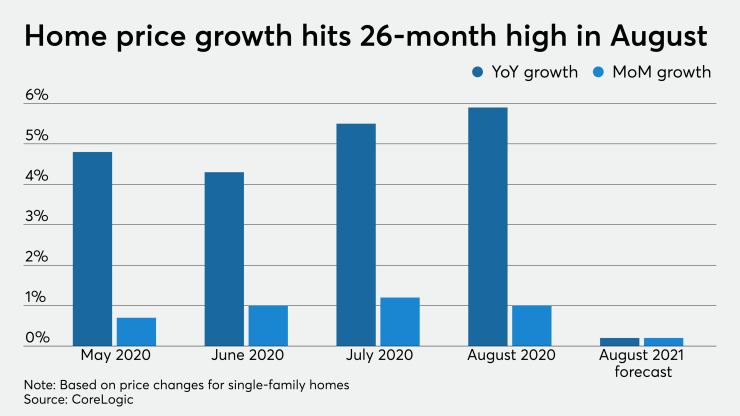

Housing price appreciation swelled 5.9% annually in August — the largest growth rate since June 2018 — beating the year-ago rate of 3.5% and exceeding

The HPI tracked positive year-over-year growth for every month since February 2012. The recent steady monthly climbs continued as well, rising

"The imbalance between homebuyer demand and for-sale inventory is particularly acute for lower-priced homes," Frank Nothaft, chief economist at CoreLogic, said in the report. "Because of this imbalance, homes priced more than 25% below the median were up 8.6% in price over the last year, compared with the 5.9% price increase for all homes."

All 50 states experienced annual increases in average home prices. Idaho once again stood above the rest with a 10.8% rate of growth from August 2019. Jumps of 9.7% in Arizona and 9.6% in Maine followed. New York generated the lowest rate, only inching up 0.6% from the year prior. Illinois and Hawaii rounded out the bottom three at 1.7% and 2.5%, respectively.

Among 10 of the largest metro areas, San Diego saw the highest annual growth, increasing 6.2%. Washington, D.C., trailed at 5.5% with Los Angeles in third at 5.3%. CoreLogic predicts home prices in some of these anchor markets will decrease. The data provider expects prices to drop 6.5% in Las Vegas, 2.9% in Boston and 2% in Houston by August 2021.

Based tourism and hospitality reliance for their local economies and probability of coronavirus revival, Lake Charles, La., Las Vegas, Miami, Springfield, Mass., and Modesto, Calif., were marked as the highest risk housing markets for price declines.