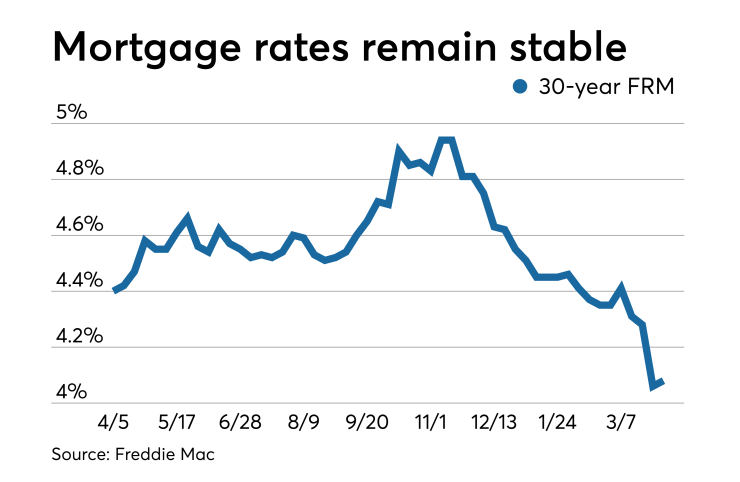

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.08% | 3.56% | 3.66% |

| Fees & Points | 0.5 | 0.4 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.08% for the week ending April 4,

"Purchase

"While the housing market has faced many head winds the last few months, it sailed through the turbulence to calmer seas with demand buttressed by a strong labor market and low mortgage rates. The benefits of the decline in mortgage rates that we’ve seen this year will continue to unfold over the next few months due to the lag from changes in mortgage rates to market sentiment and ultimately home sales."

The 15-year fixed-rate mortgage this week averaged 3.56%, down from last week when it averaged 3.57%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.87%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.66% with an average 0.4 point, down from last week when it averaged 3.75%. A year ago at this time, the five-year adjustable-rate mortgage ARM averaged 3.62%.

"Last week's sharp downward rate movements were guided by growing concerns about slowing global economic growth. Those concerns were temporarily alleviated this week, specifically in the form of encouraging economic data from overseas, which drove the recovery in rates," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker.

"The outlook for the Chinese economy has been a sore spot for economic forecasters in recent weeks, but Chinese manufacturing and services sector data released this week were promising. These developments were encouraging enough to offset a disappointing reading of U.S. private payrolls and service sector growth."

Even with the unsatisfactory news on payrolls, the April 5 employment report will be the largest influence on rates going forward as the markets are expecting a strong report, "in which case more upward movement in mortgage rates could be on the way," Speakman said.