The share of homes for sale with a price cut hit its highest level since 2010, but homebuyers are still reacting to rising prices and interest rates, according to Redfin.

About 31.3% of property listings experienced price cuts of more than 1% in October, marking a 6.3 percentage point increase from 25% a year ago. But despite signs of a cooling housing market, home shoppers continue adjusting their housing goals to overcome affordability challenges.

"An increase in interest rates effectively makes home buying more expensive because buyers have to pay higher monthly mortgage payments even if the sticker price hasn't changed. Some homebuyers are adjusting their price range down, and others are backing out of home buying entirely, deciding that renting is a better deal," said Redfin Chief Economist Daryl Fairweather in a press release.

"Sellers are now realizing buyer demand isn't what it used to be and are dropping their prices. When buyers and sellers are on the same page, the market moves quickly, but since sellers were slow to react, we've seen a slowdown in the housing market," he said.

While home prices have declined an average of 1% from September to October for the past eight years, they rose 2.4% month-over-month this year. On an annual basis, home sale prices grew 4.5% to a median of $297,200, which is lower than September's year-over-year growth rate of 6.5%.

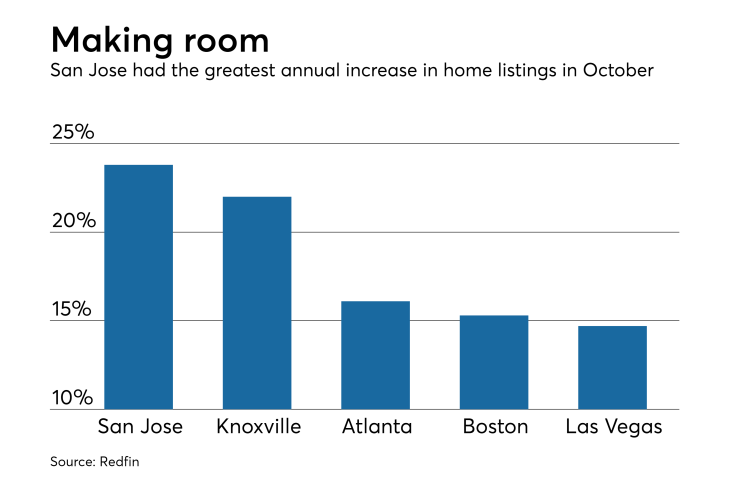

Housing inventory also increased, with the number of homes for sale rising 1.3% year-over-year to the highest level of supply growth since September 2015.