-

Policymakers could improve independent mortgage banks' financial stability by giving these companies improved access to liquidity, according to the Mortgage Bankers Association.

February 25 -

Mortgage prepayment speeds fell to a 19-year trough despite recent interest rate declines, but could rise if those lower rates lead to an increase in home purchases, according to Black Knight.

February 25 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

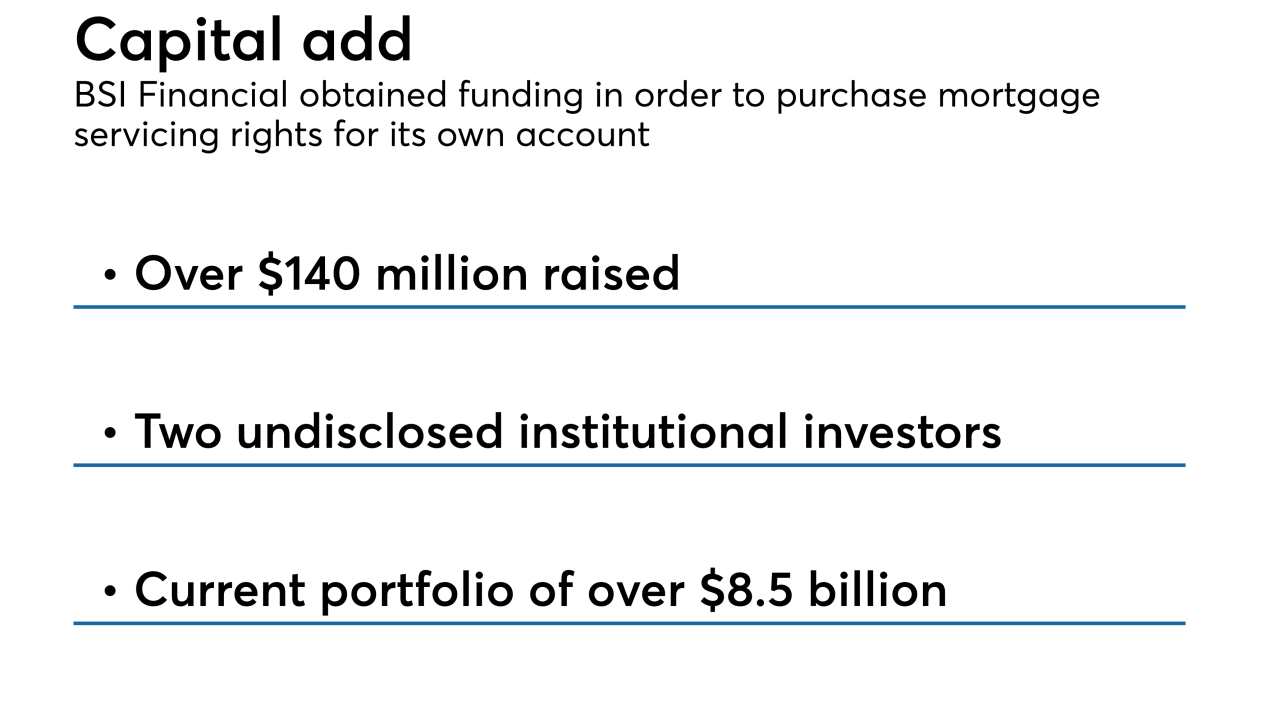

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

Mortgage industry hiring and new job appointments for the week ending Feb. 22.

February 22 -

The company disclosed that it paid $146 million for servicing rights associated with $13 billion in mortgages.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

In what some real estate professionals are referring to as part of the "after-effects" of the recession, is a spike in the sale of foreclosures across Staten Island.

February 20 -

A digital mortgage startup called Brace is using machine learning to automate loss mitigation and has lined up backing from several venture capital sources, including a fund with high-profile investors like Amazon founder Jeff Bezos.

February 19 -

The funds the bank promised to spend on consumer relief will instead be used to make new home loans, according to a report by the monitor of its 2017 settlement with the U.S. Justice Department.

February 15