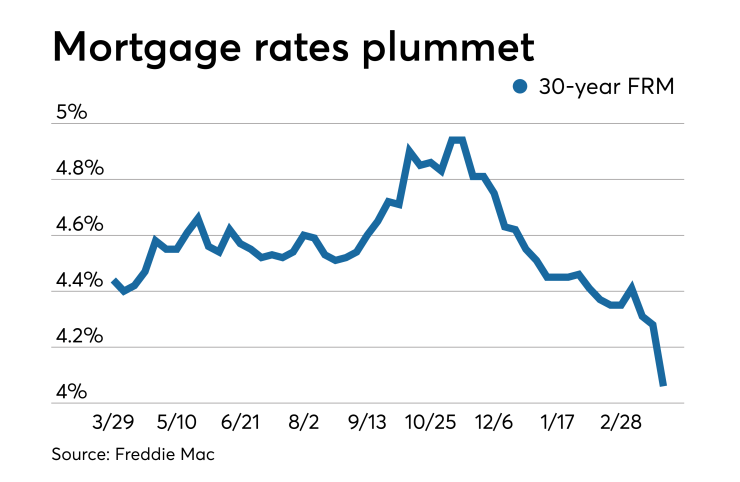

Average mortgage rates fell by their largest amount in more than 10 years last week as bond yields fell in reaction to the

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.06% | 3.57% | 3.75% |

| Fees & Points | 0.5 | 0.4 | 0.3 |

| Margin | N/A | N/A | 2.77 |

The average 30-year fixed-rate mortgage plunged 22 basis points. This is the largest drop since the week of Oct. 23, 2008, when there was a 42-basis-point decline.

The 30-year fixed-rate mortgage averaged 4.06% for the week ending March 28,

"The Federal Reserve's concern about the prospects for slowing economic growth caused investor jitters to drive down mortgage rates by the largest amount in over 10 years," Sam Khater, Freddie Mac's chief economist, said in a press release. "Despite negative outlooks by some, the economy continues to churn out jobs, which is great for housing demand. We have recently seen home sales start to recover and with this week's rate drop we expect a continued rise in purchase demand."

Rates were expected to drop after the FOMC announcement to reinvest its mortgage-backed securities portfolio and hold off on short-term rate increases, but observers did not anticipate the size of the decline. "The cautious decisions surprised markets and worsened many analysts' concerns about the outlook for the global economy, boosting demand for treasuries and pushing mortgage rates downward," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker.

There was a

The 15-year fixed-rate mortgage this week averaged 3.57%, down from last week when it averaged 3.71%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.9%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.75% with an average 0.3 point, down from last week when it averaged 3.84%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.66%.

Rates fell further on March 22 after the markets interpreted weak German manufacturing data as additional evidence of a gloomier economic outlook and that resulted in an inversion of the yield curve, which some view as a predictor of a coming recession, Speakman said.

"These concerns will undoubtedly persist for the time being and the focus now shifts to upcoming economic data releases, which should dictate whether more sharp movements are on the horizon. In particular, all eyes will be on Friday's [March 29] release of U.S. inflation data — a key indicator in the Fed’s policy decision making and a central motive for their current 'patient' approach," said Speakman.