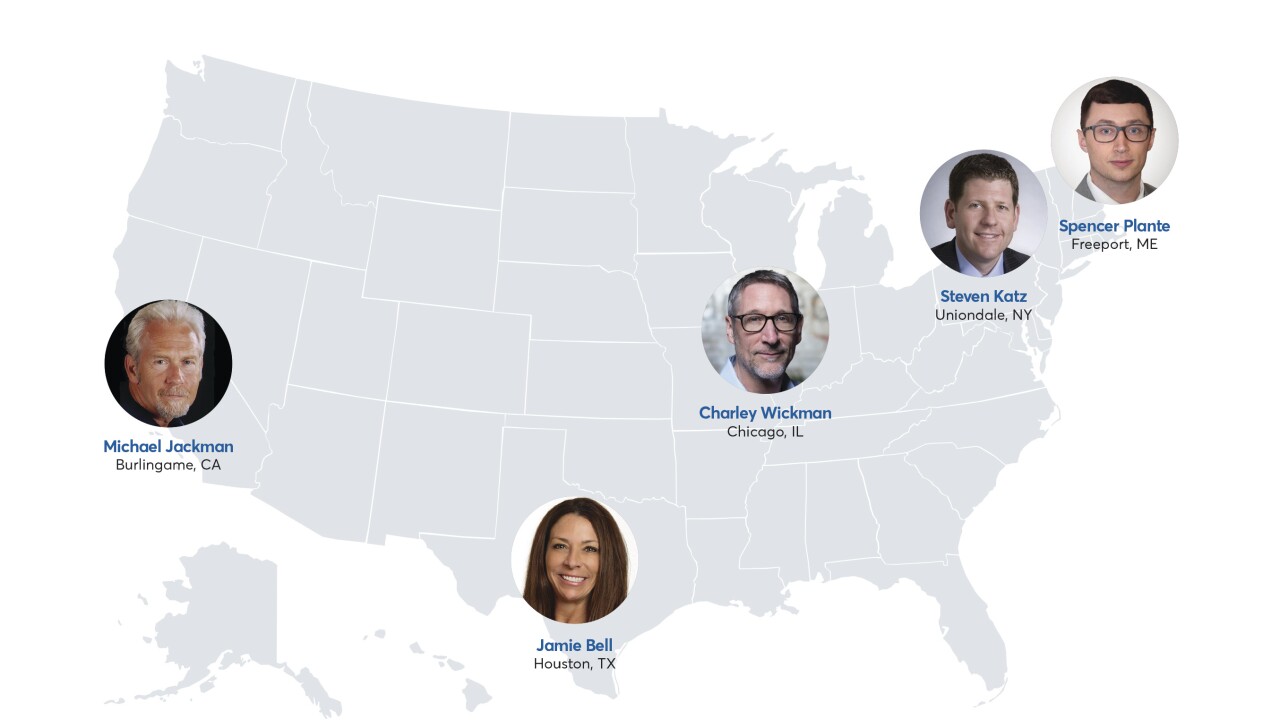

Mortgage industry hiring and new job appointments for the week ending March 15.

March 15 -

Fewer Hawaii property owners fell into foreclosure last year in continuation of a trend that began in 2014, according to state data.

March 14 -

Just minutes after his federal prison sentence was raised, Paul Manafort was charged by New York state prosecutors with residential mortgage fraud, conspiracy and falsifying business records.

March 13 -

The foreclosure rate in the Tampa Bay area was unchanged between 2017 and 2018 despite a drop in the percentage of homes that were seriously delinquent on their mortgages.

March 13 -

Strong loan performance continued into December as all delinquency stages fell annually behind equity gains and the sustained rise of home prices, according to CoreLogic.

March 12 -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8 -

Mortgage industry hiring and new job appointments for the week ending March 8.

March 8 -

Mr. Cooper Group took a net loss of $136 million in the fourth quarter after lower rates hurt the mark-to-market value of its larger mortgage servicing rights portfolio harder than its peers.

March 7