The Mortgage Bankers Association’s interest rate outlook hinges on what happens in Georgia's January Senate runoffs, Chief Economist Mike Fratantoni told attendees at the MaxOut virtual event hosted by industry fintech Maxwell.

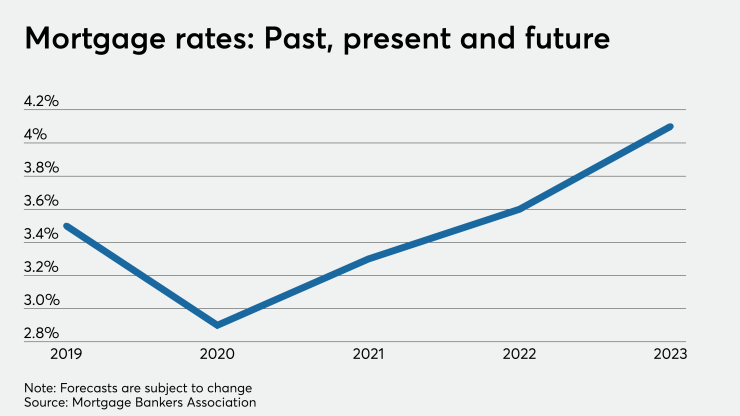

“With Democratic control of the entire government we would … forecast a much steeper rate path,” Fratantoni said. As a result, mortgage rates could be 50 basis points higher than the MBA’s current forecast, which anticipates the 30-year FRM will average 3.3% next year, up from nearly 3% this year.

President-elect Joe Biden, pending a recount, is forecast to take the state’s Electoral College votes, but a “blue wave” in which Congress is completely controlled by the Democrats is considered unlikely.

Even with forecasts calling for somewhat higher rates along with continuing unemployment concerns in some industries particularly hard hit by the pandemic, Fratantoni expects demand for homes that continues to outweigh available housing inventory to sustain relatively strong purchase activity and prices.

Prices will likely keep rising in most areas but at a slower rate, he said.

“We don’t see them dropping in much of the country at all,” said Fratantoni.

There are some concerns about credit availability and underwriting overlays for government loans given relatively higher forbearance rates in the Federal Housing Administration market. The FHA market primarily serves first-time homebuyers, and FTHBs are fueling a lot of the current demographic demand, he noted. However, the latest

Furthermore, while the forbearance rates for government loans are higher than in the government-sponsored enterprise market, they are falling.

The Ginnie Mae forbearance rate in the MBA’s most recent weekly report was 7.7%, down from 7.95%

Overall forbearance rates dropped 20 basis points to 5.67% of servicers’ portfolio volume as of Nov. 8. There was a 16-basis-point drop the previous week.