The head of the Consumer Financial Protection Bureau will work with his counterpart in Europe to identify emerging consumer threats in

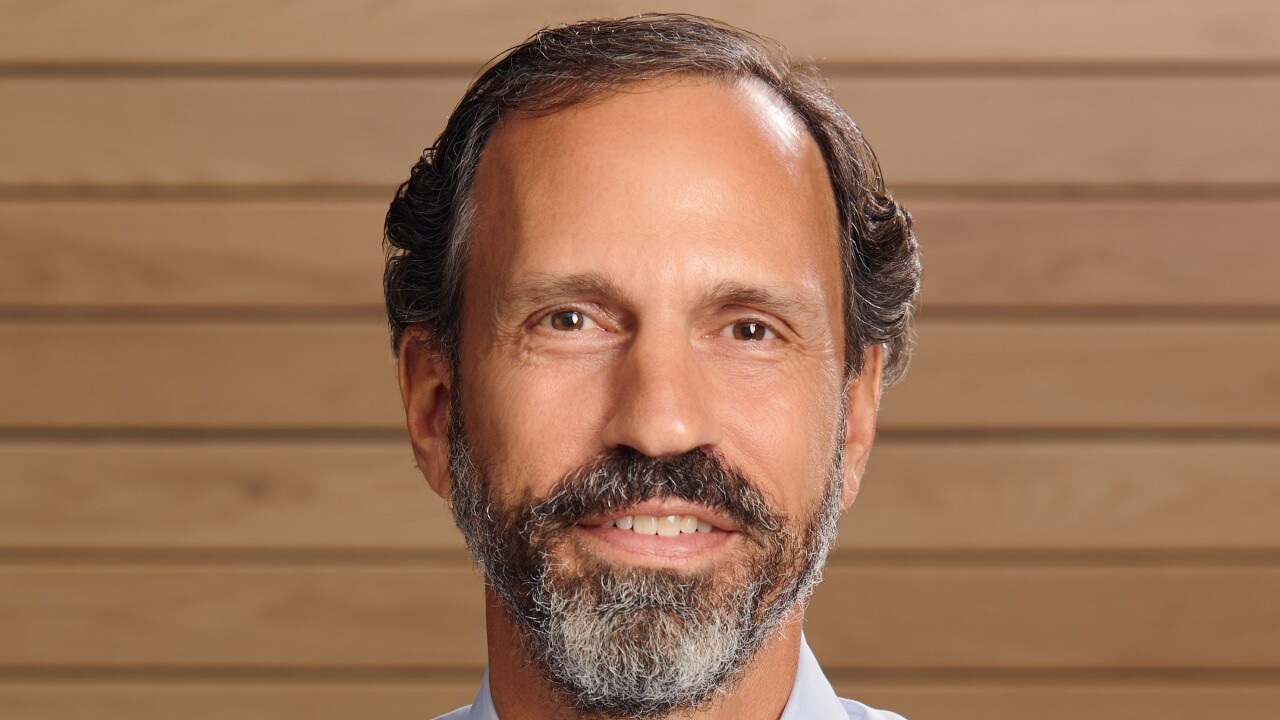

CFPB Director Rohit Chopra will have regular, informal conversations with Didier Reynders, the European Commission's commissioner for justice and consumer protection, about the impact of digitalization on financial services, the two agencies announced Monday.

The joint initiative will focus on how new technologies and the financial products that they enable affect pricing, competition and customer privacy. The talks will be used to inform regulations and other policies implemented by the CFPB and European Commission.

"These developments, if left unchecked, could increase consumers' exposure to fraud and manipulation, limit their product options over time, threaten their control over their own data, and force them to accept more expensive personalized pricing for the same products and services compared to other consumers," a joint statement from the agencies reads. "Policymakers on both sides of the Atlantic are responding to these issues, but we must do more to compete with the pace of evolving markets and consumer needs."

The joint announcement noted a concern around "Big Tech" and the outsize influence technology firms could have on the financial decisions consumers make. It also notes that new technologies could play a substantial role in shaping the provision of credit to individuals and households.

Data-sharing runs through dozens of projects designed to generate revenue beyond the point of sale.

Chopra has already spent a considerable amount of time as head of the CFPB exploring the impacts of tech innovations in the financial sector. He has

In their statement, the CFPB and European Commission noted that developing strategies to prevent and reduce excessive consumer leverage would also be a top priority for their joint effort. Addressing the impact of digitalization on unbanked people and communities will also be on their agenda.

The talks between the American and European regulators will occur at least annually and include senior staff from the two agencies as well as industry representatives, subject matter experts and other stakeholders. Some of the conversations will take place publicly while other, more sensitive topics will be discussed in private.

The joint release noted this new initiative would run parallel to ongoing efforts by the U.S. and European Union to address digitalization in the world of finance.