The commercial mortgage delinquency rate fell in September, according to Fitch Ratings. But if the agency had included in their analysis loans that are current on their payments but also in forbearance or other forms of relief, the rate would be higher, just shy of 8%, Fitch Ratings reported.

Early in the pandemic, Fitch had predicted that loan delinquencies in commercial mortgage-backed securities would reach

In September, 549 Fitch-rated loans were granted payment relief, totaling $16 billion in unpaid principal balance.

This is 3% of the CMBS Fitch has rated.

"Relief has helped to mitigate a sharp rise in delinquencies to date," said Melissa Che, Fitch's senior director, CMBS.

However, with more loans granted some form of payment relief, Fitch said, September's delinquency rate fell 12 basis points

Overall resolution volume of $2.6 billion outpaced new delinquencies of $2.2 billion for September. In a positive development, $1.4 million of September's resolutions consisted of loans previously considered 60 days or more delinquent that are now classified as current.

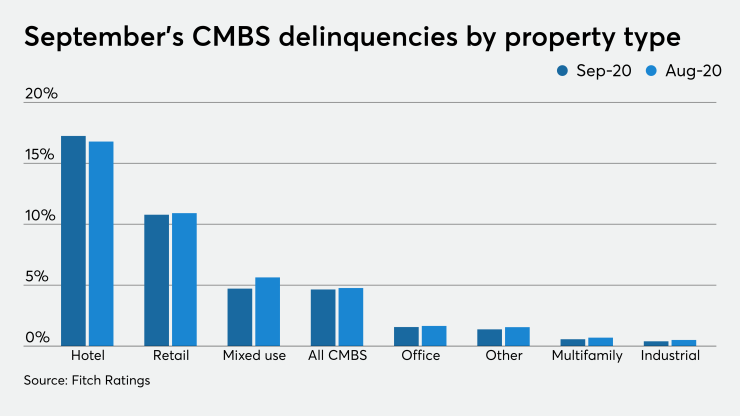

The only property type in which delinquencies increased from the prior month is hotel, which was up 46 basis points to 17.23%.

Retail, the other property type that has been a problem area during the pandemic, had a 13-basis-point decline to 10.9%; the regional mall component had a 29-basispoint drop, but is still a tremendously high 18.71%.

The biggest improvement in the delinquency rate was for mixed-use properties, a drop of 92 basis points compared with August to 4.71%, Fitch said.

However, a recent wave of small business bankruptcy filings is likely to impact both of those property categories. As part of the bankruptcy process, companies can renounce leases, which

During September, there were 747 new commercial Chapter 11 filings, up 78% over the 420 in September 2019, according to Epiq, a legal services company.

"After a slower August, we see an increase in Chapter 11 filings in September both month over month and year over year," Deirdre O'Connor, managing director of corporate restructuring at Epiq, said in a press release. "These commercial filings are primarily small businesses that do not have access to capital or stimulus. Unfortunately, those bankruptcies will continue to rise in the current economic environment."

Multifamily mortgages are still performing well, with a delinquency rate of 0.56%, down 13 basis points, Fitch said. But student housing, which Fitch includes in the multifamily category, is a problem area, with a 130-basis-point increase from August, to 5.68%.

There was a 2% increase in the unpaid principal balance of mortgages moved to special servicing during September. There are now nearly $30 billion or 1,236 loans; this is 6% of Fitch-rated CMBS transactions. For August, $29 billion or 1,217 loans were being handled by the special servicer.