The number of nonbank mortgage lenders and servicers that did not comply with the California Residential Mortgage Lending Act Annual Report requirements grew this year, prompting a reprimand and warning of penalties from the commissioner of the state's Department of Business Oversight.

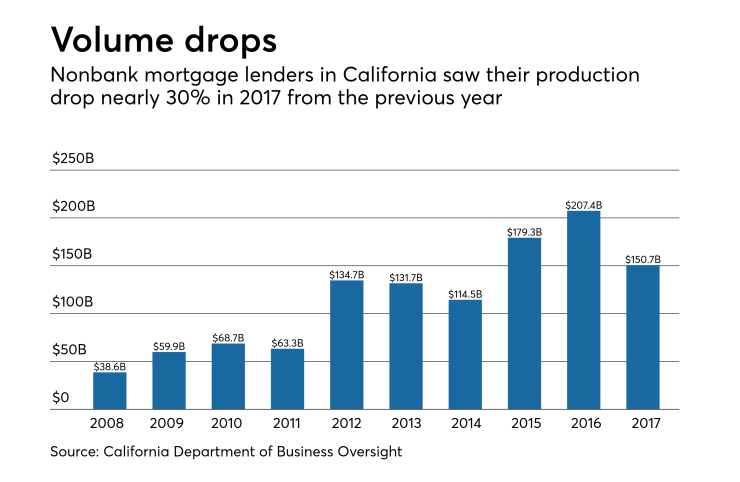

There were 418 licensed lenders and servicers at the end of 2017, but only 364 filed their reports with the DBO. In 2016, there were 409 licensees and 391 filed their annual report. The total volume of mortgages reported to the state was nearly 30% lower in 2017 than in 2016, on both a dollar volume and loan unit basis.

"It would be unwise to draw any conclusions about California's housing market from this data, because the number of licensees that filed their required reports declined by 8% from 2016," said DBO Commissioner Jan Lynn Owen in a press release. "That's disturbing, and we will take appropriate action under the law to deal with licensees that did not file their reports. The data is important for us, the public and policymakers."

Nonbank lenders licensed by the DBO reported originating 431,052 loans in 2017, down 28.4% from 602,430 in 2016. The combined principal amount of 2017 loans totaled $150.7 billion, a 27.3% decrease from $207.4 billion in 2016. Both the loan count and dollar volume for 2016 were the highest since the DBO started collecting this information in 2008.

The number of loans brokered by DBO licensees in 2017 declined 24.3% from 2016, to 9,496 from 12,536 in 2016. The aggregate principal amount of brokered loans totaled $5 billion in 2017, down 14.3% from 2016.

This information does not include data from California's mortgage brokerages, which are regulated by the state's Bureau of Real Estate.

Foreclosures completed by California servicers fell 27% from 2016 to 11,478 in 2017 from 15,883 the previous year. That was the lowest total since the DBO started collecting this data in 2012; that was the year with the most foreclosures at 18,468.

The aggregate average dollar amount of mortgage loans serviced last year was $854.8 billion, up from just under $853 billion in 2016.

The number of branches grew 8.8%, to 5,929 from 5,449.

Back in 2010, there were only 289 licensees and 1,829 branches, the DBO pointed out.

There was a slight increase in the number of lenders that said they originated adjustable-rate mortgages, 214, from 212 in 2016. Licensees retained $1.4 billion of adjustable-rate mortgages in 2017 on their books and sold another $7.4 billion to investors.

The number of licensees making or arranging other kinds of nontraditional mortgages increased to 140 in 2017 from 128 in 2016. Those other loan types included interest-only mortgages, pay-option ARMs, reduced documentation mortgages, simultaneous close second-lien loans, home equity lines of credit and covered loans.