-

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

Mortgage industry hiring and new job appointments for the week ending Oct. 12.

October 12 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

Washington Mutual successor WMIH Corp. has completed its pending 1-for-12 reverse stock split and its common shares will soon begin trading under the Mr. Cooper name it inherited from Nationstar Mortgage.

October 10 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

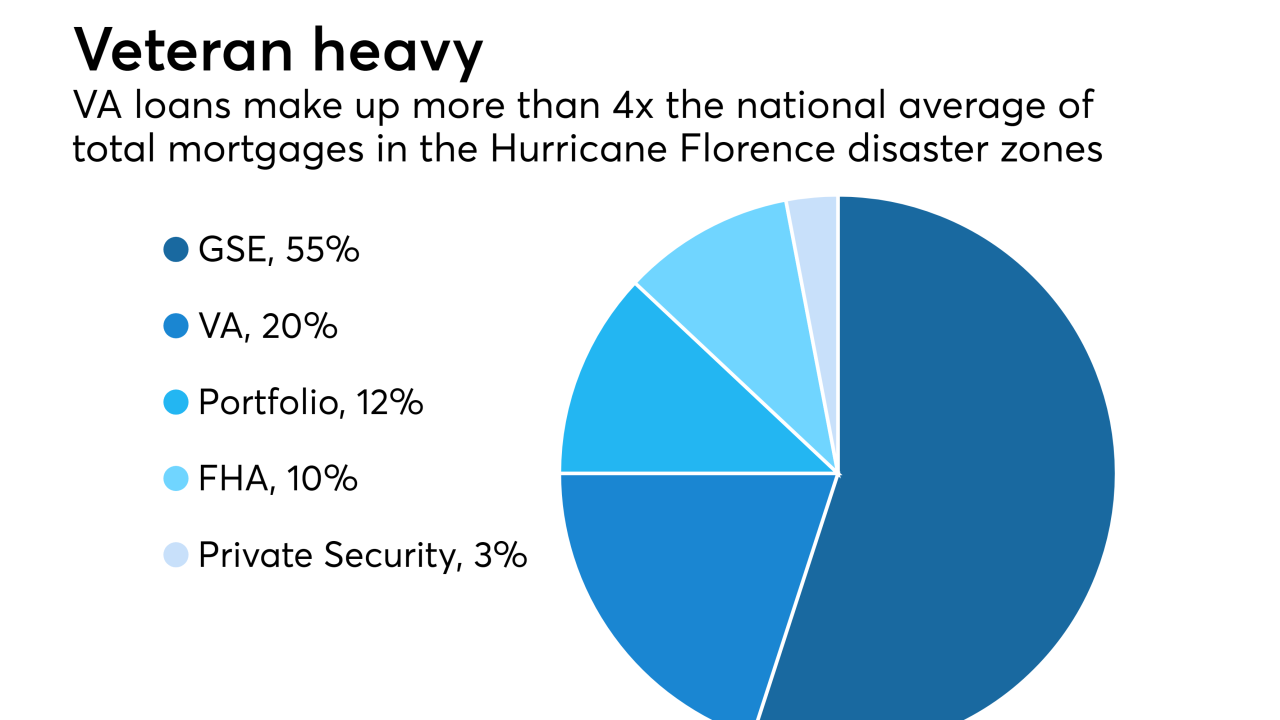

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5