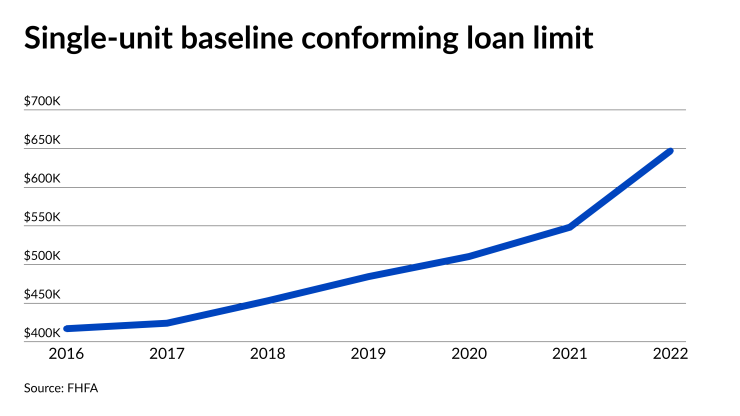

Following the announcement of increased conforming loan limits for 2022, which will come close to $1 million for a single unit property in certain areas, the acting head of the Federal Housing Finance Agency and the Housing Policy Council voiced concern that they might be getting too high.

Conforming loan limits for most of the country for a one-unit home will be $647,200 — an $98,950 increase over

Any locations where the median home price is 115% of the new conforming limit are considered high cost areas; for those, the new ceiling is $970,800, compared with $822,375 this year. By law, Alaska, Hawaii, Guam and the U.S. Virgin Islands are subject to the high cost limit.

In noting that approximately 100 counties are subject to that high cost limit approaching the $1 million mark, Acting Director Sandra Thompson said the "FHFA is actively evaluating the relationship between house price growth and conforming loan limits, particularly as they relate to creating affordable and sustainable homeownership opportunities across all communities."

Besides the 18.5% rise over the third quarter 2020, prices rose 4.2% compared with the second quarter, the FHFA announced on Nov. 30.

"House price appreciation reached its highest historical level in the quarterly series," said William Doerner, supervisory economist in the FHFA's Division of Research and Statistics, in a press release. "Real estate prices have

The Housing Equity and Recovery Act provides the formula that the FHFA must use to determine the new conforming limits. In advance of the formal FHFA announcement, a number of lenders

United Wholesale Mortgage already pushed up to the official 2022 limits.

"UWM is honoring the new higher-than-expected 2022 limits starting tomorrow, Dec 1," a company spokesperson said. "Any UWM loans currently in the pipeline that are not locked can be adjusted based on the new loan limits."

In addition to Thompson at the FHFA, the Housing Policy Council expressed concern over the high cost area loan limit, especially as it impacts affordability. It called on Congress and the Biden Administration to evaluate the level of support taxpayers provide to the mortgage market.

"Taxpayer backing of mortgage securities results in slightly lower mortgage rates which, in turn, encourages people to buy more expensive homes," the HPC statement said. "Ultimately, such backing feeds the run-up in house prices, exacerbating the affordability challenges we face in today's supply-constrained marketplace."

However, in spite of the "hand wringing" in Washington over the higher limit, "it is difficult to envision any actual policy shifts," said BTIG analyst Eric Hagen in a research note.

"The conforming loan limit is set by statute and Congress is either unwilling or unable to advance substantive mortgage policy legislation," Hagen continued. "Comprehensive reform efforts

Rising values promote borrower mobility, reduce default risk and potentially strengthen the origination opportunity for non-agency lenders, he argued. "At the same time, higher loan balances invite prepayment risk (which feeds into the financing execution achieved through securitization or loan sales), and it potentially complicates the affordability outlook (particularly for first-time buyers), and risks enticing borrowers into riskier products like cash-out refi and interest-only loans," Hagen said.

Higher limits should reduce the supply of loans to be put into private-label mortgage-backed securities, so adverse selection could become an issue. But Luisa De Gaetano Polverosi, associate managing director with Moody's RMBS group, is bullish on that market in 2022.

"In terms of private-label RMBS credit quality, we don't see much impact from the increase in conforming loan limits," said De Gaetano Polverosi. "The increase is, however, another reason why we're likely to continue to see mortgages with larger balances in both PLS and [credit risk transfer] pools after the recent sizable hikes in property prices across the country."

Furthermore, the Federal Housing Administration will soon release its own limits, which are based on the changes in the conforming limits.

"We expect the adjustment to FHA limits to similarly increase 18% in 2022, which should keep the FHA at the same size relative to the market as well," said Keefe, Bruyette & Woods analyst Bose George in his own note. "Overall, we think the headline is fairly neutral for mortgage insurers (and mortgage participants more broadly), and the news was likely already expected, given many data points on strong home price appreciation."

Last year, then-Federal Housing Commissioner Dana Wade suggested the

Mortgage lender Homepoint also

"Today's loan limit increase will provide more borrowers with access to the most affordable loan programs in the country," said Lesley Alli, senior managing director of strategic partnerships. "Given the significant home price appreciation we have been seeing throughout the country, we did expect to see a significant increase in the official conforming and high-cost area limits for 2022."

The conforming limit for a two-unit property in most of the country is $828,700; for three-units it is $1.001 million and for four-units, it is $1.245 million.